Futures, Global Markets Jump On Trump Trade Deal With UK

US equity futures storm higher, and are back to their post-Liberation Day highs on positive trade news (Imminent „comprehensive” trade agreement with UK the first of his promised deals; removal of chip export restrictions) and a neutral Fed (economy has strength to wait to see trade war impact hit hard data) even as China again reiterated that the US should cancel unilateral tariffs ahead the first official meeting between the countries this weekend amid reports the US is considering exempting child-related goods from its 145% tariffs on China. As of 8:00am ET, S&P futures rose 0.9% while Nasdaq futures are 1.2% higher, both near session highs. Elsewhere FTSE +40bps, DAX +1.2%, CAC +1%, Shanghai +28bps, Hang Seng +37bps, Nikkei +41bps. Intel rose more than 3% in premarket trading, while peers such as Nvidia and Micron also gained on news Trump will rescind restrictions regulating the export of semiconductors to various countries. Outside of tariffs, Norway and Sweden central banks left rates unch (expected) while we get the BoE this morning (25bps cut expected). US Bond yields are 4-5bp higher across the curve and USD is poised to have its best day 6 sessions with DXY +50bp. Today’s macro data focus is on jobless claims, NY Fed 1-year inflation expectations, and labor costs.

In premarket trading, Mag 7 stocks climb as the Trump administration plans to rescind some Biden-era AI chip curbs as part of a broader effort to revise global semiconductor trade restrictions (Nvidia +1.6%, Alphabet +1.9%, Meta +2%, Tesla +1.3%, Apple +1%, Amazon +1.6%, Microsoft +0.9%). Cryptocurrency-exposed stocks rise as Bitcoin approaches the $100,000 mark for the first time since February as global trade tensions show signs of easing. AppLovin climbs 14% after the AI-powered advertisement platform reported first-quarter results that beat expectations. Arm Holdings tumbled 9% after giving a disappointing sales forecast for the current quarter, stoking concerns about a tariff-fueled slowdown for the chip industry. Here are some other notable premarket movers:

- Carvana (CVNA) rises 4% after the online used-car retailer doubled its profits in the first quarter with record vehicle volume.

- Coherent (COHR) gains 6% after the semiconductor device company reported third-quarter results that beat expectations

- Dave Inc. (DAVE) rises 28% after the digital banking services company boosted its revenue and adjusted Ebitda forecast for the full year, surpassing expectations.

- Eli Lilly (LLY) drops 1.5% and AbbVie (ABBV) dips 1.7% following a Politico report that President Donald Trump plans to revive an effort to dramatically slash drug costs by tying the amount the government pays for some medicines to lower prices abroad.

- Fortinet (FTNT) tumbles 8% after the security software company reported its first-quarter results and gave an outlook

- Fluence Energy Inc. (FLNC) falls 15% after the provider of energy storage systems cut its total revenue guidance range for the full year, a reduction of $700m at the midpoint.

- Fortinet (FTNT) tumbles 14% after the security software company reported its first-quarter results that Jefferies says missed “elevated investor expectations.”

- Krispy Kreme Inc. (DNUT) falls 19% after saying the company will no longer pay quarterly cash dividends in order to pay down its debt and focus on growth.

- Magnite Inc. (MGNI) rises 11% after the advertising technology company reported first-quarter results that beat expectations on profitability metrics. It also said it was taking a cautious approach in its outlook given tariff-related uncertainty, a move analysts support.

- MercadoLibre (MELI) climbs 8% after the e-commerce and fintech giant beat analysts’ expectations in the first quarter of the year, delivering strong growth in its credit portfolio.

- Peloton Interactive Inc. (PTON) falls 4% after reporting that revenue sank 13% last quarter, marking the third straight year-on-year decline in sales.

- Shopify Inc. (SHOP) slips 8% after projected sales in the current quarter that just met expectations, suggesting steep tariffs on goods from China present a challenge.

- Tapestry Inc. (TPR) gains 9% after the handbag maker raised its annual outlook, shrugging off broader concerns about worsening consumer sentiment and the trade war.

