Goldman Reports Record Equity Trading Revenue, Misses In FICC and iBanking, Losses On Investments

On Friday, when looking at the earnings of the largest US bank, we said that while JPMorgan reported both revenue and earnings that beat estimates, it was JPMorgan’s record trading revenue that stole the show: yes, yet again the recent market turmoil meant that JPM would generate record trading revenues commissions in Q1, just as we had expected.

Make Trade Commissions Great Again

It’s official: the biggest volume session of all time https://t.co/ee3uYsA5Cb pic.twitter.com/pqd6PIiiEm

— zerohedge (@zerohedge) April 4, 2025

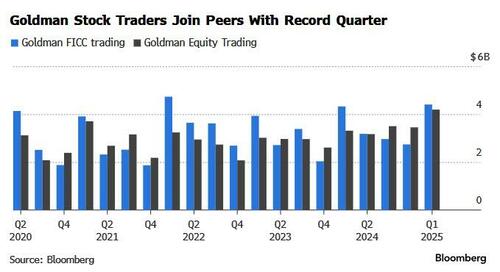

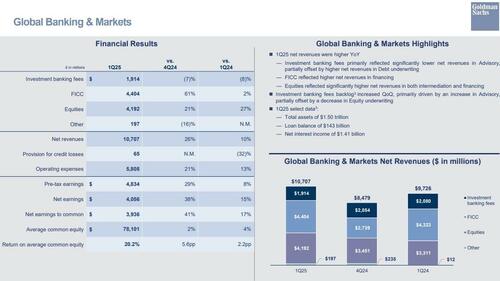

Today it was Goldman’s turn to do the same with the bank formerly known as the giant vampire squid blowing away expectations with its Q1 numbers after its traders posted their highest quarterly revenue haul on record, riding a wave of volatility triggered by an emerging global trade war that’s roiled financial markets. Specifically, Q1 equity-trading revenue rose 27% from a year earlier to $4.19 billion – the highest on record – and above the $3.80 billion expected, even as the more important FICC group actually missed, as revenues printed $4.404 bilion, below the $4.47 billion expected and up just 2% YoY.

Goldman’s results were a carbon copy of JPMorgan because not only did FICC miss, but investment banking was a big dud as well (with misses in advisory and equity underwriting, as only debt underwriting outperformed estimates).

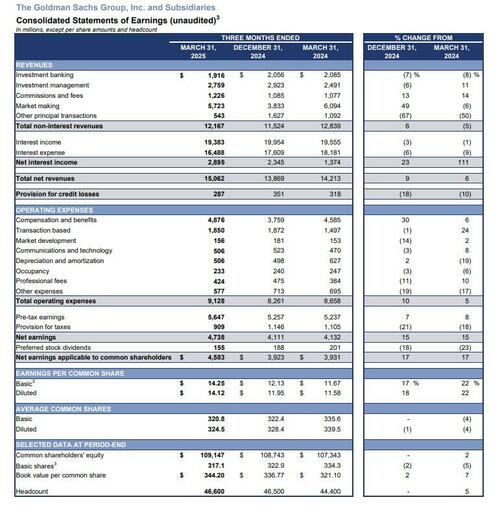

But before we dig deeper here is a snapshot of the Q1 results:

- Net revenue $15.06 billion, +6% y/y, beating estimate $14.76 billion and the third-highest quarter on record

- Global Banking & Markets net revenues $10.71 billion, +10% y/y, beating estimate $10.42 billion

- Equities sales & trading revenue $4.19 billion, beating estimate $3.8 billion

- FICC sales & trading revenue $4.40 billion, missing estimate $4.47 billion

- Investment banking revenue $1.92 billion, -8.1% y/y, missing estimate $2.03 billion

- Advisory revenue $792 million, -22% y/y, missing estimate $910.4 million

- Equity underwriting rev. $370 million vs. $370 million y/y, missing estimate $394.4 million

- Debt underwriting rev. $752 million, +7.6% y/y, beating estimate $699.5 million

- Platform Solutions pretax earnings $25 million, beating the estimate loss $106.5 million

- EPS $14.12 vs. $11.58 y/y, up 22% and beating estimates of $12.21, largely thanks to a plunge in the effective tax rate to 16.1%, down from 22.4% a year ago (according to the bank, the drop reflect „an increase in tax benefits on the settlement of employee share-based awards, partially offset by a decrease in other permanent tax benefits, for the first quarter of 2025 compared with the full year of 2024.”)

