India Is China 2.0

Authored by Spencer Morrison via American Greatness,

India is taking President Trump up on his offer for reciprocal free trade, proposing zero-for-zero tariffs on specific goods like pharmaceuticals, steel, and automobile components.

This has electrified President Trump’s base—the reciprocal tariffs are working! India’s coming to the table!

Sorry to burst your bubble: America will not benefit from free trade with India—or any other Third World country.

Why?

One word:

Externalities.

President Trump would be wise to remember that tariffs are not about moving factories from China to India—they’re about moving factories back to America.

Hunting Unicorns

Real international free trade—much like real communism—has never been tried. Why? It’s impossible.

The reality that economists & libertarians refuse to recognize is that different countries are different. And not just different in a nominal sense—different in real and practical ways that prevent economic integration.

First, America and India have different levels of economic development that cannot be reconciled without seriously rebalancing the factors of production.

The average annual wage in America is $63,000, while the average annual wage in India is just $2,500—the average American earns 25x more than the average Indian. Labor is often the largest input cost for making products, accounting for approximately 30–35% of the cost of American manufacturing—and it’s an even higher proportion in many service industries.

If America and India traded freely, India’s low wages would undercut America’s labor market—either Americans will need to accept lower wages domestically, or the factories will relocate to India to take advantage of dirt-cheap labor.

How do we know this will happen? The exact same thing happened after China joined the World Trade Organization (WTO) in 2001.

In 2001, the average annual wage in America was $30,846, while the average annual wage in China was just $1,127—the average American earned 27x more than the average Chinese. What happened when American workers competed with Chinese workers? American factories moved to China, and wages stagnated.

The pace of offshoring was harrowing. Since 2001, more than 60,000 factories have moved abroad, killing over 5 million manufacturing jobs. This has decimated America’s industrial capacity and hollowed out local communities. And no, robots and automation had nothing to do with this process, in case you were curious.

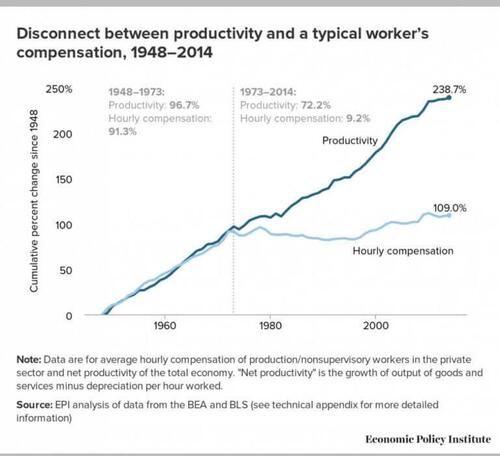

In fact, the process has been going on even earlier than 2001. America has run global trade deficits every year since 1974. The cumulative value of these deficits is $25 trillion, after adjusting for inflation. This has decoupled wages for American workers from their productivity—even though workers produce more value, they aren’t paid for it. Why? Because the wages are suppressed by competition with cheap foreign labor.

Notice how the price differentials respecting America and China in 2001 and America and India today are almost identical. Why do we think the result will be different this time around?

From India With Love

In addition to obvious market asymmetries like the price of labor, the cost of doing business in India is lower because of externalities. Essentially, there are many costs of doing business in America that are baked into the final price of a product, such as the costs of environmental remediation, labor standards, and upholding higher quality control standards.

These costs are not baked into the price of Indian products. Instead, the costs of pollution or abusive labor standards are externalized to the environment or society at large.

But of course, we always pay the piper. Rather than pay 10 cents more per spatula, we live with plastic trash from India floating up on American beaches or mercury poisoning the fish we eat—we may not pay the price at the store, but we certainly pay it with our health and with our soul—all for the sake of “cheap” goods.

Often, foreign goods are not actually cheaper than American goods: they simply do not reflect the full cost of production. For this reason, America cannot produce goods as cheaply as China or India—not unless we are willing to destroy our standard of living—not unless we are willing to sacrifice our environment—not unless we are willing to outlaw morality in the name of business and sell our very soul for profit.

No. Reducing the cost of business to compete with India on price is simply not desirable. Nor is it possible.

Remember, even if America allowed manufacturers to externalize all costs, our economy is structurally distinct from India’s. In America, private corporations dominate the market. Although these corporations are large, and many are owned by the same few investment firms—like BlackRock—they remain private entities.

This is not the case in India, where the state is crafting a cohesive industrial policy designed to industrialize the country. Part of this policy appears to be to piggyback on America’s consumer market when it comes to strategic industries, like steel or pharmaceuticals—just like China.

Ultimately, the only way to protect America’s market from asymmetrical competition from countries like China or India is to price in these externalities by imposing protective tariffs. This is discussed in detail in my book Reshore: How Tariffs Will Bring Our Jobs Home & Revive the American Dream.

The Shock and Awe of Reality

Different countries have different levels of economic development, legal systems, tax structures, histories, geographies, languages, cultural and business norms, and demographics. All of these differences can create market asymmetries that are simply not relevant domestically.

At best, free traders can reduce tariffs and other visible trade barriers, like taxes, transportation costs, and legal disharmonies. However, they cannot uproot the sort of cultural norms and political corruption that make doing business in India—or China, or Mexico, or Italy—different than doing business in America.

Ultimately, America’s interests are not served by moving industry from China to India. The industry needs to come home. Let’s not make the same mistake with India that we did with China—say no to free trade and raise the tariff walls.

Tyler Durden

Thu, 05/08/2025 – 06:30