- Tutor Perini Corp. (TPC) climbs 15% after the construction company boosted its year profit outlook. First quarter revenue increased 19% from the year-ago period and beat estimates.

Global markets were lifted after Trump administration’s plan to rescind some Biden-era curbs on chipmakers and news of a trade agreement with Britain, which followed news that US and Chinese officials will meet this weekend to discuss trade. Investors are waiting to see if crippling levies mooted by Trump will be negotiated down, averting lasting damage to economic growth and corporate profits.

„The fear has been of higher prices, company profit margins being squeezed, and the economy going into recession as a result of higher tariffs,” said Kenneth Broux, a strategist at Societe Generale. “If you start unwinding all of that, it’s got to be bullish for risk assets.”

In the UK, gilt yields rose about five basis points, reversing an earlier slide, after the BOE reduced interest rates to 4.25% in a decision made before the US trade deal was announced. However, the BOE upgraded its annual growth forecast for 2025 while two officials voted not to cut rates this time due to inflation risks and a recent easing in financial conditions.

For Neil Birrell, chief investment officer at Premier Miton Investors, the split BOE vote “goes to show the scale of the uncertainty that exists amongst a key group, namely the actual setters of policy. It’s going to be difficult to make a call on future policy on the back of that.”

Meanwhile, while there was little international fallout from the conflict between India and Pakistan, investors were monitoring signs of escalation. Pakistan’s main equity index shed as much as 8.8%, while India’s Nifty 50 Index lost as much as 01.1%. The Indian rupee slid over 1% against the dollar.

The trade headlines also lifted Europe’s Stoxx 600 index by about 0.9%, as tech, industrials and travel are the best-performing European sectors. Chip stocks including ASML were among the top gainers. Siemens Energy rose after it said the impact of tariffs was going to be limited, while Danish container giant Maersk declines after cutting its forecast amid trade war. Britain’s domestically focused FTSE 250 index rose to a two-month high. Here are the biggest winners:

- Siemens Energy shares gain as much as 4.1%, touching a record high, shrugging off US tariff chaos and saying the effect of import duties on its bottom line will be small.

- Adecco shares gain as much as 4.3% after the Swiss staffing company posts a top line beat in a mixed set of first-quarter results.

- Puma shares jump as much as 6%, hitting their highest level in almost two months, after the sportswear retailer delivered a small sales beat and reiterated its guidance for the year.

- Rheinmetall shares rise as much as 2% to a new record after the German firm’s weapon and ammunition sales for the first quarter beat the average analyst estimate.

- Novonesis shares rise as much as 4.3% after the Danish biotechnology firm reported strong results for the first quarter, including a small beat on organic sales growth.

- J. Martins shares advance as much as 6.3% after retailer maintained Ebitda margin for 1Q even as an unfavorable calendar with a late Easter slowed same-store sales in Poland.

- Argenx shares drop as much as 9.5% after the biotech firm reported Vyvgart sales for the first quarter that were slightly weaker than JPMorgan analysts had been expecting.

- Maersk shares fall 2.2% after the Danish container giant’s earnings beat was overshadowed by it cutting its forecast for the global transport market rattled by trade war.

- Zurich Insurance shares slip as much as 1.4% as Switzerland’s largest insurer cautioned that prices are moderating in Europe, the Middle East and Africa and North America even as it reported solid results for the first quarter.

- Amadeus shares fall as much as 3.6% after the travel IT services provider reported sales and Ebitda that missed estimates.

- Centrica shares drop as much as 8%, the most since last July, after analysts warned the British Gas-owner’s AGM update suggests there is downside risks to consensus numbers for this year.

- Zealand Pharma shares fall as much as 5.9% after the Danish drug developer released results for the first quarter which Van Lanschot Kempen analysts said were “uneventful.”