Some more details:

- Net interest income $2.90 billion, estimate $2.28 billion

- Total operating expenses $9.13 billion, +5.4% y/y, estimate $9.17 billion

- Compensation expenses $4.88 billion, +6.3% y/y, estimate $4.86 billion

- Total deposits $471 billion, +8.8% q/q

- Total Loans $210 billion, estimate $197.61 billion

- Provision for credit losses $287 million, -9.7% y/y, estimate $410.4 million

- Annualized ROE +16.9%, estimate +14.9%

- Return on tangible equity +18%, estimate +16.1%

- Standardized CET1 ratio 14.8%, estimate 15%

- Book value per share $344.20 vs. $321.10 y/y

- Efficiency ratio 60.6% vs. 60.9% y/y, estimate 61.6%

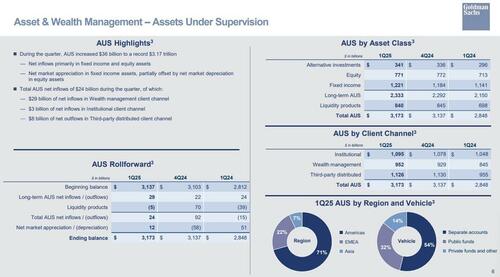

- Assets under management $3.17 trillion, +11% y/y, estimate $3.15 trillion

- Total AUS net inflows $24 billion vs. outflows $15 billion y/y, estimate $34.26 billion

Q1 consolidated summary:

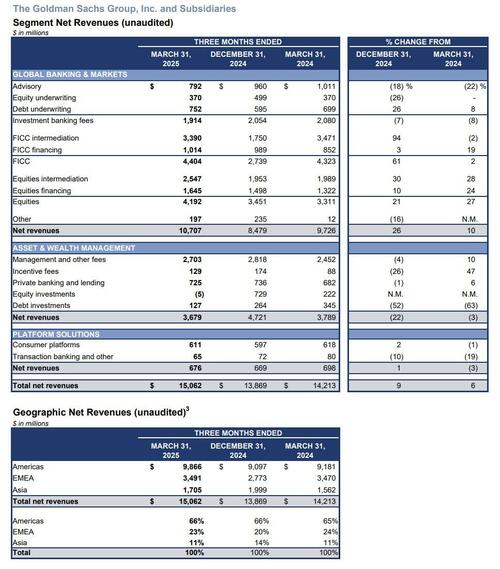

… and by segment.

Unlike JPMorgan, whose loan loss reserves soared 3x to $1bn, Goldman’s provision for credit losses was only $287 million, below estimates of $410 million, and down 10% compared with $318 million for the first quarter of 2024. Provisions for the first quarter of 2025 primarily reflected net provisions related to the credit card portfolio. Provisions for the first quarter of 2024 reflected net provisions related to both the credit card portfolio (driven by net charge-offs) and wholesale loans (driven by impairments). Then again, that is to be expected for a bank which recently took massive write down losses on its entire retail/subsprime lending effort which imploded even faster than it was launched.

Goldman’s expenses were also lower than expected:

- Operating expenses were $9.13 billion for the first quarter of 2025, below expectations of $9.17 billion, but 5% higher than the first quarter of 2024 and 10% higher than the fourth quarter of 2024.

- The firm’s efficiency ratio was 60.6% for the first quarter of 2025, compared with 60.9% for the first quarter of 2024.

- The increase in operating expenses compared with the first quarter of 2024 primarily reflected significantly higher transaction based expenses and higher compensation and benefits expenses (reflecting improved operating performance), partially offset by significantly lower consolidated investment entities expenses, including impairments (largely in depreciation and amortization) and a decrease from the FDIC special assessment fee recognized in the first quarter of 2024 (in other expenses).

- Net provisions for litigation and regulatory proceedings were $(11) million for the first quarter of 2025, compared with $23 million for the first quarter of 2024.

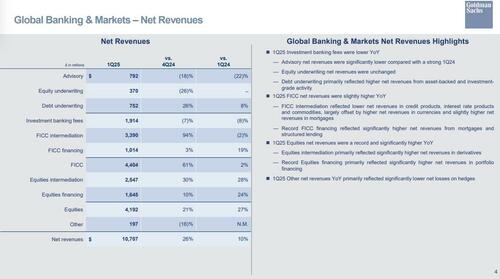

Taking a closer look at the bank’s all important Global Banking and Markets division, net revenues were $10.71 billion for the first quarter of 2025, 10% higher than the first quarter of 2024 and 26% higher than the fourth quarter of 2024. At the same time, growth in Goldman’s dealmaking machine remains challenged as the same market volatility that fuels trading hampers clients’ willingness to ink big-ticket mergers and financing agreements. The company’s investment-banking revenue was $1.91 billion, 8% lower than last year. Financial-advisory revenues and equity underwriting both missed expectations, but the bank’s debt desk came in higher than predicted. here are the deails:

- Net revenues in Equities were $4.19 billion, beating estimates of $3.8 billion, and 27% higher than the first quarter of 2024, „due to significantly higher net revenues in Equities intermediation (primarily reflecting significantly higher net revenues in derivatives) and in Equities financing (primarily reflecting significantly higher net revenues in portfolio financing).”

