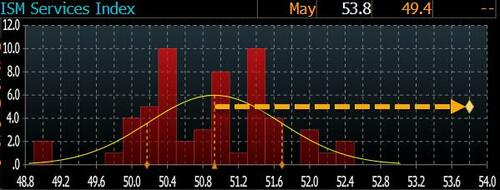

Services ISM Unexpectedly Surges Out Of Contraction, Prints At 53.8, Above All Estimates

After the Manufacturing ISM unexpectedly tumbled to the low level since February (led by a collapse in fresh Orders which tumbled at the fastest rate since Dec 2023), markets were expecting today’s Services ISM to come in well below estimates and to be mostly oblique. And, as always happens, erstwhile Wall Street effects something, the other happenings and moments ago the Institute for Supply Management reported that the May ISM Services index unexpectedly Jumped from a controversial print of 49.4 in April to a 53.8 in May, which was not only the highest print since August 2023...

... but was besides above the highest Wall Street estimation of 52.5 (from Dai-Ichi) and was a 4-sigma beat to the median estimation of 51.0.

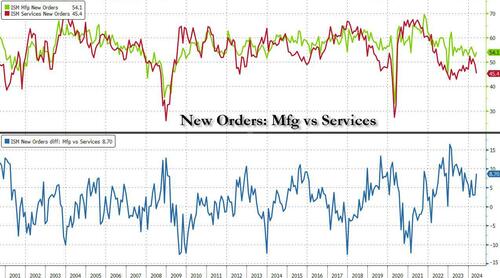

What is possibly more crucial is that unlike the Manucaturing ISM print which Saw fresh Orders collapse to 44.4 and promoted rumbling of a recession, the ISM Service fresh Orders actually jumped to 54.1, from 52.2, pushing the spread between the 2 fresh Orders series to 8.7, the widest since last October.

Also of note, the closely watched employment and Prices Pay indexes besides moved in the right direction: Prices Paid distributed from 59.2 to 58.1, below the 59.0 expected (meaning little summertime inflation),and further distant from stagflationary territory while employment regained contrastary but rebuilt from last month’s 45.9 print to 47.1 (if just below the 47.2 exp).

Here is the full breakdown:

Commenting on the report, Anthony Nieves, Chair of the ISM, said the following: “In May, the Services PMI registered 53.8 percent, 4.4 percent points higher than April’s reading of 49.4 percent. The contrast in April ended a string of 15 months of services sector growth following a composite index reading of 49 percent in December 2022; the last contrast before that was in May 2020 (44.4 percent). The Business Activity Index registered 61.2 percent in May, which is 10.3 percent points higher than the 50.9 percent recorded in April. The fresh Orders Index expanded in May for the 17th consecutive period after contracting in December 2022 for the first time since May 2020; the figure of 54.1 percent is 1.9 percent points higher than the April reading of 52.2 percent. The employment Index contracted for the 5th time in six months, though at a slow rate in May with a reading of 47.1 percent, a 1.2-percentage point increase combined to the 45.9 percent recorded in April.

“The Supplier Deliveries Index registered 52.7 percent, 4.2 percent points higher than the 48.5 percent recorded in April. The index into expansion territory — indicating slower supply transportation performance — in May for the first time since January.”

Nieves included “The increase in the composite index in May is simply a consequence of notably higher business activity, faster fresh orders growth, slower supply transportation and despite the continued relation in employment. Survey respondents suggested that overall business is increasing, with growth rates continuing to var by company and industry. employment challenges restain, primary attributed to difficulties in backfilling positions and controlling labour expenses. The majority of respondents indicate that inflation and the current interest rates are an impedition to improving business conditions.”

While not close as candid and open as the Dallas Fed survey respondents, comments from ISM respondents were not as promising as the data suggestions. People are wondering about tariffs, advanced interest rates and the upcoming US election.

- “The last period has brought a level of stableness not see is any time. fresh news of the Biden administration’s tariff actions is of advanced performance on disruption, with small information on the exclusion process erstwhile it comes to which materials and products will actually be impressed.” [Accommodation & Food Services]

- “Higher interest rates are reducing capital investment and slowing down major facility upgrades.” [Agriculture, Forestry, Fishing & Hunting]

- “Resideential construction continues to struggle, with advanced mortgage rates on the for-sale side. Higher interest rates are driving up the cost of capital and making ‘build to rent’ projects harder to fund. Building period is getting into full swing, but higherlumber prices — especially oriented string board (OSB) panels — have pinched margins.’ [Construction]

- “Some items proceed to be hard to keep at correct levels in inventory: syringes, sterile water and average saline. any paper volumes for dispensers are even being back-ordered.” [Health Care & Social Assistance]

- “Companies in most industries proceed to be deliberal with employer and non-employee labour hiring decisions. Concerts about the upcoming selection loom large, as well as uncertainty around the current economical climate, partially inflation.” [Management of Companies & Support Services]

- “General uncertainty respecting the U.S. national Reserve’s position on future interest rates and the current political environment is affecting consumer sentiment.” [Professional, technological & method Services]

- “Continuing application respecting construction contractors’ capacity and expanding price of projects. Often, bid prices are excellence engineer and budget estimates.” [Public Administration]

- “Slowdown in economy being Felt.” [Retail Trade]

- “In general, business has beensteady. Hiring is slowing and prices are lightly climbing.” [Transportation & Warehousing]

- “We are making adjustments to our employment level, capital investing strategies, and managing borerowed debit to accomplish our 2024 financial goals.” [Utilities]

- “High food costs having an impact on client request and results in flat business overall. Business activity table. Supplier costs proceed to soften.” [Whole Trade]

In kneejerk response, US 2y yield is rising lightly 1bp after the date (I would anticipate a bigger move), EURUSD is down about 0.1%, while the USDJPY suggested to 156.40, with the yen dropping as much as 1% again the dollar as the marketplace is one more time informed in its rate cut results.

Tyler Durden

Wed, 06/05/2024 – 10:24