Earlier in the session, stocks in Asia declined, on course to end a four-day run of gains, as earnings caution in Japan outweighed optimism over signs of easing trade tensions. The MSCI Asia Pacific Index fell 0.6%, reversing an earlier 0.3% gain. Japanese firms Nintendo Co. and Toyota Motor Corp. were among the biggest drags, with the carmaker expecting a $1.3 billion profit hit in just two months on tariffs. Nintendo projected weaker-than-expected initial sales of the Switch 2. Trading was halted in Pakistan after its benchmark KSE-30 Index slumped on intensifying military conflict with India. Indian stocks were slightly lower. Markets were in the green in Hong Kong, China and South Korea as signs of progress in trade negotiations supported sentiment. The confirmation of US-China trade talks starting this weekend, and Thursday’s report that the US is about to announce a deal with the United Kingdom, boosted optimism that the global tariff war has entered a de-escalation stage. Foreign investor flows into Asian stocks excluding China and Japan reached $3 billion so far this week, according to Bloomberg-compiled data.

In FX, the dollar was 0.2% higher against a basket of peers, benefiting also from the Federal Reserve’s signal that it’s in no hurry to ease monetary policy. The Fed held interest rates steady as expected on Wednesday, and warned that higher tariffs could raise inflation and unemployment. The pound climbed after the Bank of England cut interest rates as expected, but stuck to signaling “gradual and careful” moves in the coming months.

In rates, treasuries are cheaper across the curve as US stock futures rally; rate-sensitive two-year Treasury yields rose about five basis points as traders trimmed the odds of a July cut to around 80%. US yields are 3bp-4bp higher across maturities with intermediate tenors leading losses, flattening 5s30s spread by 1.5bp and unwinding a portion of Wednesday’s steepening move. 10-year at 4.30%, just off day’s high. Supply also a factor, with an auction of 30-year bonds ahead at 1pm New York time. Gilt futures fell to session lows after Bank of England cut rates to 4.25% as expected in a three-way split. UK front-end yields cheaper by about 5bp, flattening the gilt curve after the BOE rate decision. The week’s Treasury auction cycle concludes with $25 billion 30-year new issue, following strong demand for 10-year notes Tuesday. WI 30-year yield near ~4.795% is about 2bp richer than last month’s, which stopped through by 2.6bp. Investors will now monitor weekly jobless data, which is expected to show claims slipped marginally in the latest week to 230,000.

In commodities, oil climbs 1.4% higher to near $58.86. Bitcoin rose toward the $100,000 mark for the first time since February. Spot gold falls about $10 to near $3,350/oz.

Looking ahead, the US economic calendar includes 1Q nonfarm productivity and weekly jobless claims (8:30am), March wholesale inventories (10am) and April New York Fed 1-year inflation expectations (11am)