- Net revenues in Fixed Income, Currency and Commodities (FICC) were $4.40 billion, missing estimates of $4.47 billion, and 2% higher than the first quarter of 2024, „reflecting higher net revenues in FICC financing, driven by significantly higher net revenues from mortgages and structured lending. At the same time, net revenues in FICC intermediation were slightly lower, „reflecting lower net revenues in credit products, interest rate products and commodities, largely offset by higher net revenues in currencies and slightly higher net revenues in mortgages.”

- Investment banking fees were $1.91 billion, missing estimates of $2.03 billion, and 8% lower than the first quarter of 2024, „primarily due to significantly lower net revenues in Advisory compared with a strong prior year period, partially offset by higher net revenues in Debt underwriting, primarily driven by asset-backed and investment-grade activity.” Net revenues in Equity underwriting were unchanged.

- The firm’s Investment banking fees backlog increased compared with the end of 2024.

Even as big-ticket deals remain thin, the bank’s investment-banking fees backlog has grown quarter-over-quarter, the company said. That echoes the sentiment that Morgan Stanley CEO Ted Pick conveyed on Friday, when he said a lot of deals are paused but not abandoned. Finally, net revenues in Other were $197 million, compared with $12 million for the first quarter of 2024, primarily reflecting significantly lower net losses on hedges. Here is the breakdown visually:

Comparing results vs a year ago:

- Equities net revenues were a record and significantly higher YoY

- FICC net revenues were slightly higher YoY

- Investment banking fees were lower YoY

- Other net revenues YoY primarily reflected significantly lower net losses on hedges

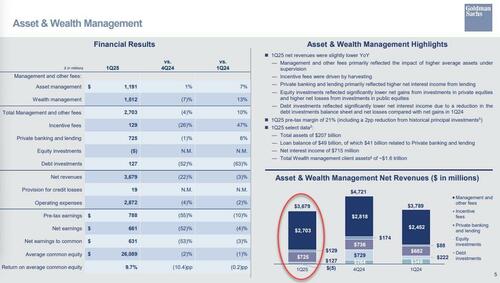

Revenue from the bank’s vast asset- and wealth-management business was $3.68 billion, lower than the $3.84 billion expected by analysts, and the reason why: investments puked and the company was busy „harvesting.”

- Equity investments reflected significantly lower net gains from investments in private equities and higher net losses from investments in public equities

- Debt investments reflected significantly lower net interest income due to a reduction in the debt investments balance sheet and net losses compared with net gains in 1Q24

- Incentive fees were driven by harvesting (i.e. selling)

- Private banking and lending primarily reflected higher net interest income from lending

Goldman has been trying to expand its wealth management unit – which now manages $3.17 trillion – including by opening private equity funds to individual investors outside the bank.

In doing so, it aims to create a more steady stream of fee-based income, tapping growing demand for private-market investments and alleviating investor concerns over its less predictable businesses.

Goldman’s Q1 results build on the sector’s momentum from last week, when banking peers including JPMorgan and Morgan Stanley also notched record stock-trading hauls for the period. And they follow a record year for Goldman in 2024, when the New York-based bank lifted its revenue in the division by almost 50%.

„While we are entering the second quarter with a markedly different operating environment than earlier this year, we remain confident in our ability to continue to support our clients,” Chief Executive Officer David Solomon said in the statement.

Goldman traders stand to gain from market volatility to a point, but Solomon has also called for more clarity on Trump’s policy agenda to provide certainty to investors. The results are the first since his future at the bank’s helm was cemented with an $80 million retention bonus – criticized by investor-advisory firms – that keeps him at Goldman until at least 2030.

Stripping away the record equity trading revenue which was a given, Wall Street commentary was mixed:

RBC’s Gerard Cassidy (Sector perform, $610)

- Goldman “posted a strong quarter driven by better-than-expected total revenues, lower-than-expected expenses and a lower-than-expected provision for credit losses,” the analyst wrote

- Effective tax rate was lower than expected, reflects increase in tax benefits on the settlement of employee share-based awards

Evercore’s Glenn Schorr (Outperform, $594)

- Goldman put up a strong quarter, Schorr and colleagues wrote

- Issues include: investment-banking down 8% year-on-year and advisory down 22% year on year; but the backlog was up

- “Second quarter will bring other challenges as banking and AWM start out the quarter in deficit, but trading remains strong and somehow Goldman’s banking pipeline is up”

- “Goldman Sachs will likely ebb and flow with the macro backdrop, but the great start to the year, continued growth in trading, financing and management fees and the high comp accrual should provide some offsets to what could be a mid-year slowdown”

JPMorgan’s Kian Abouhossein (Overweight, $614)

- Asset- and wealth-management revenue was “below JPM estimates, reflecting significantly lower net gains from investments in private equities and higher net losses from investments in public equities”

- “Investment-banking fees backlog increased quarter-on-quarter, primarily driven by an increase in advisory, partially offset by a decrease in equity underwriting”

Shares of the company, which were down 14% this year through Friday, rose 1.5% in early trading.

More in the full Q1 presentation below (pdf link)

Tyler Durden

Mon, 04/14/2025 – 10:30