OPEC+ Boosts Output More Than Expected In Quest To Snuff Shale

Confirming earlier media leaks, OPEC+ agreed to increase oil production even more rapidly than expected next month, as the Saudi-led group seeks to capitalize on strong summer demand in its move to reclaim market share.

The eight core group members agreed to raise supply by 548,000 barrels a day at a video conference on Saturday, putting the group on pace to unwind its most recent layer of output cuts one year earlier than originally outlined. The countries had announced increases of 411,000 barrels for each of May, June and July, already three times faster than scheduled, and traders had expected the same amount for August.

Saturday’s decision was based on “a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories,” the Vienna-based OPEC said in a statement.

Crude traders had widely expected OPEC+ to ratify another hike of 411,000 barrels day for August, according to a Bloomberg survey, and delegates’ initial discussions this week also focused on that level.

The latest increase amplifies a dramatic strategy pivot by the OPEC+ that helped drive oil prices lower this year, one which many view as punishment for quota abusers and as targeting US shale production which recently peaked and has been unchanged for months. Since April, the group shifted from years of output restraint to reopening the taps, surprising crude traders and raising questions about its long-term strategy. Officials have said that Riyadh is especially eager to restart more idled capacity as quickly as possible in a drive for market share.

Saturday’s decision also provides the latest indication of how Riyadh has consolidated its control of the group’s decision-making process, as late as Friday evening, delegates from several member nations appeared unaware of the plan to accelerate.

Meanwhile, citing unnamed delegates Bloomberg added that the cartel will consider adding another roughly 548,000 barrels a day in September at the next meeting on Aug. 3, which would represent the final step in reviving the 2.2 million barrels a day of supply curbs announced in 2023. Beyond that, it’s not clear whether the group would turn its attention to the next 1.66 million-barrel tier of idle output.

With OPEC+ pushing barrels into a market that is widely expected to be oversupplied later in the year, Brent futures have retreated 8.5% in 2025 as crude production rises both across the alliance and globally, while the threat to economic growth from President Trump’s trade war has cast a shadow on future demand.

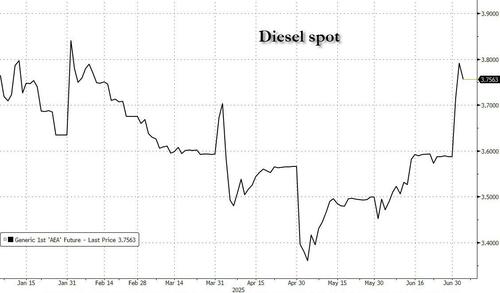

Still, oil fundamentals look more robust in the immediate term, and some delegates said the group is accelerating supply increases in part to take advantage of stronger demand during the northern hemisphere summer. Refiners in the US are churning through the most crude for the time of year since 2019, and prices for some fuels like diesel have soared.

The extra oil output will be welcomed by President Trump, who has repeatedly called for lower oil prices to bolster the US economy, and needs to stave off inflation while pushing the Federal Reserve to lower interest rates.

Yet they also threaten to swell a looming supply surplus. Global oil inventories have been accumulating at a pace of about 1 million barrels a day in recent months, as consumption in China cools while production climbs across the Americas, from the US to Guyana, Canada and Brazil.

A substantial surplus looms later this year, according to the International Energy Agency in Paris. JPMorgan and Goldman Sachs anticipate that prices will sink towards $60 a barrel or lower in the fourth quarter. Prices jumped during the conflict last month between Iran and Israel, but fell back quickly as it became clear that oil flows remained unaffected.

By pushing for faster supply increases, Saudi Arabia risks offsetting the benefits of higher sales volumes with the impact of falling oil prices. The kingdom is already grappling with a soaring budget deficit, and has been forced to slash spending on some of Crown Prince Mohammed bin Salman’s flagship projects.

OPEC+ co-leader Russia is confronting a deteriorating economic outlook and potential banking crisis as President Vladimir Putin continues to wage a costly war against neighboring Ukraine.

The drop in prices is also spreading pain through the American shale industry. In a recent survey, US shale executives said they expect to drill significantly fewer wells this year than planned at the start of 2025, citing lower oil prices and uncertainty around Trump’s tariffs.

“OPEC+ is sending a clear message, for anyone still in doubt: the group is firmly shifting toward a market share strategy,” said Jorge Leon, an analyst at research firm Rystad Energy A/S who previously worked at the OPEC secretariat.

“Two big questions now hang over the market,” Leon added. “Will OPEC+ target the next tier of 1.66 million barrels? And second, is there enough demand to absorb it?”

There is a third question: with US wells plunging to 4 years low and US E&P companies now maximizing output from only on the most efficient Permian wells, how long until shale hits a major depletion air pocket and US production plunges, sending oil prices surging.

Tyler Durden

Sat, 07/05/2025 – 13:25