Market Snapshot

- S&P 500 mini +1%

- Nasdaq 100 mini +1.4%

- Russell 2000 mini +1.3%

- Stoxx Europe 600 +0.5%

- DAX +1.2%

- CAC 40 +0.8%

- 10-year Treasury yield +4 basis points at 4.31%

- VIX -1 points at 22.52

- Bloomberg Dollar Index +0.3% at 1225.78

- euro little changed at $1.129

- WTI crude +1% at $58.67/barrel

Top Overnight News

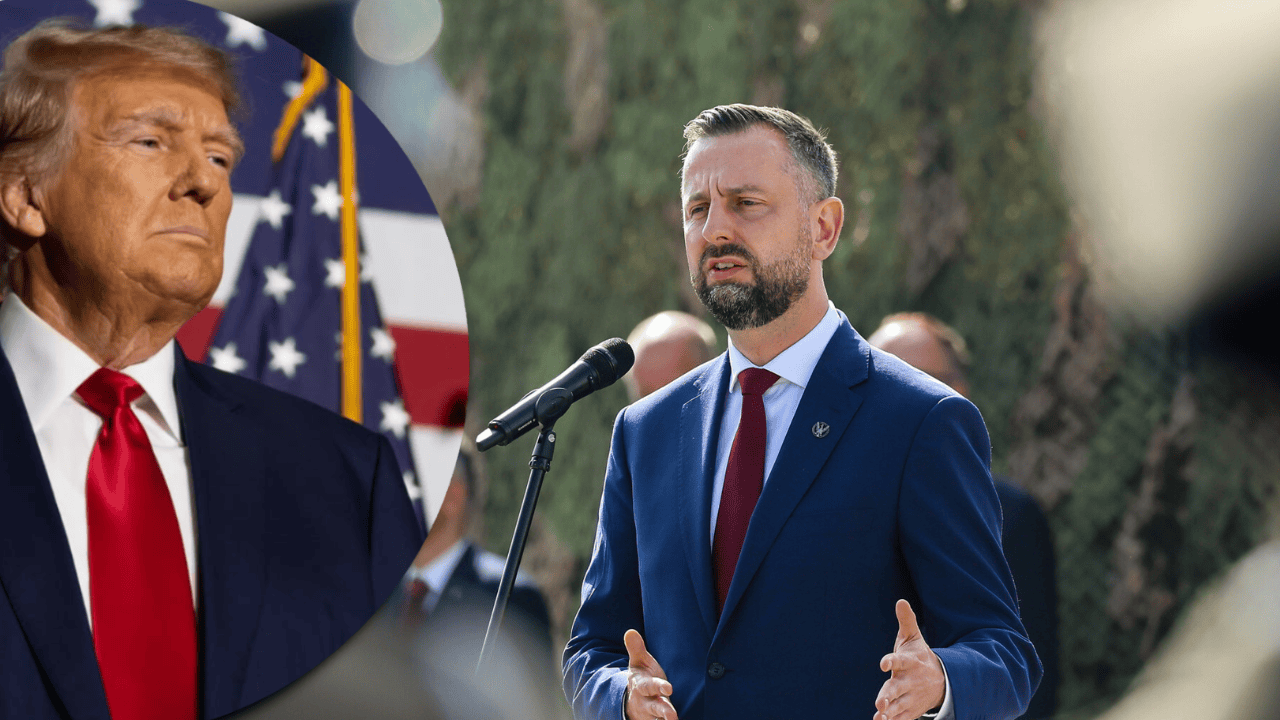

- President Trump is expected to announce a framework of a trade deal with the U.K. on Thursday, the first in what the White House hopes is a series of trade agreements since it imposed tariffs against allies and adversaries. Trump said there would be a press conference in the Oval Office at 10 a.m. WSJ

- Pakistan said it shot down 12 drones from India that had killed one civilian and injured four soldiers. India’s rupee weakened 1%. BBG

- Ukraine has discussed ways to pressure Russia into agreeing to a 30-day ceasefire with U.S., French, British and German senior officials, President Volodymyr Zelenskiy’s top aide said on Thursday, part of a flurry of diplomacy to try to end the war. RTRS

- US President Trump’s big announcement is regarding a Medicare drug plan, according to Politico.

- US President Trump posted „We are making great progress on “The One, Big, Beautiful Bill.” Our Economy is doing well, but it’s going to BOOM in a way never seen before. We are going to do NO TAX ON TIPS, NO TAX ON SENIORS’ SOCIAL SECURITY, NO TAX ON OVERTIME, and much more. It will be the biggest Tax Cut for Middle and Working Class Americans by far, and it is time for Main Street to WIN. MAKE AMERICA GREAT AGAIN!”

- White House said the Treasury and Commerce departments have formulated plans for a sovereign wealth fund, but no final decisions have yet been made.

- China is considering largely scrapping its pre-sales model for homes, people familiar said. The move aims to address the country’s housing crisis, but may exacerbate cash flow pressure on developers. BBG

- The BOJ can’t ignore the potential downside risks to prices stemming from US tariffs, Kazuo Ueda said. BBG

- The Bank of England cut interest rates by a quarter point to 4.25% as Donald Trump’s global trade war weighs on UK growth, in a decision that split senior officials into three groups and was made before the US President hinted at an imminent deal to lower tariffs on British exports. BBG

- Brazil’s central bank raised its interest rate by a half-point to 14.75%, the highest level since 2006. Policymakers kept their options open for either another hike or a pause at its next decision. BBG

- GOOGL +2% … Google issued statement overnight, responding to AAPL’s intraday comments on search traffic: We continue to see overall query growth in Search. That includes an increase in total queries coming from Apple’s devices and platforms. More generally, as we enhance Search with new features, people are seeing that Google Search is more useful for more of their queries — and they’re accessing it for new things and in new ways, whether from browsers or the Google app, using their voice or Google Lens. We’re excited to continue this innovation and look forward to sharing more at Google I/O.”

