It is very hard to make a large investment within the planned deadline and budget - regardless of whether it concerns roads, railway lines or another infrastructure. However, the more technologically complex the object and the longer the construction time, the greater the hazard of undesirable events.

Therefore, in the last fewer years, virtually no of the crucial projects of the fresh power blocks have ended in time and budget, which originally provided for contracts concluded between investors and general contractors. The flagship example is simply a carbon block of 910 MW in Jaworzno - plagued with subsequent delays during construction and then with failures.

Tauron's dispute with Rafako came back like a boomerang in more and more fresh appearances. Eventually, this communicative ended at the end of April this year by fulfilling the conditions settlementsTauron received PLN 240 million from the Rafako Guarantee. The agreement between the companies was terminated and the companies besides waived any remaining common claims, jointly announcing that specified a finale of cooperation has been in place for them since 2014.

Another example is the 450 MW gas block in Steel Wola (Tauron/PGNiG), which was commissioned in 2022 - 5 years later than the first assumptions. While in Jaworzno 1 can be tempted to say that the dispute ended with a tie pointing at Tauron, in Stalowa Wola the communicative did not go so well for the investor.

Spanish Abener Energia, who was incapable to complete the investment and was thrown out of construction, left the dispute with a shield after years, collecting after arbitration EUR 93 million as part of the settlement.

See more:Steel will to take over? Not in PGNiG

Costs increase faster than blocks

Problems in energy construction can be influenced by many factors - starting with poorly calculated budgets and timetables, errors in the phase of tenders and selection of contractors, to various types of difficulties already during the implementation of the contract. The second may be due, for example, to inadequate work or bad cooperation between the investor and the contractor.

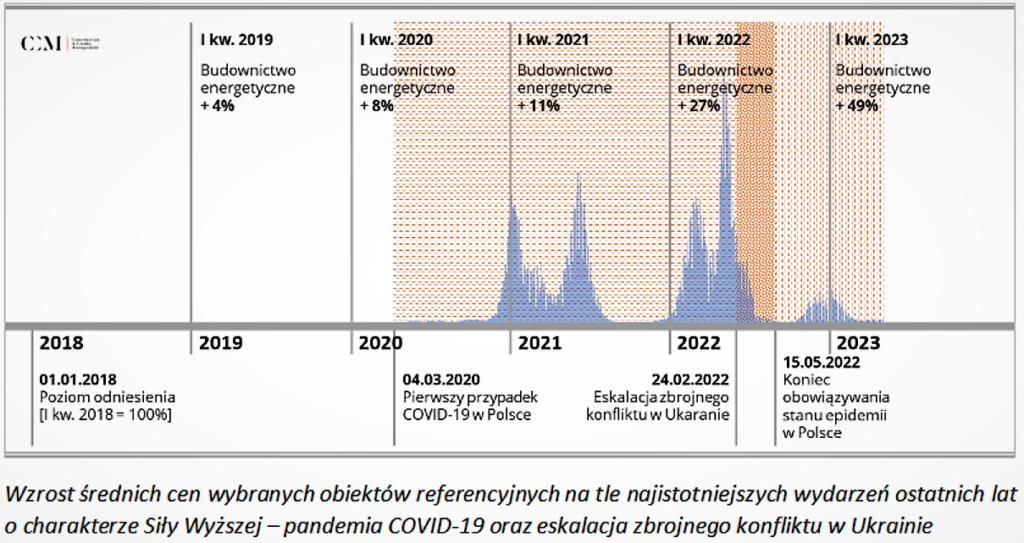

However, there are besides situations that are hard to foretell and so besides measure the possible risks associated with them. These in fresh years are COVID-19 pandemics and Russian aggression to Ukraine. The erstwhile was 1 of the catalysts for inflation and the reason for the disruption of supply chains. In turn, the war deepened these phenomena and further caused a large outflow of Ukrainian workers.

The combination of pandemic and war has hit many industries, but the construction sector is 1 of the biggest inflation risks - due to the most frequently low profitability of orders, as well as the staff gap, which in fresh years has been complemented mainly by Ukrainians.

Michał Lempkowski, managing partner of the CCM consulting and engineering company, and at the same time expert on contract advice and timely and cost analyses, stressed that energy construction was besides affected by these events.

