Markets Can Absorb Geopolitic Risks, To A Point

By Michael Msika and Jan-Patrick Barnert, Bloomberg Markets Live reporters and strategists

Geopolitics is having an impact on investment decisions again, and risks are rising as well as equity flexibility. Yet under the hood, the stock marketplace is absorbing the shock comparatively well so far.

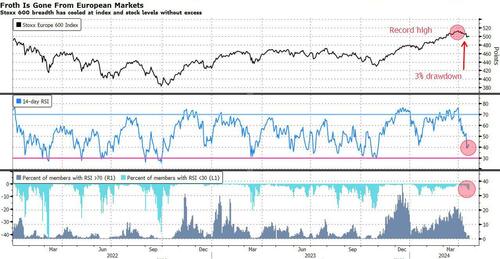

Stress levels have had a bargain surge as passions in the mediate East show no sign of abating. Systematic funds are reducing exposure, technicals are showing any cracks, but the large image for markets hasn't changed much. In fact, price action on Friday already seems mill, with a emergence in oil prices reversing. Market breadth has cooled, both at a stock and index level, with just a 3% drop this month.

“This seat has been very busy buses, but hasn’t seen signs of panic,” Says Carl Dooley, head of EMEA trading at TD Cowen. “While optically we see inducers specified as the VIX print at akin levels to last October erstwhile markets were lower and realized volatility was higher, another inducers we track, dry as the request for crash protection, haven’t moved. It has all felt very circumstantial and technical.”

After the marketplace was focused on having the upside, there is simply a more balanced approach to flexibility. The force from funds selling options is now being matched by options required from investors hedge positioning. This is “keeping the hazard environment far more two-way than any time in fresh history“says Nomura’s Charlie McElligott.

US stocks are down about 4.5% over six trading days. That’s a comparative chilled decline given the frequency of headslines coming from the mediate East, especially composed to any of the sudden, more elevator-like moves in 2022 and in the summertime of 2020. Even Nvidia, the biggest bullish bet in this market, is just down 20% after a 600% gain.

There’s no talk about emergency meetings to reduce hazard and no signs of hasty investment decisions. Commentary from trading boards about hedge funds and another buy-side flows is inactive carrying a notation of dip buying and is far from a sale everything market. Granted, hazard taking is getting a bit of a re-think, positioning is being adapted along with another thematic indexes that soared in 2024 but now show large 5-day declines.

Trend followers specified as CTAs are a potent chaotic card, with their inactive elevated exposition. But their reaction grants on stop-loss levels being broken, and so far the marketplace reaction and the impact on prices have been reassuring.

“Leverage deals about CTAs are easing,” say Societe Generale Sandrine Ungari, adding that positioning has been reduced, while breakpoints, the percent decision needed on the asset for CTAs to reduce exposure, are now little negative. In addition, CTAs are diversified across asset classes, so looses in equities would have been offset by gain in communities and FX. “A portfolio that allocates equally across asset classes is flat to lightly up,” she says.

The VIX curve has flipped into concern levels as previously thought in this column, and the bargain emergence is akin to early 2022, erstwhile Russia invaded Ukraine. Yet the very low base line of stresses is keeping markets well below panic levels at this point.

“Further developments in the mediate East reconstruct subject to increased uncertainty,” says Deca Investment CIO Christoph Witzke. “As a fund manager, I am paying partial attention to the reaction of the oil price and the US dollar. So far, the movement has been mutated. If this claims the case, we are presently more likely to see a recovery in equity over the next fewer days/weeks than the age of a fresh downtrend. The lounge-term framework restores fast construction.”

Tyler Durden

Mon, 04/22/2024 – 17:40