- Trump tapped Casey Means to be the next US surgeon general after his prior nominee was withdrawn. The health app founder is a vocal critic of the pharmaceutical industry and Big Food. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly higher amid some trade optimism and following the mildly positive handover from Wall St where price action was choppy in the aftermath of the FOMC meeting as the Fed kept the FFR at 4.25-4.50%, as expected, and noted that risks to the economic outlook increased further, while Fed Chair Powell reiterated a wait-and-see approach and ruled out a pre-emptive cut during the presser. ASX 200 marginally gained amid strength in gold miners, industrials and tech but with the upside capped by weakness in the top-weighted financial sector after Big 4 bank ANZ’s earnings. Nikkei 225 was underpinned by recent currency weakness and trade deal optimism, although a return to the 37,000 level remained elusive. Hang Seng and Shanghai Comp remained positive following the previous day’s PBoC’s policy loosening, but with further upside in the mainland limited after recent comments from US President Trump, who was unwilling to lower tariffs to get China to the table.

Top Asian News

- HKMA maintained its base rate at 4.75%, as expected, in lockstep with the Fed.

- BoJ Minutes from the March 18th-19th Meeting reiterated they are to raise rates if the economic outlook is realised and a member said it’s appropriate to pay close attention to the new US policies and their impact on the global economy. Furthermore, a member said the BoJ would need to be particularly cautious when considering the timing of the next rate hike as downside risks stemming from US policies had rapidly heightened, while a member said that even with heightened uncertainties, it did not warrant BoJ to be always cautious and the BoJ may face a situation where it should act decisively.

- China is weighing housing market overhaul to curb pre-sales, via Bloomberg

European bourses (STOXX 600 +0.3%) opened mostly firmer and have traded with an upward bias throughout the European morning. European sectors are mixed; Tech takes the top spot, joined closely by Industrials whilst Healthcare lags. Tech benefits from post-earning strength in Infineon (+3%) – despite missing on headline metrics and highlighting that it sees 2025 rev. slightly lower Y/Y due to tariff impact. US equity futures (ES +0.8%, NQ +1%) are broadly in the green, in-fitting with the broader risk tone as markets await Trump’s trade announcement.

Top European News

- UK PM Starmer is expected to promise on Thursday that his government will deliver a defence dividend for voters, framing an increase in military spending forced by a US shift away from underwriting Europe’s security, as an economic opportunity, according to Reuters.

- Sky’s Coates says his sources are confirming that the US-UK trade deal claims are correct. Will be a „heads of terms” agreement, rather than a full deal, but substantive.

- NIESR lowered its UK 2025 GDP growth forecast to 1.2% from 1.5%, while it said Chancellor Reeves looks set to miss her budget targets again, partly due to the economic impact from her tax increase on employers, which raises the prospect of more tax hikes.

- Swedish Riksbank Rate 2.25% vs. Exp. 2.25% (Prev. 2.25%); it is somewhat more probable that inflation will be lower than that it will be higher than in the March forecast. This could suggest a slight easing of monetary policy going forward.

- Norges Bank Key Policy Rate 4.5% vs. Exp. 4.5% (Prev. 4.5%); outlook implies that the policy rate will most likely be reduced in the course of 2025.

FX

- DXY saw an uptick in early European trade, taking the index back above the 100 threshold; no obvious driver was seen behind the move at the time. Last night’s FOMC policy announcement had little follow-through into the USD with the Fed keeping rates unchanged as expected whilst noting that risks to the economic outlook increased further and risks to both sides of the mandate have risen. From a trade perspective, attention is on the details of the expected upcoming UK trade deal announcement whereby the agreement will be eyed as a proxy of what is to come. DXY has hit a new high for the week at 100.20.