The pandemic and war spurred an increase in costs in energy construction. photograph CCM

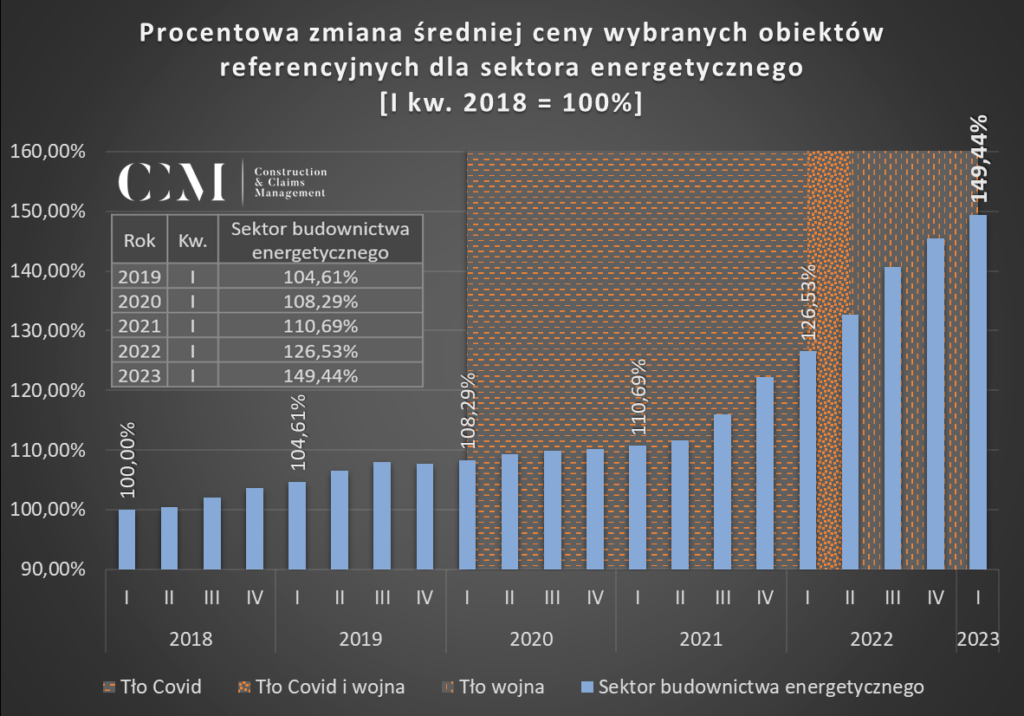

The pandemic and war spurred an increase in costs in energy construction. photograph CCMThe CCM data, covering the years 2018-2022, show that in the first half of this period, the prices of construction facilities from the energy sector increased moderately, ranging from 2 to little than 5%. However, since the 3rd 4th of 2021 there has already been a steep increase in prices, reaching nearly 16 percent in early 2022. From the first 4th of 2022 to the first 4th of 2023, i.e. already during Russia's aggression against Ukraine, prices increased by almost 23 percent.

- I'm sorry. The problem of the prices of energy construction projects is mainly the last 2 years, with a combined increase of almost 40%. For this period there are besides successive waves of diseases on COVID-19 in Poland between 2021 and 2022 and the war behind the east border - explains Michał Lempkowski.

Among the costs at that time labour (+62%), then construction equipment (+49%) and construction materials (+32%) increased. Lempkowski, however, stated that among the materials there were besides specified product groups, where the increase in costs was much higher. An example is the iron products, where the average price increase was 144%.

Deadlines disappeared from the presentation

In the last fewer years, the leading general contractor for the largest investments in energy blocks is Polimex Mostostal - either alone or in consortia.

The company avoided bankruptcy and underwent a long restructuring after a failed adventure with the construction of highways over a decade ago. After that, however, she focused on energy and there the company goes much better. In addition, since 2017, the majority stake of Polimex, taken over from the Industrial improvement Agency and TF Silesia, has state-owned energy (PGE, Enea, Energia, PGNiG).

Polimex Mostostal - like its main customers - is listed on the Warsaw Stock Exchange, which makes it easier to track the destiny of projects that attract quite a few attention in the energy sector.

Previously, these were fresh coal blocks in Opole (2x910 MW) and Kozienice (1075 MW), and presently gas units in Lower Oder (2x700 MW), Rybnik (900 MW) and Czechnica (180 MW). The company is besides liable for the last coal investment of Polish energy, Pulawy (100 MW).

At the end of April, Polimex published very good yearly results from 2022: 131 million PLN net profit (+51 percent) with almost 3.8 billion PLN of gross (+64 percent). Almost 44 percent of the group's revenues came from the energy sector.

This time, however, a skilled eye could see a certain detail. For many years, during the publication of subsequent financial results - quarterly, semi-annual or yearly - the company has been preparing a presentation in which it presents its achievements, including strategical projects, mainly contracts for energy blocks.

Since the April presentation for the year 2022 from the description of the strategical projects of Polimex the deadlines for the implementation of contracts have disappeared - possibly due to the fact that this list is opened by Puławy, which was originally to be completed by October last year.

It's either an annex or a goodbye.

More interesting information, but already easier to spot, brought the same study of Polimex annual. They concern the expected agreement with PGE on the subject of updating the deadline for implementation and valorisation of the remuneration of the block contract in Czechnica.

