E-Trade May Ban 'Roaring Kitty' From Platform For marketplace Manipulation

ETrade has had adequate of the stock shenanigans of meme stock guru Keith Gill, besides known as Roaring Kitty, who just happens to be a client of the online brokerage now owned by Morgan Stanley. Gill’s non-stop promotion of GameStop on social media, coupled with garant trades, raised deals about possible stock manipulation. This could force E*Trade to dump the retail trader, according to Wall Street diary sources.

The scale of Gill’s online influence, with millions of followers across various social media platforms, and his active promotion of the strugdling video game retailer, has sparked concern among executives at the Morgan Stanley-owned trading platforms. The companies are uncomfortable with Gill’s presence on the trading platform, as it could attract unwanted attention, given his crucial reach.

That power created deals he can pump up a stock for his own benefit. Their debate includes whother his actions increased to manipulation and whother or not the company is going to risk drawing the attention of his meme army by renovating him, according to people household with their interior discretions. - WSJ

With the SEC incapable to decide how to adopt the bizarre pump (and dump), and how to classify Gill’s unique social media kind as marketplace manipulation, brokerages are now taking action into their own hands.

The sources confirmed what became public cognition summertime on Sunday, namily that Gill bought a "large volume of GameStop options on E*Trade" before the first pump in May.

Morgan Stanley employees, knowing that Gill is simply a customer, looked at his E*Trade account, according to people household with the matrix. That kind of monitoring of clients is routine.

The employers saw he had purchased call options before the tweet, the people said. A call option gives a trader the right to buy the stock by a certain date at a fixed price. At least any of these options expired that week, 1 of the people said. That means Gill’s trades likely generated profits thanks to the stock decision his tweet generated.

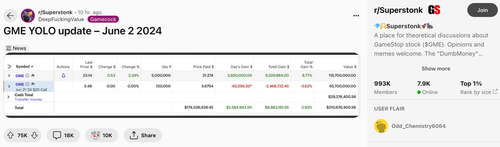

Gill’s trading continued, likely loading up with equity and short-term options ahead of Sunday’s posting of his E*Trade account. He showed GME stock valued at $115.7 million, $65.7 million in GME short-term options, and $29 million in cash.

The post alone on Reddit triggered a stock frenzy in GME on Monday but rapidly fated summertime into the session.

The people said the debate about Gill as a client at Morgan Stanley began 3 weeks ago, around the time of the first GME pump. They said no decision has been made yet.

One of the biggest red flags around the first pump was GME’s ability to slam the marketplace with an offer of 45 million shares, allowing the company to emergence $933 million, and Sparking specification that Gill was working along the company.

Meanwhile, sentiment around Gill is shifting: far from the "authentic" retail daytrading beachon that he became in early 2021 erstwhile his foray into the historical Gamestop short sketches sparked the meme stock frenzy, his later AUM which is clear in the hundreds of millions "appearing more like manipulation without a solid thesis", has promoted specification that far from working for himself, Gill may be in cahoots with 1 or more hedge funds...

What made Keith Gill aka Kitty interesting initially was his authenticity. He shared a detailed investment thesis and put his money where his mouth was, which combined with a advanced short interest and a restless country and boom.. investing history. This time it feels different...

— Citron investigation (@CitronResearch) June 3, 2024

... while established voices specified as Clifford Asness slammed the "Internet scammer" whose "Coming back to pump and dump again is insane. It’s a cult. It’s an angry clueless cult (are there another kinds) angry about nonexist scams and following ridiculous cult leaders.‘

A bunch of the comments below are about now going short this silliness.

And actually have no idea. I don’t do individual stocks. These meme stocks are down so much (esp. AMC my individual bete noire) they may or may not be good ideas now (conversely I absolutely don’t say they are... https://t.co/xaAEbk0kgl

— Clifford Asness (@CliffordAsness) June 3, 2024

But what may be the most damning twist in this latest episode of meme stonk mania is that the another OG of the daytrading movement, Dave Portnoy himself, asked if he is simply a large mark for Roaring Kitty.

I’m not accusing anyone of anything, but am I just a large mark for Roaring Kitty? #GME #AMC #DDTG pic.twitter.com/SZFzDkkZBR

— Dave Portnoy (@stoolpresidente) June 3, 2024

Tyler Durden

Mon, 06/03/2024 – 19:40