Invest Or Index – Exploring 5-Different Strategies

Authored by Lance Roberts via RealInvestmentAdvice.com,

Investing is about choices. Every investor faces the same challenge: how to grow wealth while controlling risk. Over the years, distinct approaches have proven effective, though none guarantee success. Some strategies require patience. Others demand discipline in timing and execution. A few provide stability and income. There is no right or wrong way to invest, and every strategy has pros and cons. In some cycles, one approach will outperform another. That doesn’t mean a strategy is broken; it just means it is out of favor in the current environment. The problem that investors often face is that they abandon an underperforming strategy to chase another, often at precisely the wrong time.

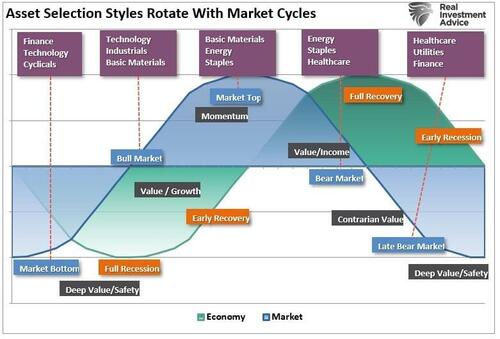

The cycle rotation on investment strategies was discussed in detail in “Why Investing Is Like Gardening:“

“Like everything in life, there is a “season” and a “cycle.” When it comes to the markets, “seasons” are dictated by the “technical and economic constructs,” and the “cycles” are dictated by “valuations.” The seasons are shown in the chart below.”

With this in mind, we will examine five major investment strategies: value, growth, momentum, dividend, and index investing. Each comes with strengths and weaknesses. More importantly, each offers lessons from history’s greatest investors, including Benjamin Graham and Warren Buffett. By exploring these strategies, you can better align your portfolio with your financial goals, risk tolerance, and time horizon.

1. Value Investing

Value investing focuses on buying stocks trading below their intrinsic value. Benjamin Graham, often called the father of value investing, defined the approach in Security Analysis (1934) and later The Intelligent Investor. Graham wrote: “An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.”

Value investing emphasizes fundamentals—strong balance sheets, healthy cash flow, and low debt. The strategy assumes markets misprice securities in the short run, but eventually, fundamentals assert themselves. Graham explained this with his famous line: “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

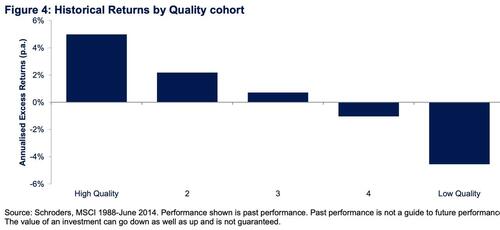

“Why do quality stocks outperform over the long run? The below graph is pretty clear, although recent years could question the conclusions drawn from it: does high-quality always outperform lower-quality? Market euphoria, quantitative easing et cetera oftentimes lead to temporary deviations from this general trend.” – The Compounding Tortoise

Warren Buffett, Graham’s most famous student, captured the essence of value investing in fewer words: “Price is what you pay. Value is what you get.” He also stressed the importance of discipline through the idea of a margin of safety. By buying below the intrinsic value, investors protect themselves if the company underperforms or the market takes longer to recognize value.

Tactics for Value Investors

-

Screen for companies with low price-to-earnings and price-to-book ratios.

-

Favor firms with consistent free cash flow and limited debt.

-

Require a margin of safety before buying.

-

Diversify across sectors to avoid concentration risk.

-

Exercise patience. Recognition of value often takes years.

Value investing works best for investors willing to wait for fundamentals to assert themselves. It is not exciting, but it has delivered reliable long-term returns.

2. Growth Investing

Growth investing takes the opposite view. Instead of focusing on undervaluation, it targets companies expected to expand faster than the market. Technology, healthcare, and other innovation-driven sectors dominate this space. These companies often reinvest earnings into expansion rather than pay dividends, prioritizing growth over immediate income.

The attraction is clear: owning the next Amazon, Apple, or Nvidia before the market fully appreciates its potential can generate outsized returns. But growth investing carries risks. Paying high multiples for future earnings leaves no margin for error. If growth slows or expectations are missed, share prices fall quickly.

As noted above, growth investing works during economic expansion cycles. However, in late-cycle and pre-recessionary periods, the risks of being solely allocated to growth investing can be detrimental.

Buffett once said: “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This statement captures both value and growth perspectives. Growth matters, but only when tied to quality and reasonable valuation.

Tactics for Growth Investors

- Target companies with sustained revenue growth above the market average.

- Use metrics like price-to-sales and price-to-earnings-growth (PEG) to avoid overpaying.

- Dollar-cost average into volatile names to manage timing risk.

- Limit allocation. Growth should complement a portfolio, not dominate it.

- Be prepared for volatility and trim exposure when valuations stretch.

Growth investing suits investors with longer time horizons and higher risk tolerance. The rewards can be significant, but discipline is essential.

3. Momentum Investing

Momentum investing rests on a simple premise: stocks that are rising tend to keep rising, while those falling tend to keep falling. Investors identify strong trends and ride them until they weaken. This strategy relies heavily on technical analysis and often involves short holding periods.