Construction of a fresh Czechnica CHP plant. photograph by Polimex Mostostal

Construction of a fresh Czechnica CHP plant. photograph by Polimex Mostostal- I'm sorry. A legal and method opinion of external experts has been prepared to get a reliable, nonsubjective and professional assessment of the impact of the extraordinary change in economical relations and the unpredictable increase in prices of goods and materials resulting from the accumulation of pandemics and the outbreak of war in Ukraine on the implementation of its strategical business processes - Polimex describes.

He besides pointed out that he submitted to the investor a summary of 12 purchasing packages, whose analysis showed an increase in the value of works for a full of PLN 125 million net, and besides prepared a summary of subsequent packages of works.

- I'm sorry. Taking account of the full estimated costs of completing the contract on the basis of existing contractual regulations would lead to the request to account for the failure in crucial value - said Polimex, and besides stressed that "in the absence of a valuation annex by the end of September 2023, the Group will resign and take action to suspend implementation or terminate the contract".

How does the validity of the pandemi-war claims of Polymex measure PGE? The company's press office only told us that if there was information to be provided on this subject, it would do so "according to regulations, including stock exchanges." More has been learned about the advancement of the work, which is about 45 percent.

- I'm sorry. The advancement of construction and assembly works on the construction site shows that it is possible to meet the contractual deadline, namely the transfer of the gas and steam block into operation in April 2024 - emphasised PGE.

So far, there is no evidence of any claims related to building blocks in Lower Oder, which Polimex conducts jointly with General Electric. This agreement was concluded in early 2020 - just over a period before the first case of COVID-19 in Poland. It may have been there that all the most crucial supplies and services were contracted before inflation launched. The agreement for Czechnica was signed in June 2021.

Construction of gas blocks at the Lower Odra Power Plant. photograph by Polimex Mostostal

Construction of gas blocks at the Lower Odra Power Plant. photograph by Polimex MostostalPGE erstwhile asked about Lower Oder informed us that the advancement of the work exceeded 90%, and the contractual value and date of the transfer of blocks for usage in December 2023 remains valid.

For the energy group Polimex has been implementing since last autumn, among others, a smaller gas heat and power plant in Bydgoszcz (50 MW, 360 million PLN). In January 2023, he signed a contract for Rybnik in a consortium with Siemens.

See more:The largest gas block in Poland for PLN 4.6 billion. Tender decided

Puławy in expanding slip

In fresh days, however, the Pulaw case has partially been clarified. Let us remind that in November 2021 Polimex proposed to Grupa Azoty Puławy to extend the deadline by 223 days and increase the contract value by PLN 36 million - due to the impact of the pandemic on the investment. In April 2022, he added another PLN 189 million, justifying both COVID-19 and the consequences of Russia's aggression against Ukraine.

There was no advancement in talks, so at the end of last year the case went to mediation in the arbitration court at the lawyer General of the Republic of Poland. Almost half a year passed and any effects can be seen after General Puławy, which on May 24 voted to increase the building budget of the block and extend the implementation deadline.

- I'm sorry. As of 24 May this year, the parties agreed that the negotiations were concluded with an increase in the general remuneration of the contractor by PLN 35 million and setting the deadline for completion of the investment by 3 June 2023 (at the full value of the erstwhile claims of Polymex Mostostal in the amount of PLN 227 million) - Paweł Wójcik, the spokesperson of Grupa Azoty Puławy at the beginning of this week.

This information did not stay full up-to-date for besides long, as not much later, the Pulańska company in the stock exchange communication reported that, according to Polimex, the deadline of 3 June would not be possible.

- I'm sorry. The inadequate operation of the steam turbine caused the request to halt any of the start-up work. The contractor is presently waiting for the turbine supplier to submit a method study on the event. The contractor's preliminary assessment predicts that the completion of the investment (the transfer of the block into service) will take place by 30 September 2023 - informed Puławy's Azoty.

The deadline for cutting the ribbon on the last coal investment in Polish energy will most likely be extended by 1 year. Potentially, this will be the end of the electoral run to parliament. The question is whether the government will want to brag about the carbon block - a year later.

Construction of the power block in Puławy. photograph by Polimex Mostostal

Construction of the power block in Puławy. photograph by Polimex MostostalApart from the investment deadline, approved by the General Puławy PLN 35 million represents only a tiny part of the claims made by Polimex. Is it hard to justice whether specified a construction group is satisfactory, due to the fact that the question we asked did not want to comment on the subject.

On the another hand, it is not known whether there would be any chance that in a conciliation way more Polimex could obtain. Especially since in the first 4th of 2023 the full Azota Group for the first time in past recorded a failure in the first 4th of the year, which for fertilizer companies is usually best in the year. And not just any loss, due to the fact that at the level of over half a billion zlotys. "Puls Biznesu" even stated that there are concepts in the government to make financially limp Azota take over Orlen.

