Key Events This Week: GDP, Core PCE, Durables, Powell And Fed Speakers Galore

There’s a lot going on this week but the latest developments in the Israel-Iran conflict will clearly dominate, especially now the US is involved. Against this backdrop, the NATO summit will be held in The Hague tomorrow and Wednesday. It seems all members will agree to a 5% of GDP defense spending plan apart from Spain who will get an exemption. The latest draft appears to be – what else – a delay of the full spending spree until 2035 rather than the initial 2032 that Secretary General Rutte was aiming towards (and which sparked the rabid move higher in European stocks at the start of the year which has all but fizzled now). Note 3.5% would be core military spending, and 1.5% would be defense related areas such as infrastructure and cybersecurity.

Elsewhere Fed’s Chair Powell’s semi-annual testimonies to Congress on Tuesday and Wednesday are usually key events but note that this comes shortly after last week’s FOMC so maybe they’ll be less additive information this time. There is also lots of Fedspeak this week that will be in the day-by-day calendar but Waller speaking again today will be of note given his dovish speech on Friday where he all but confirmed that he was one of the two members who have three cuts this year in the dots. He didn’t rule out a July cut and markets are trying to handicap what it would mean if he became the next Fed chair. In a speech earlier today, Fed vice chair Michelle Bowman joined Waller in calling for a July rate cut, sending the dollar plunging.

Staying in the US, the Senate will continue its mark-up of the “One Big Beautiful Bill Act” (OBBBA) with potential for a vote by the end of the week. However, several substantial policy debates remain – namely, Medicaid, SALT cap reform and repeal of clean energy tax credits. Though many details remain in flux, from what our economists know at present, their expectations for 6.5 – 7.0% deficits as a share of GDP over the next three years has remained largely unchanged.

Outside of the big NATO meeting, China will hold its NPC Standing Committee meeting from tomorrow through to Friday. There will also be an EU-Canada summit today, with Canada’s Prime Minister Carney attending. Finally, EU leaders will hold a summit in Brussels on Thursday/Friday.

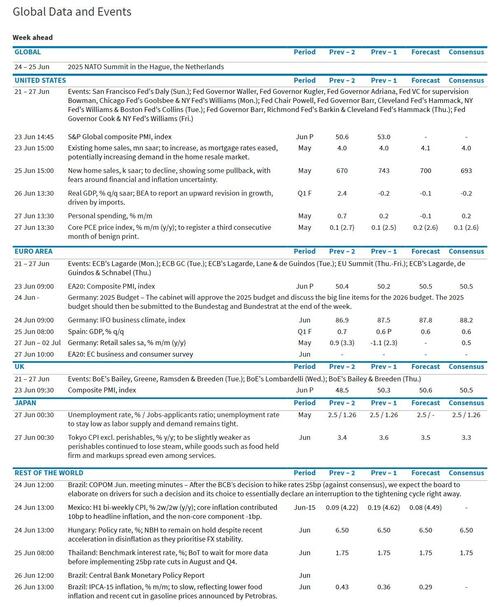

In terms of the other highlights we have preliminary June PMIs, US existing home sales and Lagarde speaking today; US consumer confidence, the German Ifo and Canadian CPI tomorrow; US new home sales, Japanese PPI, Australia CPI and a 5yr UST auction on Wednesday; final US Q1 GDP, US durable goods, the Chicago Fed, the US trade balance, jobless claims, and a 7 yr UST auction on Thursday; and core US PCE, US personal spending/income, Chinese Industrial profits, Tokyo CPI, and French and Spanish CPI. There are more in the calendar at the end but of these the core US PCE is the most interesting.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 23

- Data: US, UK, Japan, Germany, France and the Eurozone preliminary June PMIs, US May existing home sales

- Central banks: Fed’s Waller, Bowman, Goolsbee, Williams and Kugler speak, ECB’s President Lagarde and Nagel speak

- Other: EU-Canada summit

Tuesday June 24

- Data: US June Conference Board consumer confidence index, Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index and business conditions, April FHFA house price index, Q1 current account balance, Germany June Ifo survey, Canada May CPI

- Central banks: Fed’s Chair Powell testifies to the House Financial Services Committee, Fed’s Hammack, Williams, Collins and Barr speak, ECB’s President Lagarde, Guindos and Lane speak, BoE’s Governor Bailey, Greene, Ramsden and Breeden speak

- Earnings: FedEx, Carnival

- Auctions: US 2-year Notes ($69bn)

- Other: NATO summit through June 25, China’s NPC Standing Committee meeting through June 27

Wednesday June 25

- Data: US May new home sales, Japan May PPI services, France June consumer confidence, EU27 May new car registrations, Australia May CPI

- Central banks: Fed’s Chair Powell testifies to the Senate Banking Committee, BoJ’s summary of opinions from the June meeting, Tamura speaks, BoE’s Lombardelli speaks

- Earnings: Micron Technology

- Auctions: US 2-year FRN (reopening, $28bn), 5-year Notes ($70bn)

