In Her Last Official Act, Yellen Warns US Will Hit Debt Ceiling One Day After Trump Inauguration

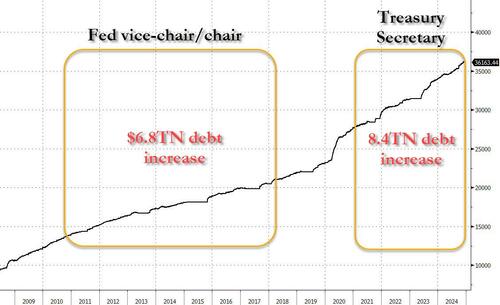

Back in the last week of December, when the stock market was desperately trying to reverse the slump of the Santa rally which prevented stocks from closing 2024 at an all time high, we warned that a bigger threat than a modest 1% market drawdown was looming: the countdown to the next debt ceiling crisis. We quoted Democratic operative – and the only US government official who has personally overseen total debt increase by a staggering $15 trillion under her watch at both the Fed and Treasury – Janet Yellen…

… the said the United States would hit its statutory debt ceiling around the middle of January, at which point the Treasury would resort to “extraordinary measures” to prevent the government from defaulting on its obligations.

While it may not feel like it, we are now in mid-January, and late on Friday, Janet Yellen, in what is almost certainly the last ever official announcement of her long and undistinguished political career, said that the US would hit its debt ceiling the day after President Trump is inaugurated, and that the Treasury will launch “extraordinary measures” to stave off the threat of a national default.

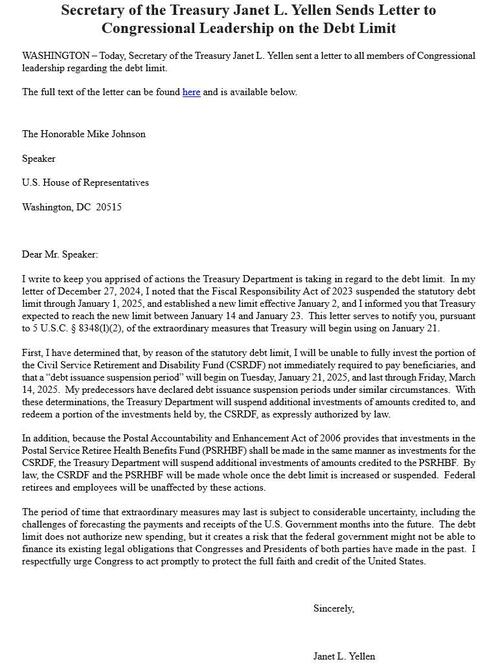

After a previous 20-month suspension of the debt limit expired earlier this month, Yellen wrote in a letter to bipartisan congressional leaders Friday she was advising them “of the extraordinary measures that Treasury will begin using on January 21.” That will be a day after the Biden administration leaves office. “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

The letter marked the second notification in the latest tussle over the debt limit, which kicked back in as of Jan. 2, and the last ever for Yellen before the Trump administration takes office Jan. 20. Congress had suspended the ceiling in 2023 after a close-fought battle by lawmakers to avert a default on federal obligations. The limit is currently set at about $36 trillion.

While some strategists anticipate an easier path to an agreement to suspend or lift the cap given Republicans’ unified control of Congress and the White House once Trump takes office again on Jan. 20, until that action is taken the Treasury will need to deploy measures used repeatedly over the decades to avoid breaching the limit.

As Bloomberg reminds us, during his Senate confirmation hearing, Trump’s nominee to succeed Yellen as Treasury chief, Scott Bessent, vowed that there’d be no default on his watch… which is glaringly obvious. Which nominee for Treasury secretary would ever say out loud: „Yes, I fully intend on watching the US default under my watch.”

While nothing new to those familiar with the periodic song and dance when the US enters its debt ceiling crunch, Yellen advised that the Treasury’s extraordinary measures would begin by redeeming a portion of, and suspending full investments in, the Civil Service Retirement and Disability Fund. It will also suspend additional investments of amounts credited to the Postal Service Retiree Health Benefits Fund. Those funds will be made whole after Congress acts on the debt ceiling, Yellen said. She gave no indication how long the accounting measures and Treasury’s cash balance would last.

“The period of time that extraordinary measures may last is subject to considerable uncertainty, including the challenges of forecasting the payments and receipts of the US government months into the future,” she wrote.

One thing we do know, is that the Treasury currently has $680 billion in cash in the Treasury General Account which will now be drained at an accelerated pace, and potentially hit $0 by the summer, until a new debt ceiling deal is reached (it will be, it’s just a matter of when). What is just as notable is that as we first described it at the start of 2021, this rapid drain of Treasury cash serves to goose risk assets aggressively, and according to some strategists, has an even greater impact on prices than the Fed’s QE, since there is no new net debt issuance for the duration of the debt ceiling suspension.

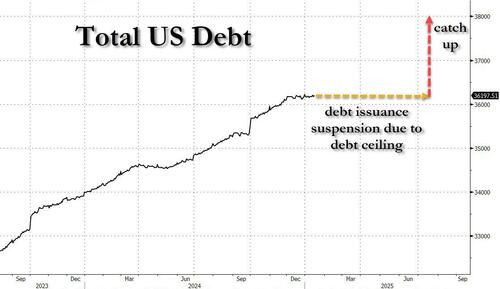

And speaking of debt issuance suspension, total US debt will now remain frozen at around $36.2 trillion for the next ~6 months, until the next debt deal is reached, at which point the debt issuance will „catch up” to where it was supposed to be, and surge by almost $2 trillion overnight.

The above assumes of course that after the requisite fire and brimstone, a new debt deal will be reached. Naturally, should the Treasury become unable to issue fresh debt and then run out of cash, the US government would be in danger of defaulting on some financial obligations. Wall Street is already trying to handicap how long the US government has before it’s unable to pay its bills because of the newly re-imposed debt ceiling. That so-called X-date has been estimated by some strategists as looming around July or August.

In the event of congressional standoffs, investors tend to dump the Treasury bills most vulnerable to a potential default in favor of securities maturing before or after the X-date, creating a kink in the curve. Right now, though, the bill market is showing no signs of angst, given the uncertainties about the outlook.

Tyler Durden

Fri, 01/17/2025 – 23:17