- EUR is fractionally softer vs. the USD with Eurozone newsflow on the light side. On the trade front, the EU is set to announce today a provisional list of tariffs against the US which will be enforced if talks with the US fail. EUR/USD has reverted back to a 1.12 handle and hit a fresh low for the week at 1.1271.

- JPY is softer on account of the positive risk sentiment which has stemmed from hopes on the trade front. BoJ Minutes was a non-event given it recaps the March meeting. USD/JPY has ventured as high as 144.51.

- GBP is a touch softer vs. the USD but to a lesser degree than peers amid increased optimism on the trade front with the US and UK expected to announce a trade deal later today. That being said, it is worth noting that the announcement is set to be a „heads of terms” agreement, rather than a full deal, but substantive, according to Sky News. Attention now turns to Thursday’s BoE meeting, which is expected to see policymakers deliver a 25bps rate cut; focus will be on any potential tweaks to guidance. Morgan Stanley expects the „gradual and careful” language to be removed to provide the MPC “space to accelerate cuts if needed”.

- Antipodeans are both slightly softer vs. the USD with domestic newsflow from Australia and New Zealand on the light side.

- SEK is a touch softer in the aftermath of the Riksbank policy announcement which saw the central bank stand pat on rates as expected. The accompanying statement noted that „it is somewhat more probable that inflation will be lower than that it will be higher than in the March forecast”, adding that this „could suggest a slight easing of monetary policy going forward”. However, the Bank did stress the uncertainty surrounding the outlook. EUR/SEK has been as high as 10.9424 but is yet to approach its 50DMA to the upside at 10.9491.

- Little follow-through seen in the NOK after the Norges bank stood pat on rates at 4.5% as expected. The accompanying statement noted that restrictive monetary policy is still needed, adding that, if the policy rate is lowered prematurely, prices may continue to rise rapidly. However, the outlook implies that the policy rate will most likely be reduced in the course of 2025.

- PBoC set USD/CNY mid-point at 7.2073 vs exp. 7.2385 (Prev. 7.2005).

- Brazil Central Bank hiked the Selic rate by 50bps to 14.75%, as expected with the decision unanimous, while it stated that additional caution is needed for the next meeting and the scenario also demands flexibility to incorporate data that impact the inflation outlook. Furthermore, the BCB said it will remain vigilant and the calibration of the appropriate tightening of the monetary policy will continue to be guided by the objective of bringing inflation back to the target in the relevant horizon.

Fixed Income

- The Fed’s decision to keep rates steady (as expected) and Powell stressing a wait-and-see approach to policy, sparked some two-way action in USTs – before then extending a little lower into the APAC session. As for today, US President Trump saying he will announce a trade deal (with the UK) today has managed to boost the risk tone. USTs currently a touch into the red but above yesterday’s low in a 111-11 to 111-19 band. Ahead, weekly jobless claims are due before the NY Fed SCE, in March it showed an increase in near-term inflation expectations and a slight moderation further out alongside an expected deterioration in the labour market. A 30yr auction is also scheduled.

- Gilts opened bang on the unchanged mark and despite an initial slip to a 93.35 low, comfortably above Wednesday’s 92.79 base, the benchmark has since been on a gentle grind higher despite the constructive risk tone as participants prepared for upcoming UK-specific risk events. Holding around its 93.54 session peak. Awaiting Trump’s 15:00BST press conference for details on a trade announcement which has since been confirmed to be between the US and UK. But before that, attention will be on the BoE where rates are expected to be cut by 25bps in a unanimous decision though the magnitude could be subject to dovish dissent.

- Bunds are softer, in-fitting with USTs and the constructive risk tone. In contrast to the US and UK, newsflow for the bloc has been a little lighter. No move to a surprisingly strong set of German Industrial data for March this morning. At the low end of a 131.35 to 131.65 band.