Thursday June 26

- Data: US May durable goods orders, Chicago Fed national activity index, pending home sales, advance goods trade balance, wholesale inventories, June Kansas City Fed manufacturing activity, initial jobless claims, Germany July GfK consumer confidence

- Central banks: Fed’s Barkin, Hammack and Barr speak, ECB’s Schnabel and Guindos speak, BoE’s Governor Bailey and Breeden speak

- Earnings: Nike, H&M

- Auctions: US 7-year Notes ($44bn)

- Other: European Council in Brussels through June 27

Friday June 27

- Data: US May PCE, personal income, personal spending, June Kansas City Fed services activity, China May industrial profits, Japan June Tokyo CPI, May jobless rate, job-to-applicant ratio, retail sales, France June CPI, May PPI, consumer spending, Italy June consumer confidence index, economic sentiment, manufacturing confidence, May PPI, April industrial sales, Eurozone June economic confidence, Canada April GDP

- Central banks: Fed’s Williams, Hammack and Cook speak, ECB’s Rehn speaks

* * *

Finally, turning to the US, Goldman writes that the key economic data releases this week are the durable goods and advance goods trade balance reports on Thursday and the core PCE inflation report on Friday. There are many speaking engagements by Fed officials this week, including Chair Powell’s semiannual Congressional testimony on Tuesday and Wednesday.

Monday, June 23

- 03:00 AM Fed Governor Waller speaks: Federal Reserve Governor Christopher Waller will give opening remarks at the 2025 International Journal of Central Banking Conference. Speech text is expected. On June 20, Waller said, „I think we’ve got room to bring [the funds rate] down, and then we can kind of see what happens with inflation,” and that the FOMC “could [lower interest rates] as early as July.”

- 09:45 AM S&P Global US manufacturing PMI, June preliminary (consensus 51.0, last 52.0); S&P Global US services PMI, June preliminary (consensus 52.9, last 53.7)

- 10:00 AM Existing home sales, May (GS +1.5%, consensus -1.3%, last -0.5%)

- 10:00 AM Fed Governor Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will speak at the 2025 International Journal of Central Banking Conference. Speech text and a webcast are expected.

- 01:10 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will participate in a moderated Q&A at the Milwaukee Business Journal Mid-Year Outlook 2025 in Milwaukee, Wisconsin. On June 3, Goolsbee said, „The answer to the question of where interest rates will go depends on what will happen in the next three months to the data on inflation and employment.” He went on to say, „Personally, I’m a little gun shy about making the argument [that the inflation shock from tariffs will be transitory] before we know how big the shock is going to be.”

- 02:30 PM New York Fed President Williams (FOMC voter) and Fed Governor Kugler speak: New York Fed President John Williams and Fed Governor Adriana Kugler will host a Fed Listens event at SUNY Schenectady Community College. On May 27, Williams said „You want to avoid inflation becoming highly persistent because that could become permanent, and the way to do that is to respond relatively strongly.” On June 5, Kugler said, „I see greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road.”

Tuesday, June 24

- 09:00 AM FHFA house price index, April (consensus -0.1%, last -0.1%)

- 09:00 AM S&P Case-Shiller 20-city home price index, April (GS -0.2%, Consensus -0.2%, last -0.1%)

- 09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak on monetary policy at the Barclays-CEPR Monetary Policy Forum 2025 in London. Speech text and Q&A are expected.

- 10:00 AM Conference Board consumer confidence, June (GS 100.6, consensus 99.8, last 98.0)

- 10:00 AM Fed Chair Powell Speaks: Fed Chair Jerome Powell will testify before the House Committee on Financial Services for the Federal Reserve’s Semi-Annual Monetary Policy Report. Speech text and Q&A are expected. In his press conference following the June FOMC meeting, Powell reiterated that monetary policy is “in a good place” and acknowledged the favorable recent inflation news while making it clear that he still expects to see meaningful further tariff effects on consumer prices over the summer.

- 12:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks at an event organized by the Center for Economic Growth and NY CREATES in Albany, New York. Speech text and Q&A are expected.

- 02:00 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will speak at an event co-hosted by Harvard University’s Joint Center for Housing Studies and several Federal Reserve Banks. Speech text and Q&A are expected.

- 04:00 PM Fed Governor Barr speaks: Fed Governor Michael Barr will give welcoming remarks at a Fed Listens event. Speech text and a livestream are expected.

- 08:15 PM Kansas City Fed President Schmid (FOMC voter) speaks: Kansas City Fed President Jeff Schmid will give a speech on the economic outlook at the 2025 Agricultural Summit. Speech text and Q&A are expected. On June 5, Schmid said, „While theory might suggest that monetary policy should look through a one-time increase in prices, I would be uncomfortable staking the Fed’s reputation and credibility on theory.”