Interestingly, on the same day that General Puławy voted on the arrangements for the Polimex contract, a request for an increase of EUR 24 million in remuneration was made to the Azota Group with a pandemic-war increase in remuneration.

The Korean company is simply a general contractor aiming at the end of the Polymery Police task - a flagship chemical investment of the company in a complex for the production of propylene and polypropylene. The erstwhile annex of the Azots from Hyundai Engineering, dated January 2022, was worth EUR 72 million and extended the deadline by six months.

Claims and delays are everywhere

Polimex Mostostal is making large investments, making it a prominent place, but the increase in costs besides concerns smaller projects. Even though Erbud late announced the conclusion of an annex to the contract for the construction of a highest and reserve boiler home in Bielsko-Biała, which increases the contractual remuneration by more than PLN 8 million - to over PLN 60 million.

- I'm sorry. The annex concerns the valorisation of direct and indirect costs of performance of the contract and is linked to the occurrence of impossible circumstances in the course of performance of the contract - explained Erbud.

Moreover, there is no shortage of claims and disputes between contractors and investors in the electricity transmission and distribution sectors. We wrote about this in May during announcements of immense investments in the network in the draft update of the State Energy Policy.

See more:PLN 500 billion on the network until 2040. Real plan or fantasy?

Referring to the subject of valorization Michał Lempkowski points to the results of the study "The outbreak of war in Ukraine and the increase in the cost of construction investments in Poland", published in March by CCM and the law firm FOR Piper. Its edition was preceded by a marketplace survey, which included, among others, all companies associated with the Polish Association of Construction Employers.

Price increases in energy construction. photograph CCM

Price increases in energy construction. photograph CCMThe study indicated that within a year of Russia's attack on Ukraine only 25% of the cases managed to scope an agreement with the awarding entities on valorization. However, almost half of the companies active in the survey continued to negociate on this issue. Therefore, talks between contractors and investors are not the easiest, but - as Lempkowski emphasized - not always the attitude of the awarding entities is to blame.

- I'm sorry. Our experience shows that energy sector performers, erstwhile formulating their valuables, very frequently request to cover 100% of price increases without taking into account any of their own risks in this respect. Only a fewer people admit that specified risks should besides be assumed on their side, with typically a price increase of around 1-2 percent. In the case of long-term contracts, this simply has no right to defend itself - the expert explained.

Another origin which makes it hard to scope an agreement is the different views of the parties on an appropriate indicator for energy construction that would reflect the real price increases for this marketplace sector. For example, the price structure of a typical cubic object will be completely different from, for example, the power block, where an crucial component in addition to the construction itself is besides the installation-technology part.

Therefore, the usage of general price change indicators, e.g. for construction and assembly works and construction works according to the CSO data, will not always be appropriate for technologically complex facilities. In Lempkowski's opinion, it would aid to make a single standard, including setting an energy price basket - analogous to the road or rail basket utilized by GDDKiA in the case of PKP PLK.

The agreement is cheaper than the dispute

If the agreement on valorisation can be worked out, both sides can benefit. According to the aforementioned report, specified an agreement reduces the hazard of further escalation of the dispute, as only a tiny part of the companies (14%) is considering a judicial investigation to cover costs beyond the resulting valuation.

- I'm sorry. As early as 2022, many awarding entities openly presented a affirmative attitude towards consensual talks, knowing that the deficiency of agreement could consequence in the abandonment of contracts or the initiating of litigation. This in turn means the hazard of even higher costs in the future - concluded Michał Lempkowski.

New block in Turów Power Plant. Photo: PGE

New block in Turów Power Plant. Photo: PGEHowever, not all current disputes in energy construction are about valorisation itself. It has just been a year since PGE issued a burden note of PLN 562 million to the general contractor of the 496 MW coal block in Turów - a consortium of Mitsubishi Power, Tecnicas Reunidas and Budimex companies. The reason was that the block was not available in the first year of operation.

The consortium rejected the note and refused the PGE payment. Budimex considered it unfounded adequate that he even announced the deficiency of the request to include the note in his financial books. This, on the another hand, did the PGE, which does not want to mediate with the general contractor of the block until this 1 leads to "a state consistent with the contract's provisions and his unfailing work". Therefore, the parties to the dispute stick to their positions, but at the same time cooperate in another commitments relating to the duration of the guarantee.

So possibly this dispute will should be included in the list of cases to be dealt with by the National Energy safety Agency to absorb the coal-based manufacturing assets of state energy groups. However, waiting for its imminent uprising slow begins to be counted not in quarters only in years, as we wrote in the article last week. Old power plants are wasting time due to the fact that companies are waiting for NABE.