- Spain sells EUR 6.2bln vs. Exp. EUR 5.5-6.5bln 2.40% 2028, 2.70% 2030, 4.00% 2054 Bono & EUR 0.672bln vs. Exp. EUR 0.25-0.75bln 1.00% 2030 I/L

Commodities

- Crude is bid, but off best as the USD fights back in the European morning (see FX). Currently holding around the mid-point of today’s parameters which are just under USD 1/bbl in size and in very familiar levels from the last few days/weeks. At best, WTI and Brent got just above the USD 58.50/bbl and USD 61.50/bbl marks but failed to make any further ground as the DXY picked back up above the 100.00 mark.

- Gold is under pressure as the risk tone is supported by Trump’s trade announcement, an event we now know relates to the UK, and also the discussed recovery in the USD. Currently trading in a USD 3,320.68-3,414.50/oz range.

- Copper has been rangebound since APAC trade after the pressure seen on Wednesday with 3M LME Copper basically holding at the bottom end of yesterday’s USD 9.36-9.47k band.

- PBoC is reportedly to allow local lenders to purchase more USD to fund increased gold import quotas, via Reuters citing sources.

- Citi revises its 0-3 month point price for Brent to USD 55/bbl (prev. 60/bbl). No US-Iran deal and escalatory action could see prices return to USD +70/bbl.

- Iraq sets the June Barah medium crude OSP to Asia at plus USD 0.45/bbl to Oman/Dubai average, Europe minus USD 3.20bbl vs. dated Brent, North and South America minus USD 0.75/bbl vs. ASCI, according to SOMO.

- Kazakhstan (Apr) oil and condensate daily output +6.5% to 277k tons, according to Interfax; production in May seen at similar levels to April.

US Event Calendar

- 8:30 am: 1Q P Nonfarm Productivity, est. -0.75%, prior 1.5%

- 8:30 am: 1Q P Unit Labor Costs, est. 5.1%, prior 2.2%

- 8:30 am: May 3 Initial Jobless Claims, est. 230k, prior 241k

- 8:30 am: Apr 26 Continuing Claims, est. 1895k, prior 1916k

- 10:00 am: Mar F Wholesale Inventories MoM, est. 0.5%, prior 0.5

DB’s Jim Reid concludes the overnight wrap

In a Trump 2.0 world it often seems like the news flow doesn’t really get going until after the US market closes and today is another example of that as overnight Mr Trump has teased that a „major trade deal” will be announced today at 10am DC time (15:00 BST). This must be the very big announcement he flagged on Tuesday. The media are all lining up behind the deal being with the UK. Given that full trade deals take years to negotiate, this will likely be a framework and it will be interesting to see whether the 10% baseline tariff stays as that will provide an important template for negotiations with other countries and a good guide to the long-term tariff strategy of the US.

Asian equity markets and European/UK futures are responding positively to the news that comes a couple of days before trade talks between Washington and Beijing over the weekend. Across the region, the Hang Seng (+1.10%) is leading gains with the CSI (+0.75%) and the Shanghai Composite (+0.38%) also higher. Elsewhere, the Nikkei (+0.28%), the KOSPI (+0.49%) and the S&P/ASX 200 (+0.21%) are also edging higher. S&P 500 (+0.84%) and NASDAQ 100 (+1.16%) futures are building on a strong close that we will discuss below. Euro Stoxx futures are +0.80% and FTSE futures +0.75%. Sterling is around half a percent higher.

This news has slightly overshadowed the Fed last night, where as widely expected, the FOMC kept the fed funds rate on hold for a third meeting running at 4.25-4.50%, while sticking to a patient tone amid heightened uncertainty. The prepared statement noted that uncertainty had “increased further” as risks of both “higher unemployment and higher inflation have risen”. In the press conference Chair Powell acknowledged opposing pressures on its dual mandate stemming from larger-than-expected tariffs announced so far and offered little guidance on the policy path ahead. Powell emphasized the elevated uncertainty but also noted that the economy remains resilient and repeated that policy is well positioned to respond, while pushing back on the idea of pre-emptive rate cuts. Our US economists continue to expect the next rate cut to come in December, with risks tilted towards earlier cuts if unemployment rises more sharply. See their full reaction here.

