Goldman Sees Boycott Easing For Target – But Says „Still Too Early For Turnaround” Story

With earnings season just kicking off for corporate America, it’s hard not to recall what Target CEO Brian Cornell told investors in May—blaming a soft quarter on a consumer boycott over the retailer’s decision to scale back its DEI initiatives. The retailer has faced multiple boycotts in recent years.

It’s certainly not a question in our minds—but one that Goldman has raised: When will the boycott pressure on the retailer that has managed to anger both sides of the political aisle finally subside?

First, recall, Target managed to spark a boycott among conservatives for its demonic LGBTQ-friendly kids clothing, telling consumers in 2023 that the branding is „the right thing for society.” Some of those offerings included T-shirts that say „Pride Adult Drag Queen 'Katya,'” „Trans people will always exist!” and „Girls Gays Theys.”

Then, earlier this year, Target, yet again, managed to spark a boycott among progressives for discontinuing several of its DEI initiatives. The retailer simply cannot navigate the political and social minefields.

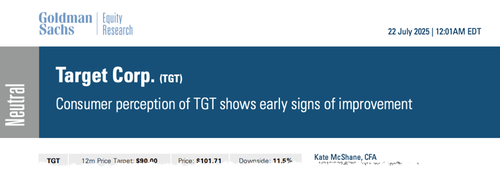

This brings us to a new report published Tuesday by Goldman analysts led by Kate McShane, who told clients that the Target boycotts may be starting to ease, with „some early green shoots” visible—though it’s „still too early to call a turnaround.”

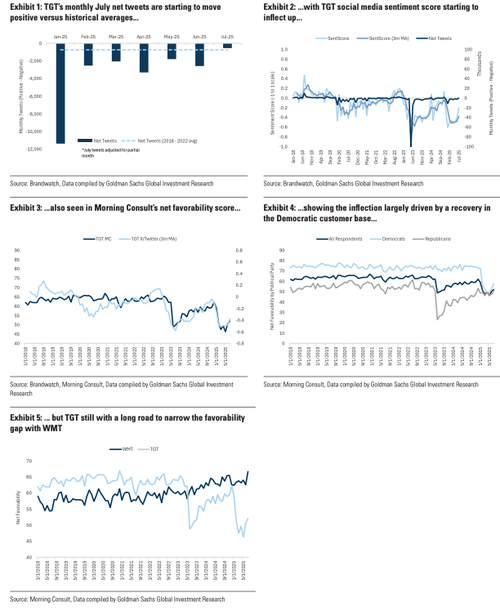

McShane cited sentiment data—including X feeds, social sentiment, app downloads, and traffic trends—to better gauge consumer behavior around the retailer.

The analyst noted:

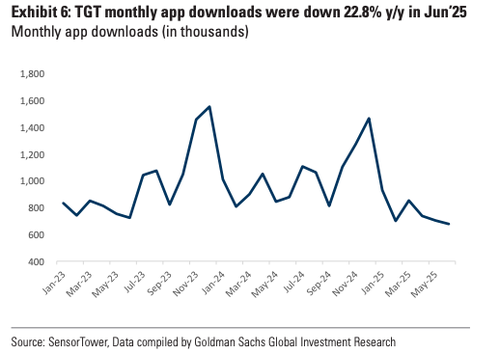

We are starting to see some early green shoots (through 7/16) with a sequential improvement in both Twitter sentiment and Morning Consult’s net favorability score. That said, app downloads declined both sequentially and y/y, and traffic data remains negative. Compared to June, we highlight that NPI/NPS trends have improved, especially with frequent customers; however, we note it is still too early to call a turnaround given that KPIs have not improved m/m and TGT’s NPI for less frequent customers still remains at its lows While TGT reset its FY25 earnings guide with 1Q earnings in May, to get more positive we would need to see an improvement in comp trends and a rightsizing of the company’s inventory position.

On the social media front, McShane noted that negative sentiment around the retailer is easing, with some positive sentiment beginning to emerge. She added that the recovery may still be a long one…

Target app downloads remained depressed.

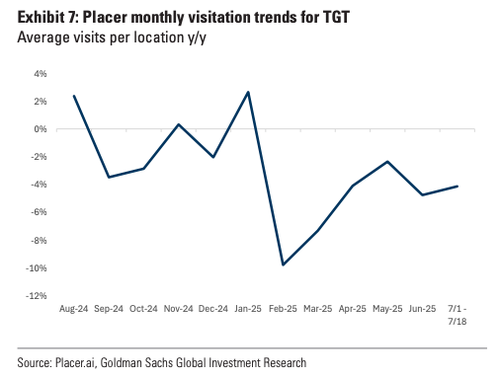

Traffic trends via Placer have steadily improved since February.

