„Frozen At The Wheel”: Bessent Slams Fed For Delay On Rate Decisions In Wide-Ranging Interview

US Treasury Secretary Scott Bessent on Monday criticized Federal Reserve policymakers for what he described as their hesitant posture on interest rates, while signaling that the U.S. Treasury is unlikely to alter its current strategy on debt issuance by increasing long-term bond sales.

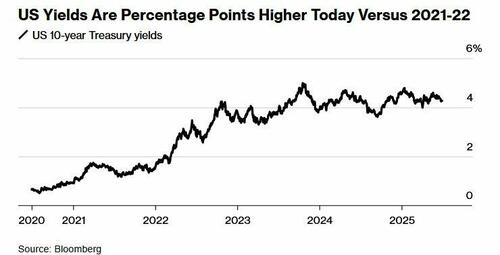

In a wide-ranging interview, Bessent said that recent yields on long-duration Treasurys make it a poor time to lengthen the government’s debt profile. “Why would we do that?” Bessent said on Bloomberg Television. “The time to have done that would have been in 2021, 2022.”

Ten-year Treasury yields currently stand at about 4.26%, well above the levels of shorter-term instruments such as the two-year note (3.73%) and 12-month bills (3.81%). Bessent suggested issuing more long-term bonds at these rates would be counterproductive, especially given his expectation that inflation will continue to moderate and pull interest rates lower across the maturity spectrum.

Treasury Secretary Scott Bessent indicated it wouldn’t make sense for the government to ramp up sales of longer-term securities given where yields are today, though he held out hope that interest rates across maturities will be falling as inflation slows https://t.co/aVi8yJyDOT pic.twitter.com/5yqcNjFCXQ

— Bloomberg TV (@BloombergTV) June 30, 2025

“As we see inflation come down, I think the whole curve in parallel can shift down,” he said, referencing the Treasury yield curve, a key barometer for economic sentiment.

Bessent, who succeeded Janet Yellen as Treasury chief, has retained much of his predecessor’s issuance strategy, despite having previously criticized her for over-reliance on short-term borrowing. At the time, he argued the policy was politically motivated to suppress long-term borrowing costs ahead of the 2024 election.

But Bessent emphasized that now is not the moment to pivot. “Why would we do it at these rates, if we are more than one standard deviation above the long-term rate?” he asked rhetorically.

Fed 'Frozen at the Wheel’

While expressing confidence in the direction of fiscal policy and trade strategy, Bessent leveled pointed criticism at the Federal Reserve’s rate-setting stance. They „seem a little frozen at the wheel,” he said of Fed officials. “My worry here is that, having fallen down on the American people in 2022, the Fed’s now looking at their feet,” rather than looking ahead.

The Treasury Secretary cited the Fed’s delayed response to rising prices in 2022 as a pivotal misstep and warned that similar inertia could hinder the central bank’s ability to respond to changing economic conditions. “The Fed made a gigantic mistake in 2022,” he added.

Bessent also pushed back against the idea that recent tariffs have stoked inflation. “We have seen no inflation from tariffs,” he said, calling such effects “transitory” and suggesting they result in only a one-time price adjustment. He hinted at more trade activity on the horizon, saying he expects a “flurry of trade deals” in the days leading up to the July 9 negotiating deadline. The U.S. has already reached agreements with the United Kingdom and China, with ongoing talks still underway.

US Treasury Secretary Scott Bessent discusses the July 9 deadline for trade deals and the potential to “spring back to the April 2 levels” on tariffs for countries that can’t get a deal across the line https://t.co/sI2bIFyJ9z pic.twitter.com/HaKopYwcjx

— Bloomberg TV (@BloombergTV) June 30, 2025

Meanwhile, as speculation mounts over who might succeed Fed Chair Jerome Powell when his term ends in May 2026, Bessent acknowledged that discussions are already underway. “Obviously there are people who are currently at the Fed who are under consideration,” he said, adding that the administration is eyeing the January 2026 seat opening as a potential stepping stone for the next chair.

Observers have noted Governor Christopher Waller – a Trump-era appointee who has recently called for possible rate cut – as a likely contender. Bessent also mentioned that current Governor Adriana Kugler’s term concludes in January, providing another possible opening for strategic appointments.

He downplayed speculation about his own interest in the job. “I’ll do whatever the president wants,” he said, but added that he already has the „best job in DC”

US Treasury Secretary Scott Bessent says he „has the best job in DC,” and that the administration will be working on Fed Chair Powell’s successor over the coming months https://t.co/hDX84K48mZ pic.twitter.com/JulxyYoppy

— Bloomberg TV (@BloombergTV) June 30, 2025

Looking forward, Bessent expressed optimism about the direction of U.S. fiscal strategy. He voiced support for the Republican budget bill currently advancing in Congress, describing it as a “start” in the effort to bring U.S. debt under control while promoting economic growth.

Bessent also suggested that we could see a lowering of rates, as inflation is „very tame,” adding that he is confident the fiscal policy bill will progress in the coming hours.

US Treasury Secretary Scott Bessent says that the proposed Medicaid cuts will get able-bodied people back to work, and bring enrollment down to pre-Covid levels https://t.co/rhGgfhuuR5 pic.twitter.com/Mg9ipQEikp

— Bloomberg TV (@BloombergTV) June 30, 2025

Tyler Durden

Mon, 06/30/2025 – 11:25

![Nowoczesne przejście dla pieszych przy Szkole Podstawowej w Długopolu Dolnym [zdjęcia]](https://storage.googleapis.com/intergol-pbem/klodzko24/articles/image/679c8348-0ef8-4d55-9fa5-b892263e2545)