Goldman Warns of „Accelerated Property Price Declines” Across Chinese Cities

The latest 70-city house price data from China’s National Bureau of Statistics indicate that the property market remains in decline as of June, despite ongoing policy easing measures and recent rumors that Beijing may revive its 2015 stimulus playbook. Overnight, China reported 5.2% year-over-year growth for Q2, just fractionally above expectations (does anyone actually believe these numbers?).

A team of Goldman analysts, led by Andrew Tilton, penned a note on Tuesday for clients, warning that China’s housing market is continuing to accelerate to the downside.

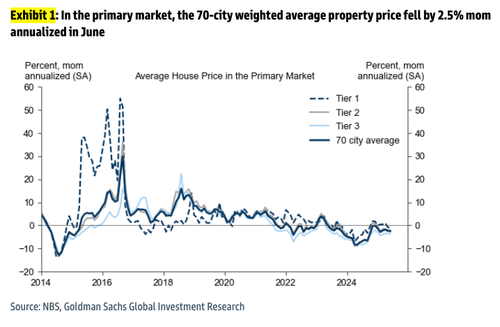

- NBS’ 70-city primary-market weighted average property price change in June: -2.5% mom annualized (seasonally adjusted by GS), -3.1% yoy. May: -2.3% mom annualized, -3.5% yoy.

Tilton said new data from the National Bureau of Statistics shows new home prices across 70 cities fell 2.5% month-over-month annualized in June—despite ongoing easing efforts. The downturn isn’t limited to Tier 1 cities—it’s widespread. Translation: The „floor” Beijnng continues to promise looks more like a trapdoor every time.

The five main points from the data:

After seasonal adjustments, weighted average house prices in the primary market fell by 2.5% mom annualized in June (vs. -2.3% in May; Exhibit 1), despite ongoing easing policies.

The number of cities that experienced sequentially higher property prices ticked up in the primary market but continued to fall in the secondary market in June (Exhibit 3).

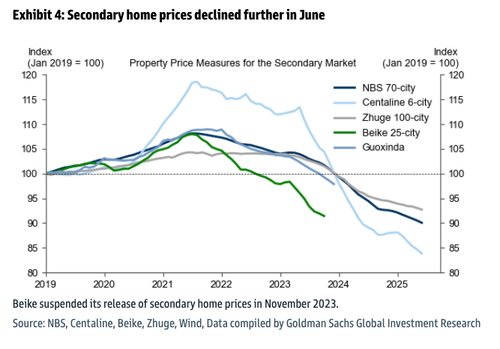

Year-on-year change in the weighted average new home prices fell by 3.1% in June, compared to -3.5% in May. We emphasize the 70-city data are for primary market transactions (new home sales) only; secondary market data by NBS and some third-party platforms suggest price declines of 5%-15% over the past year (Exhibit 4).

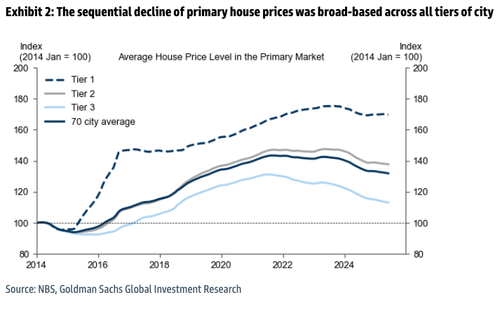

By city tiers[2], house prices of Tier-1 and Tier-2 cities declined sequentially by 1.3% and 2.1% mom annualized in June (vs. -0.7% and -1.9% in May), respectively (Exhibit 2). For Tier-3 cities, house prices declined sequentially by 3.5% mom annualized (vs. -3.5% in May). Despite more local housing easing measures in recent months, we believe the property markets in lower-tier cities still face strong headwinds from weaker growth fundamentals than top-tier cities, including the more severe oversupply problems.

Our high frequency tracker suggests that the 30-city new home transaction volume declined by 4% yoy in June. Major cities’ inventory months (sellable gross floor area divided by 12-month rolling gross floor area sold) increased slightly to 26.0 in July from 25.5 in June, with the increase mostly led by Tier-2 cities.

Since the September policy pivot last year, policymakers have aimed to provide a floor to the property market. In the recent State Council meeting, the government stated to construct a new real estate development model (房地产发展新模式) and advance the „good housing initiative” (好房子建设). We expect incremental housing easing measures to stabilize home prices and contain the left-tail risk in the property sector, including further cuts to mortgage rates, faster implementation of local government purchases of raw land and existing housing inventory, and more policy support for cash-backed urban village renovation programs (with 1mn units already announced). However, we believe a repeat of the 2015-18 shantytown redevelopment program is unlikely.

Related:

-

China Property Stocks Erupt On Rumors Beijing May Revive 2015 Stimulus Playbook

-

China’s Big Housing Stimulus Rescue Is Wishful Thinking

Overnight News:

- China Q2 GDP Drops To 5.2% But Beats Expectations Thanks To Subsidies And Tariff Frontrunning

The larger question is whether another shantytown redevelopment stimulus package will have the same effect as it did a decade ago. Beijing needs to fire the stimulus bazooka here.

Tyler Durden

Tue, 07/15/2025 – 19:40