Florida Condo Owners Dump Units Over Six-figure peculiar Assessments

Authorized by Mike Shedlock via MishTalk.com,

Have a Florida condo? Can you afford a $100,000 or higher peculiar assessment for fresh safety standards?

After the collapse of a Surfside Building on June 24, 2021that killed 98 people, the state passed a structural safety law that is now biting owners.

Not only are insurance rates soaring, but owners are hit with large peculiar assessments topping $100,000.

New Florida Law Rails Its Condo Market

The Wall Street diary reports fresh Florida Law Rails Its Condo Market

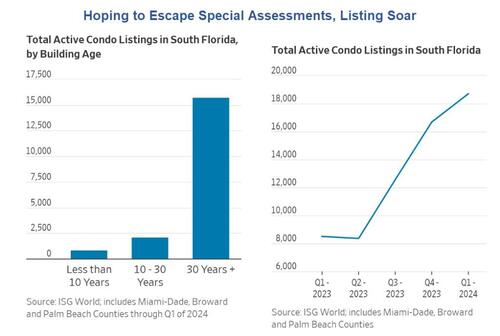

Condo inventory for sale in South Florida has more than doubled since the first 4th of last year, to more than 18,000 units. While the harp emergence in Florida home insurance costs is driving any to sell, the most of the units on the marketplace are in building 30 years or older. Under the fresh law, building must pass milestone structural inspections no later than 30 years after they are built.

In Miami, about 38% of the housing stock is condos, the highest of any major metropolitan area in the U.S., according to Zillow. Of these buildings, nearly three-quarters are at least 30 years old. For that have large repairs loving, many owners are scrambling to sale before Jan. 1 erstwhile building reserves must be full funded to be in compliance with the law.

“I think this is just the beginning,” said Greg Main-Baillie, an executive managing manager at real-estate companies Colliers, who oversees 40 Condo renewal projects across the state.

Owners are strugdling to find all-cash buyers due to the fact that mortgage lenders are creatively unwilling to take on the hazard associated with these units. “It’s not the buyers that Aren’t Qualifying,” said Craig Studnicky, Chief Executive at ISG World. “It’s the building that Aren’t Qualifying.”

State law has previously allowed condos to wave reserve backing year after year, leading many buildings, including the close 50-year-old Cricket Club, to keep next to nothing in their coffers. Now, about 40 units in the building of 220 are listed for sale but are seeing small interest.

“These units are practically being given away,” said Sari Papir, a retired real-estate agent who has lived in the Cricket Club with her partner Shaul Szlaifer since 2018. “Even if we found a buyer, what could we buy with the birds we’d receive for our unit?”

Some are welcomed developers may already be purchasing condos in the building for a powerful takeover, where a developer tries to gain control of a building to knock it down and build a newer, more luxurious one. These condo terms are happening up and down the state’s coastline. While the rules can disagree by building, if adequate people vote to sale their units, the others gotta follow along.

No Way to Escape the Assessment

These who cannot sale and don't have the peculiar assessment, will be issued and their units are specified for whatever the Associations can get for them.

South Florida listings have been doubled in the past year to over 18,000. fewer of these units will sell, and those that do sale will be at a large haircut.

The diary noted the plight of Ivan Rodriguez who liquidated his 401K to buy a condo for $190,000. He then faced a $134,000 peculiar assessment. Evening he sold the unit for $110,000.

Got the Insurance Blues?

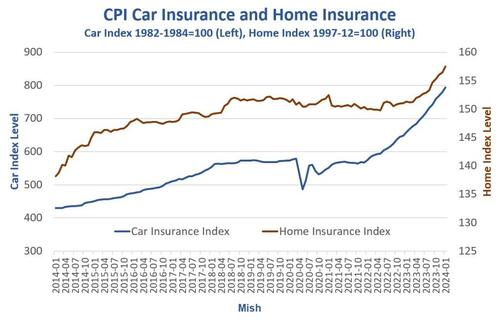

Auto insurance is up more than 20 percent from a year ago. In many places, private home insurance isn’t available at all. Consumers are steaming.

Insurance data from the BLS, illustration by Mish

He February 17, 2024 I asked Got the Insurance Blues? car and Home Insurance Costs are Soaring

Car insurance is on an amazing run. For 13 consecutive months, insurance is up at least 1.0 percent. For 20 consecutive months car insurance is up at least 0.7 percent.

Home insurance, if you can get it at all from any private insurance, is besides rising at a fast clip.

If you live in a level zone, hurricane zone, or fire zone, insurance may be very hard to get.

Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Citing wildfire risk, State Farm will not renew policies on 30,000 homes and 42,000 business in California. Blame the state, not insurers.

He March 26, I note Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Proposal 103 limited the yearly increases of insurance companies. State Farm responded by cancelling 72,000 policies.

The Idiot’s Response

Carmen Balber, the executive manager of Consumer Watchdog, said “The manufacture is not going to start covering Californians again without a mandate.”

“That is why we think the government needs to step in and require insurance companies to cover people.“

Force companies to cover people. What a hoot. The insurers would all leave and everyone would be on the “FAIR” plan.

Think!

Think carefully about where you want to live. And if it’s a condo, you better be prepared for large peculiar assessments.

And most of all, know your builder. For discretion, delight see America’s Homebuilder: D.R. Horton Homes Falling Apart in Months

Tyler Durden

Thu, 05/16/2024 – 13:45