The Police Central Bureau of Cybercrime has published a peculiar information bulletin addressed to payment card users.

Despite the deficiency of publication of collective statistic that illustrate the scope of the payment card problem, the immense number of messages on various incidents surely suggests that this is simply a substance of interest. That is why the CBZC issued a newsletter in which it gives applicable guidance to citizens on how to effectively avoid possible unpleasantness.

In this document, the officers collected a number of advice which they believe could importantly reduce the hazard of theft or card fraud. These tips supply a applicable guide to card users, helping them to better realize and minimize the risks of cyber-financial crime. These include aspects ranging from PIN protection to transaction past monitoring, creating a comprehensive set of safety measures for card users.

The most crucial is the PIN code

Police point out that the key aspect of securing funds is the usage of the PIN code. This institution warns against storing this code together with the card and categorically advises against utilizing easy to guess sequences specified as its own date of birth. This way of safeguarding creates the hazard that a possible thief who has access to another papers can easy guess the PIN code. But it's just the tip of the iceberg.

According to the opinion of the officers, it is besides crucial to set appropriate limits on the regular availability of funds on the card. These limits should be low adequate that even if a card was stolen and tried to usage it, the thief could not clear the full bill. In addition, they urge regular checking of the account history, allowing you to rapidly announcement any irregularities or suspicious transactions. Police encourage conscious action to safe their own funds against possible risks related to theft or unauthorized access to the account.

Pay carefully from your ATM

One of the key moments in request of peculiar attention from the police are cash withdrawals from the ATM. According to their analysis, in this case there is the top hazard that a 3rd organization may impersonate the card owner and look at the PIN code. In addition, criminals can manipulate the ATMs themselves by installing card-copying devices in them or blocking the cash paid in the dispenser to later take over.

The authoritative police newsletter emphasizes that it is crucial to check that no 1 else is besides close to be able to eavesdrop the PIN code erstwhile making cash withdrawals. In addition, careful control of the device is recommended, paying attention to any suspicious elements specified as glue marks or another irregularities. The usage of non-cash transactions, specified as BLIK, is besides suggested in advanced traffic areas to minimise the risks associated with cash withdrawals. Police call for vigilance and caution erstwhile utilizing ATM services to reduce possible risks associated with financial crime.

What about terminals?

The most crucial thing is that you do not let individual to vanish with your card for a minute – that is the appeal made by the police. They besides indicate that it is worth considering utilizing one-off virtual cards or prepaid cards, options that any banks and fintech companies offer.

Additionally, the editorial board points out that while the theft of a physical card is becoming increasingly rare, it inactive happens especially in hotels and rental shops. The employees of these locations sometimes keep terminals in the back, which in the days of wireless terminals may be unreasonable logically and origin safety concerns. It is adequate for a dishonest worker to enter a card number with CVV2/CVC2 code.

Note that specified situations do not always should be the consequence of dishonesty. Years ago, there was a scandal in the Qubus hotel network, where the client cards were recorded during the report, as part of a regular procedure. Although the company rapidly explained itself, blaming the outdated form, this event is simply a informing to future generations.

Police pay peculiar attention to the protection of card data, recommending that they be avoided for 3rd parties, even hotel workers or suspicious websites. If you receive an unexpected 3D safe notification regarding the transaction, delight contact the bank immediately.

For those who store online, it is crucial to know the chargeback mechanism. This tool allows the card operator to initiate a refund procedure for circumstantial purchases if they are found to be the consequence of fraud or the product does not conform to the description. A thorough cognition of these mechanisms can increase the sense of safety erstwhile utilizing electronic payments.

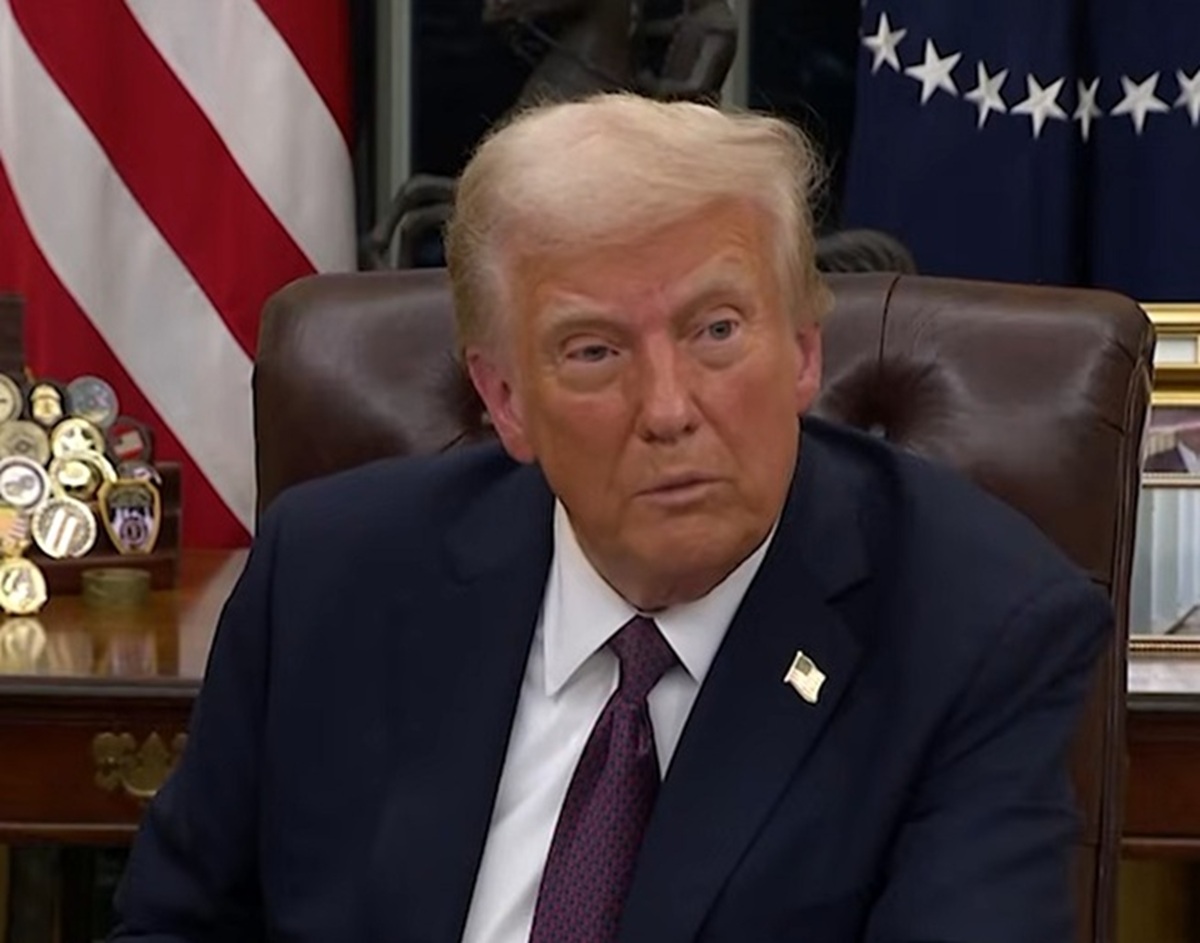

This is from

Do you have a PIN code for a card or a phone? You better change it right away. Police have issued an announcement: