Intel Jumps After Nvidia, Broadcom Test Chips On Intel 18A Process; Taiwan Semi To Invest $100BN In US Chip Plants

Update: (10:30am ET): In related news, the WSJ reports that taiwan chip giant TSMC, or Taiwan Semiconductor, intends to invest $100 billion in chip manufacturing plants in the U.S. over the next four years under a plan expected to be announced later Monday by President Trump.

The investment would be used to build out cutting-edge chip-making facilities. Such an expansion would advance a long-pursued U.S. goal to regrow the domestic semiconductor industry after manufacturing fled largely to Asian countries in recent decades.

TSMC, the world’s largest contract chip-maker, set down roots in Arizona in 2020, when it said it would build a chip factory there for $12 billion. Its ambitions for the site have expanded rapidly since, with two more factories on the same site and a total investment of $65 billion. The company’s first factory began mass production late last year.

Since the Biden administration, the U.S. has expressed concerns about TSMC’s near-monopoly on advanced chip manufacturing and has been urging the company to relocate more of its cutting-edge production, including advanced chip packaging facilities, to the U.S. Advanced chip packaging is particularly critical for AI related chips, as it enhances performance by integrating multiple semiconductor components, reducing size, improving power efficiency, and ensuring faster data transfer — key factors for AI applications.

It wasn’t immediately clear if the TSMC investment would include Intel’s own chip fabs although it would certainly defeat Trump’s purpose of trying to prop up Intel if he is also encouraging the world’s biggest chipmaker to grab marketshare from Intel.

* * *

Earlier

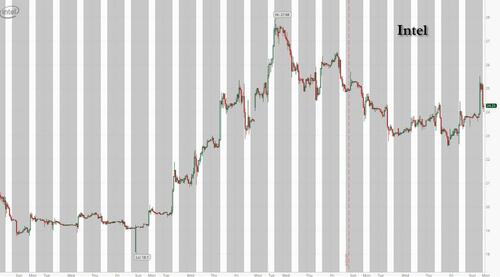

Intel stock is sharply higher (or at least was until the market decided to dump just after the open), on a Reuters report that Nvidia and Broadcom are running manufacturing tests with Intel „demonstrating early confidence in the struggling company’s advanced production techniques.”

The two tests indicate „the companies are moving closer to determining whether they will commit hundreds of millions of dollars’ worth of manufacturing contracts to Intel.” The decision to do so could generate a revenue windfall and endorsement for Intel’s contract manufacturing business that has been beset by delays and has not yet announced a prominent chip designer customer. Separately, AMD is also evaluating whether Intel’s 18A manufacturing process is suitable for its needs but it was unclear if it had sent test chips through the factory.

An Intel spokesperson said, „We don’t comment on specific customers but continue to see strong interest and engagement on Intel 18A across our ecosystem.”

The tests by Nvidia and Broadcom are using Intel’s 18A process, a series of technologies and techniques developed over years that is capable of making advanced artificial intelligence processors and other complex chips. The 18A process competes with similar technology from Taiwan’s TSMC, which dominates the global chip market.

These tests are not being conducted on complete chip designs but are instead aimed at determining the behavior and capabilities of Intel’s 18A process. According to Reuters, chip designers sometimes purchase wafers to test specific components of a chip to work out any kinks before committing to producing a full design at high volume. Testing is under way and can last months. It is unclear when the tests started.

The success of Intel’s contract manufacturing business, or foundry, was the centerpiece of former CEO Pat Gelsinger’s plan to revive the once iconic American technology company. But the board fired Gelsinger in December. The interim co-CEOs mothballed its forthcoming artificial intelligence chip, which pushed back any hopes of a viable AI chip of its own until at least 2027.

Manufacturing tests are no assurance that Intel will eventually win new business. Last year, Reuters reported that a batch of Broadcom tests disappointed its executives and engineers. At the time, Broadcom said it was continuing to review Intel’s foundry. However, the market was clearly glad to read the news, pushing Intel stock up as much as 5% before it faded much of the gains amid the broader market selloff.

The early endorsement is happening against the backdrop of potential further delays in Intel’s ability to deliver chips for some contract manufacturing customers that rely on third-party intellectual property, according to two additional sources and documents seen by Reuters.

Intel’s struggling business has attracted the attention of President Trump’s administration, which is keen on restoring American manufacturing prowess and battling China. Intel is considered the only hope for the U.S. to manufacture the most advanced semiconductors within its borders. Earlier this year, administration officials met with C.C. Wei, CEO of Taiwan’s TSMC in New York about taking a majority stake in a joint venture in Intel’s factory unit, according to a source familiar with the matter. The talks included the possibility of other chip designers purchasing equity stakes in the new venture.

Intel has said it signed deals with Microsoft and Amazon.com to produce chips on 18A, but details are scarce. Intel did not disclose which chip Microsoft plans to use Intel’s factories for or a specific product in Amazon’s case. It was unclear how much manufacturing volume either deal represents.

The 18A process was already delayed to 2026 for potential contract manufacturing customers. Now, according to supplier documents reviewed by Reuters and two sources familiar with the matter, Intel has pushed back its timeline another six months.

The delay is due to the need to qualify crucial intellectual property for the 18A process, which is taking longer than anticipated. Without the qualified fundamental building blocks of intellectual property that small and mid-size chip designers rely on, a swath of potential customers would be unable to produce chips on 18A until at least mid-2026, according to the two sources and documents.

It is unclear why the intellectual property qualification has been delayed. Qualifying intellectual property includes a guarantee from the supplier that it will work on a given manufacturing process.

Asked about the delay, Intel said, „(We will) begin ramping production in the second half of this year, delivering on the commitments we have made to our customers.” The company added that it expects its factories to receive designs from customers this year.

Many chip designers are watching Intel’s foundry progress closely in the hope they will be able to use its manufacturing soon, according to industry experts.

Intel’s 18A process currently performs at a level between TSMC’s most advanced process and its predecessor, Sassine Ghazi, CEO of Synopsys, said in an interview after its financial results. Synopsys supplies some of the crucial intellectual property needed for Intel’s foundry.

„Right now, there are a lot of customers waiting – I’m talking foundry customers – to see the state of Intel. Will I commit? Will I not?” Ghazi said.

Tyler Durden

Mon, 03/03/2025 – 10:15

![Olsztyn. Ukradł portfel i balował za cudze? Mężczyzna z nagrania poszukiwany [WIDEO]](https://static.olsztyn.com.pl/static/articles_photos/44/44155/35c0e8c41d7669418df9d0613ef7936a.jpg)