Japan Is Now Caught In A Doom Loop

By Russell Clark, Author of the Capital Flows and Asset marketplace substack

Japan and Treasures

My interest in Japan dates from 1991 erstwhile I was fresh personed advanced school exchange student in Kobe. There are no prices for uncovering me in the above photo. I was the only “foreigner” in the school, and would go without seeing anyone else that looked like me or even speaking English. I managed to combine my cognition and experience in Japan with my another love, economics. I don’t think it besides much of an execution to say I those my career and wellness through studying the Japan experience carefully and then applying these lessons to the remainder of the world.

One of the most fascinating things about Japanese, economically speaking, is that even its only abroad reserves are made up of US treaties, with almost no gold. As the right hand side column below shows, the share of gold as abroad exchange reserves is higher for the “old world”, while fresh powers specified as China, Japan, Taiwan and Saudi Arabia have comparatively low shares.

In absolute terms, China and Japan are by far the largest holders of abroad exchange reserves.

While China has larger abroad reserves than Japan now, Japan fundamentally “invented” the thought of sovereign bonds as abroad exchange reserves. During the golden standard days, if a country like the US wanted to consume more than it produced, it would request to transfer gold overseas. With limited gold supply, this limited consumption. Moving to a treatment based financial strategy fundamentally removed this constraint. The only issue is which another government would accept treatment or not.

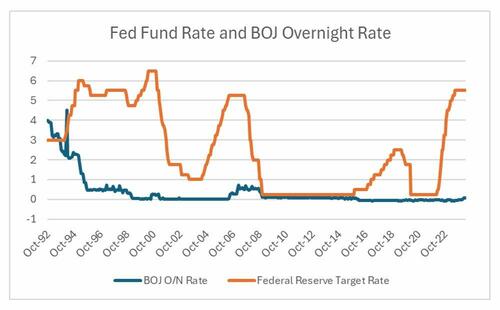

Why did Japan buy treaties? Well erstwhile the bubble economy burst in the early 1990s, the BOJ cut rates to close zero, but the Yen did not collapse as expected.

In fact in the first stages of BOJ interest rates cuts, the Yen actually rallied. The failure of monetary policy to work as it should have led the Ministry of Finance to intervene to effort and aid weaken the Yen, and authoritative buying of US dollar assets took off.

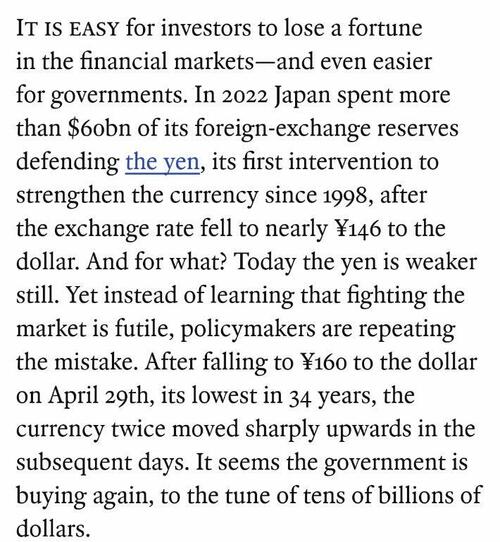

In pro-labor terms, erstwhile a government is pro-capital it wants to devalue to reduce the scales of its workers. This creates a trade surplus, which should origin the currency to appreciate, but if the government wants to keep the exchange rate competitive (i.e. keep real scales low), then it needs to buy more and more treaties. A pro-labor government is happy to see itcurrency appreciate, and hence does not build abroad currency reserves. What is unusual late is that even as the BOJ remains utmost tardy in its monetary policy response, the Ministry of Finance in Japan has started utilizing abroad reserves to “strengthen” the Yen. As the Economist points out, Japan is presently intervening in the currency marketplace to effort and strengthen the Yen.

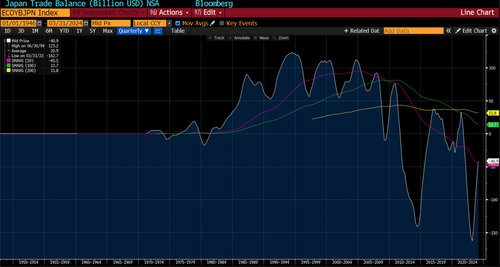

We don’t know the cost of the abroad exchange intervention at the minute [ZH: we do, it was $59BN], but as can be seen above, Japanese abroad exchange reserves have not been rebuilt since the last intervention in 2022. Japan besides does not run the structural trade surplus that it did from 1980 to 2010.

With falling abroad exchange reserves, trade default, and the likely increase in defence spending that the Russian-Ukrainian war implies, BOJ policy looks creatively crow. Markets seem to agree, with 10 year JGB years at 13 year highs.

With either a Biden or Trump Presidency in 2025, the Chances of an austerity driven fiscal policy or a change in trade policy looks improbable to me. The nipponese may well be caught in a doom loop, where they request to sale more abroad reserves to prop up the currency, which origin U.S. yields to rise, which causes the Yen to weather further and so on.

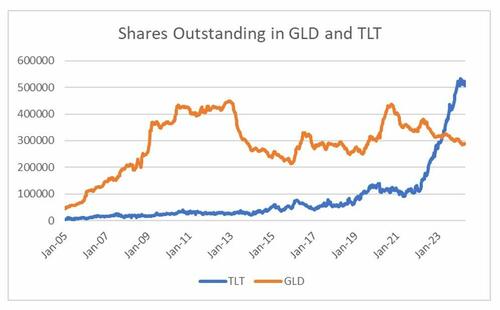

Until and unfree the BOJ becomes more aggressive, Treasures look like to have a systematic buyer turn into a systematic seller. China is likely a seller of treaties and buyer of gold for political and strategical reasons, and Japan is simply a seller of treaties for economical reasons. I am inactive baffled to why retail investors like treats to gold.

Japan was the key to knowing why treaties did so well form 1980 to 2020. I think it is now the key to knowing why treaties are going to do partially from 2020 onwards.

Tyler Durden

Wed, 05/08/2024 – 14:45