Momentum thrives in bull markets. Herd behavior pushes winners higher, creating self-reinforcing trends. But the risks are significant. Trends can reverse quickly. Benjamin Graham warned: “The more you trade, the more you are likely to lose.” Frequent trading increases costs and exposes investors to sharp reversals when sentiment shifts.

We discussed the concept in more detail in “Momentum Investing:”

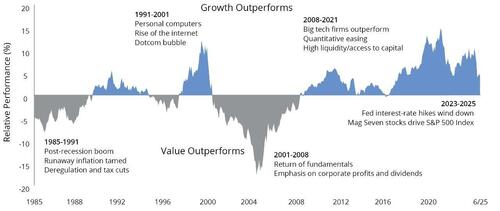

“The chart shows the difference in the performance of the “value vs. growth” index. (Fidelity Value Fund vs S&P 500 Index).

Notable are the periods when “value investing” outperforms.

While it may seem like the current bull market will never end, abandoning decades of investment history would be unwise. As Howard Marks once stated:

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the most exceptional opportunities for gain and loss come when other people forget Rule No. 1.”

Momentum is not about fundamentals. It is about psychology and timing. That makes it risky for most investors.

Tactics for Momentum Investors

- Use strict stop-loss orders to protect capital.

- Limit position size and portfolio exposure.

- Focus on liquidity. Stick to names where you can exit quickly.

- Be disciplined about exits. Do not wait for confirmation once momentum fades.

- Treat momentum as tactical, not core.

Momentum requires constant monitoring and emotional discipline. It is not for casual investors, but it can be effective for those willing to stay vigilant.

4. Dividend Investing

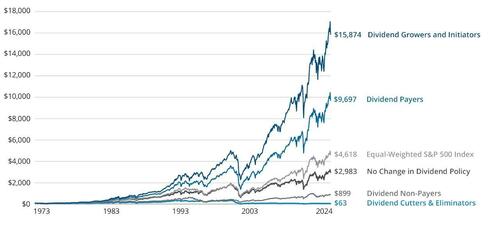

Dividend investing focuses on stability and income. Investors buy companies with reliable dividend payments and strong balance sheets. This approach appeals to retirees and others who prioritize cash flow over growth. The benefit of dividend investing is that the provision of consistent income reduces reliance on capital gains. They also offer a compounding advantage when reinvested. Over time, reinvested dividends significantly increase portfolio value.

“Dividends have played a significant role in the returns investors have received during the last several decades. Going back to 1960, 85% of the cumulative total return of the S&P 500 Index can be attributed to reinvested dividends and the power of compounding.” – Hartford Funds

Dividend stocks tend to be less volatile than growth names. Companies that pay dividends often have mature businesses and steady earnings. But this stability comes with trade-offs. High-dividend companies may reinvest less in expansion, limiting growth. Dividend stocks are also sensitive to interest rate changes, as higher bond yields can make them less attractive.

Tactics for Dividend Investors

- Seek companies with long records of raising dividends.

- Avoid chasing yield. High yields may signal financial distress.

- Diversify across industries such as utilities, consumer staples, and healthcare.

- Reinvest dividends during accumulation years.

- Transition to income withdrawals during retirement.

Dividend investing provides both income and resilience. It works best for investors seeking stability and compounding power.

5. Index Investing

Index investing is simple. Buy a portfolio that mirrors a benchmark, such as the S&P 500, and hold it. This passive approach minimizes costs and provides broad diversification.

Buffett has long recommended index funds for most investors. In his 2013 annual letter to shareholders, he wrote: “My advice to the trustee could not be simpler: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund.” His reasoning is straightforward; most active managers underperform the market after fees.

Index investing reduces the need for constant decision-making. It captures market returns without trying to predict winners. But it also has drawbacks. Index funds hold every stock in the benchmark, including poor performers. They will not outperform the market, because they are the market.

Tactics for Index Investors

- Use low-cost funds to minimize expense drag.

- Make index funds the foundation of your portfolio.

- Rebalance annually to maintain allocation.

- Combine with active strategies if you want additional exposure.

- Stay invested. The biggest risk with index investing is abandoning the strategy during downturns.

Index investing suits those seeking long-term consistency without the complexity of stock selection.

Final Thoughts

Each strategy offers lessons. Value emphasizes patience and fundamentals. Growth rewards innovation but demands valuation discipline. Momentum takes advantage of market psychology but carries high risk. Dividends provide stability and compounding. Index investing delivers simplicity and cost efficiency.

Benjamin Graham warned against speculation disguised as investing: “The essence of investment management is the management of risks, not the management of returns.” Warren Buffett added his own guardrail: “Know your circle of competence, and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital.”

In practice, the best approach often blends elements of each. Index funds can form a low-cost core. Value and dividend strategies add resilience. Growth provides upside. Momentum, if used carefully, offers tactical opportunities. Success lies not in chasing the latest idea, but in consistency through cycles.

Markets will always be volatile. Strategies will fall in and out of favor. What matters most is discipline. The investor who remains patient, diversified, and focused on long-term goals will outperform those who chase trends or panic during downturns.

Tyler Durden

Mon, 09/15/2025 – 13:05