Wednesday, June 25

- 10:00 AM New home sales, May (GS -4.5%, consensus -6.7%, last +10.9%)

- 10:00 AM Fed Chair Powell speaks: Fed Chair Jerome Powell will testify before the Senate Committee on Banking, Housing, and Urban Affairs for the Federal Reserve’s Semi-Annual Monetary Policy Report. Speech text and Q&A are expected.

Thursday, June 26

- 08:30 AM Advance goods trade balance, May (GS -$85.0bn, consensus -$91.0bn, last -$87.0bn)

- 08:30 AM Wholesale inventories, May preliminary (last +0.2%)

- 08:30 AM GDP, Q1 third release (GS -0.2%, consensus -0.2%, last -0.2%); Personal consumption, Q1 third release (GS +1.0%, consensus +1.2%, last +1.2%); Core PCE inflation, Q1 third release (GS +3.42%, consensus +3.4%, last +3.4%): We estimate no revision on net to Q1 GDP growth, reflecting a downward revision to consumer spending (-0.2pp to +1.0%) due to softer utilities and personal home care details in the Quarterly Services Survey (QSS), an upward revision to business fixed investment (+0.1pp to +11.9%), and an upward revision to net exports.

- 08:30 AM Durable goods orders, May preliminary (GS +15.0%, consensus +8.5%, last -6.3%); Durable goods orders ex-transportation, May preliminary (GS flat, consensus flat, last +0.2%); Core capital goods orders, May preliminary (GS -0.4%, consensus -0.4%, last -1.5%); Core capital goods shipments, May preliminary (GS -0.2%, consensus -0.2%, last -0.1%): We estimate that durable goods orders jumped 15% in the preliminary May report (month-over-month, seasonally adjusted), reflecting a sharp increase in commercial aircraft orders following President Trump’s visit to the Middle East. We forecast a 0.4% decline in core capital goods orders—reflecting contractionary new orders readings for manufacturing surveys in May—and a 0.2% decline in core capital goods shipments—reflecting the decline in orders over the last month.

- 08:30 AM Initial jobless claims, week ended June 21 (GS 240k, consensus 245k, last 245k); Continuing jobless claims, week ended June 14 (consensus 1,945k, last 1,945k)

- 08:45 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will speak on the economy during an event hosted by the New York Association for Business Economics.

- 09:00 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will give opening remarks at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed in partnership with the Federal Reserve Banks of Atlanta, Boston, Chicago, Dallas, Kansas City, New York, Philadelphia, Richmond, and St. Louis. Speech text is expected.

- 10:00 AM Pending home sales, May (GS +2.5%, consensus flat, last -6.3%)

- 01:15 PM Fed Governor Barr speaks: Fed Governor Michael Barr will discuss how community development advances the Fed’s objectives at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed. Speech text, Q&A and a webcast are expected.

Friday, June 27

- 07:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will serve as chair for a session featuring keynote remarks by Professor Carmen Reinhart at the Bank for International Settlements.

- 08:30 AM Personal income, May (GS +0.3%, consensus +0.2%, last +0.8%); Personal spending, May (GS +0.1%, consensus +0.2%, last +0.2%) ; Core PCE price index, May (GS +0.18%, consensus +0.1%, last +0.1%); Core PCE price index (YoY), May (GS +2.63%, consensus +2.6%, last +2.5%); PCE price index, May (GS +0.14%, consensus +0.1%, last +0.1%); PCE price index (YoY), May (GS +2.29%, consensus +2.3%, last +2.1%): We estimate that personal income and personal spending increased by 0.3% and 0.1%, respectively, in May. We estimate the core PCE price index rose by 0.18% in May, corresponding to a year-over-year rate of 2.63%. Additionally, we expect that the headline PCE price index to increase by 0.14% in May, corresponding to a year-over-year rate of 2.29%. Our forecast is consistent with a 0.13% increase in our trimmed core PCE measure (vs. 0.21% in April).

- 09:15 AM Fed Governor Cook and Cleveland Fed President Hammack (FOMC non-voter) speak: Fed Governor Lisa Cook and Cleveland Fed President Beth Hammack will participate in a Fed Listens event at a conference focused on housing, workforce and economic development hosted by the Cleveland Fed in partnership with the Federal Reserve Banks of Atlanta, Boston, Chicago, Dallas, Kansas City, New York, Philadelphia, Richmond, and St. Louis. Q&A is expected. On June 3, Cook said, „As I consider the appropriate path of monetary policy, I will carefully consider how to balance our dual mandate, and I will take into account the fact that price stability is essential for achieving long periods of strong labor market conditions.”

- 10:00 AM University of Michigan consumer sentiment, June final (GS 60.7, consensus 60.3, last 60.5): University of Michigan 5-10-year inflation expectations, June final (GS 4.1%, last 4.1%)

Source: DB, Goldman

Tyler Durden

Mon, 06/23/2025 – 12:00

![Fala podtopień w regionie! Kolejna doba z serią pilnych interwencji straży pożarnej [ZDJĘCIA]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2026/podtopienia_25_02.jpg)