Rates initially saw a moderate rally following the Fed decision, but this then reversed as Powell emphasised a wait-and-see approach. The next rate cut is now 80% priced by the July meeting while the amount of Fed cuts priced by December declined by -3.1bps yesterday to 78bps, though this move had already played out pre-FOMC. 2yr Treasury yields were little changed (-0.6bps to 3.78%), while 10yr yields declined -2.6bps to 4.27%. This morning in Asia, Treasury yields have reversed higher again with 2yr (+2.3bps) and 10yr (+1.9bps) yields settling at around 3.80% and 4.29% respectively as we go to print.

Equities saw a muted response to the Fed decision, but the S&P 500 managed to post a +0.43% gain by the close thanks to a late rally following a Bloomberg report that the Trump administration is planning to rescind Biden-era AI chip curbs as part of a broader move to revise semiconductor trade restrictions. The reporting helped the Philadelphia semiconductor index rise +1.74% on the day, with Nvidia +3.10% higher.

However, the overall Mag-7 underperformed (-0.26%) as Alphabet (-7.26%) and Apple (-1.14%) lost ground following comments by a senior Apple executive that the company was “actively looking at” revamping its Safari web browser to focus on AI-powered search engines. The comments came amid a DoJ lawsuit against Alphabet that could threaten the companies’ partnership that makes Google the default offering in Apple’s browser. In addition to highlighting the anti-trust cases against big tech, the news is a reminder that while the Mag-7 stocks have benefited immensely from AI optimism, their existing business models also face risks from AI-driven disruption.

Ahead of the Fed’s decision, European markets experienced a risk-off move, with the STOXX 600 (-0.54%) posting its biggest decline in four weeks. The moves occurred across the continent, and even the FTSE 100 (-0.44%) moved lower, ending its record winning run of 16 consecutive gains. A remarkable stat. Let’s see what today’s trade deal does for the UK. Otherwise, France’s CAC 40 (-0.91%) saw a particular underperformance, losing ground for a third day running, and Germany’s DAX was down -0.58%. And the risk-off tone was echoed on the rates side, as yields on 10yr bunds (-6.6bps), OATs (-6.4bps) and BTPs (-7.9bps) all took a sharp turn lower. The moves also got a boost from the latest decline in oil prices, with Brent crude down -1.66% on the day to $61.12/bbl. The peak this year was $82.03/bbl on January 15.

Looking forward, central banks will stay in the spotlight today, as the Bank of England are announcing their own policy decision. It’s widely expected they’ll deliver a 25bp cut today, which would take the Bank Rate down to 4.25%, and continue the pattern of quarterly rate cuts that we’ve had since August. As with the Fed, it’s their first decision since Liberation Day, so all eyes will be on the new forecasts, and our UK economist thinks that meaningful changes are likely. He expects them to cut their growth projections as the unfolding trade shock hits GDP. And he also sees the inflation forecasts being revised lower thanks to stronger sterling and lower energy prices.

Finally on the geopolitical side, there’s been increasing market attention on the situation between India and Pakistan. In terms of the latest, Pakistan said yesterday that they would retaliate against India’s air strikes, and Pakistan’s KSE-100 equity index closed -3.02% lower. By contrast, Indian equities have been much less affected, and the NIFTY 50 index was up +0.14%. This morning, the NIFTY 50 (-0.04%) is fairly flat. The situation has raised fears about an escalation between the two counties, and it represents another example of how the Global South is likely to prove increasingly important for the global backdrop.

To the day ahead, and one of the main highlights will be the Bank of England’s latest policy decision, along with the subsequent press conference with Governor Bailey. Separately, the Bank of Canada will release their Financial Stability Report, and we’ll hear from Governor Macklem too. Elsewhere, US data releases include the weekly initial jobless claims, as well as nonfarm productivity for Q1.

Tyler Durden

Thu, 05/08/2025 – 08:24