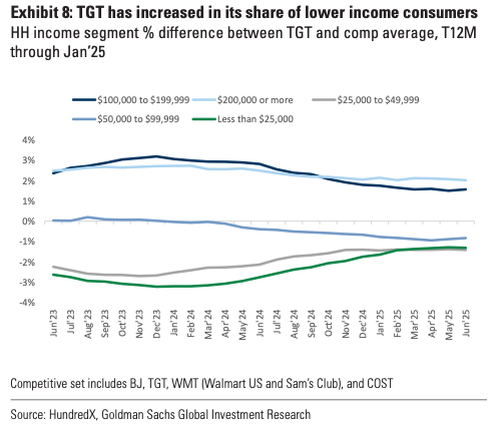

And more low-income consumers have been shopping at the retailer, with a noticeable increase in this cohort beginning about a year ago

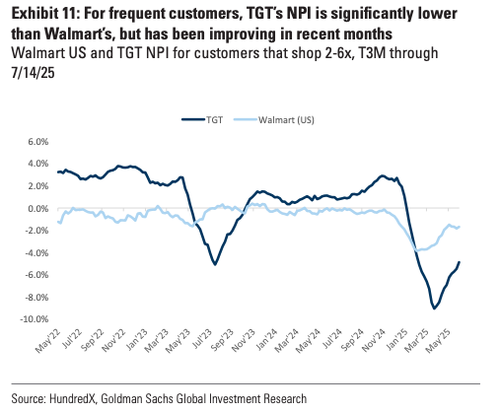

Net Promoter Scores (NPS) and Net Purchase Intent (NPI) metrics via HundredX have potentially bottomed out.

However, Target’s NPI is significantly lower than Walmart’s.

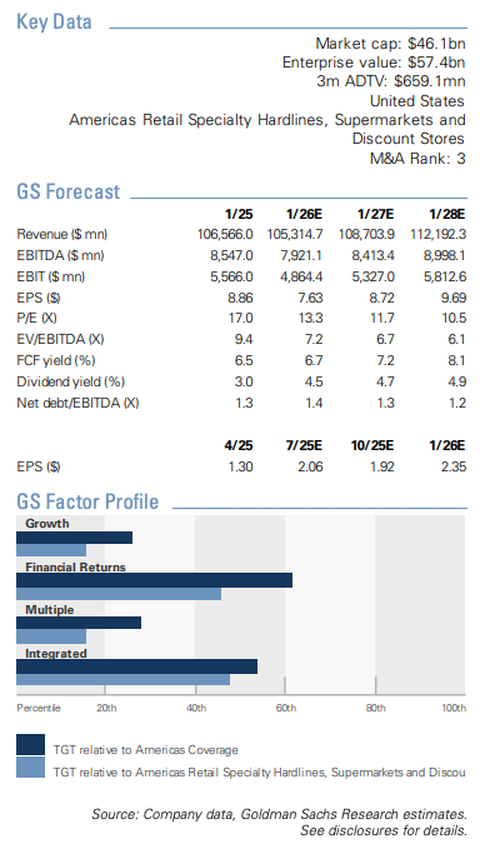

Looking ahead to Target’s upcoming Q2 earnings (expected release Aug. 20), McShane forecasts same-store sales to fall by 3%, slightly better than the -3.1% LSEG Data & Analytics consensus estimate. She also expects an operating margin of 5.3% (vs. 5.1% consensus) and earnings per share of $2.06, modestly above the consensus estimate of $2.02. Her rating is „Neutral” on the stock with a 12-month price target of $90.

Beyond Target, we recently referenced Goldman’s Beverage Bytes survey, which showed that Bud Light is still struggling years later after the brewer partnered with Dylan Mulvaney—a biological male pretending to be a woman—for TikTok promotional videos.

The lesson for corporate America is that Gen-Zers and Millennials with DEI degrees from elite liberal colleges are increasingly viewed as liabilities in an era where the Overton Window has shifted to the center-right—and is likely to remain there throughout President Trump’s second term.

Tyler Durden

Wed, 07/23/2025 – 07:45