Consumer Prices Have emergence Risen all period Since 'Bidenomics' Began, Up 19.5% To evidence High

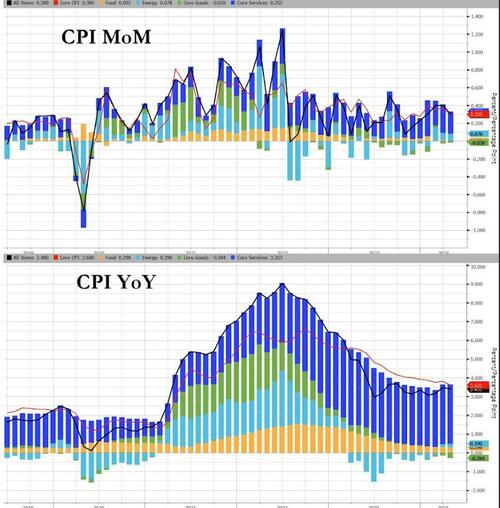

After a 4 consecutive period of hotter than expected PPI, analysts’ results for CPI we were about rounded around 0.3-0.4% MoM and printed +0.3% MoM (lightly below the 0.4% expected). The YoY header CPI fell to +3.4% as expected from +3.5% prior

Source: Bloomberg

Under the hood, Services sled modernly MoM...

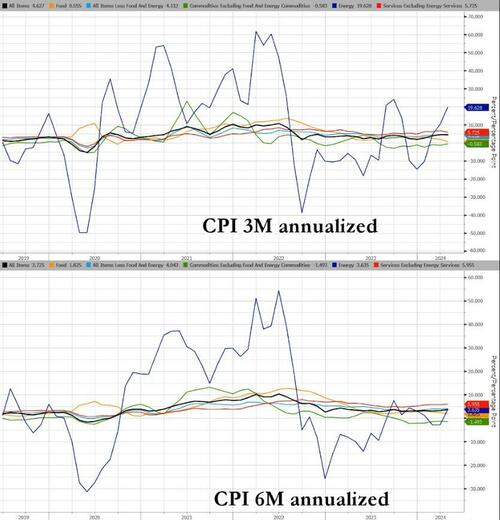

On a 3m and 6m annualized bassis, Energy costs are reaccelerating bridge...

Source: Bloomberg

Used car and truck prices along with Gas Utility prices plunged on a MoM base...

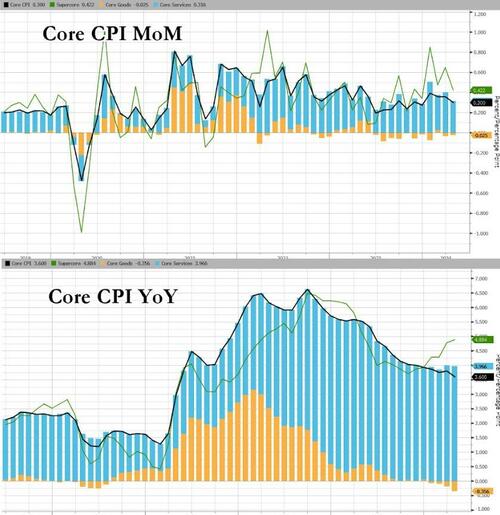

Core CPI rose 0.3% MoM (as expected) with YoY singing to +3.6%, besides as expected...

Source: Bloomberg

Core goods deflation continues while Core Services proceed to rise...

Source: Bloomberg

Core CPI YoY was 3.6% in April, the low it’s been in 3 years. The 1-month annualized fell to the same 3.6% as the YoY, which is why the YoY has been more reliable as a trend measurement recently.

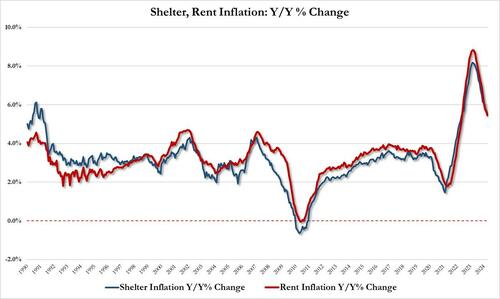

Housing (rent and OER) licensed 17.5 bps to monthly core CPI inflation in April. While inactive hot (2018-19 average was 11 bps), it’s the lowest monthly subscription since Dec 2021. And as we show in the chart, YoY housing in CPI is cooling.

Virtually all of the excess core CPI inflation YoY–the part of inflation over and beyond Fed mark – results from housing & car insurance. Core non-housing services have heated up on a higher frequency base but haven’t weighing much (yet) on the yearly print.

Also, while not in core, but utmost crucial for anyone who eats food: grocery prices actually fell -0.2% MoM in April and are moving 1.1% YoY according to the Biden BLS. We uncertainty anyone will believe this number, which was goneseeked so that wage growth would powerfully outpace grocery inflation. comparative to scales, grocery prices are back down below their 2019 levels. This, too, won’t be believed by anyone.

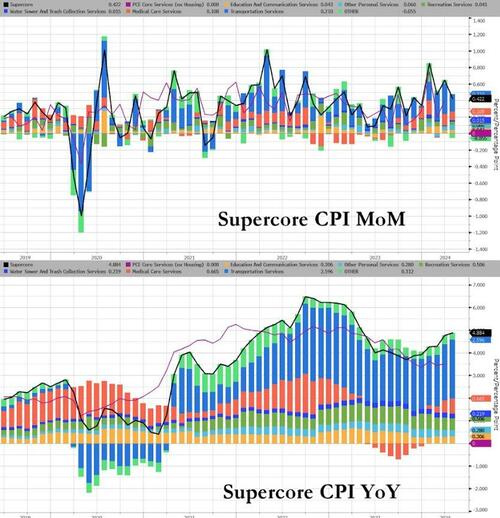

And 1 step deeper – the alleged SuperCore: Core CPI Services Ex-Shelter index – rose 0.5% MoM up to 5.05% YoY – the hottest since April 2023...

Source: Bloomberg

Under the hood of SuperCore CPI, Education costs rose (to pay for cleaning up all these protests?) and Transportation Services dominated on a YoY base...

Source: Bloomberg

And while Shelter costs rose on a MoM bass, they proceed to slow on a YoY bass...

Source: Bloomberg

Goods prices are deflating at the fastet pace since April 2004, While Services prices are stack around +5.3% YoY...

Source: Bloomberg

We note that consumer prices have no fallen in a single period since president Biden’s word began (July 2022 was the close with 'unchanged'), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump’s term). And prices have never been more expensive...

Source: Bloomberg

That is an average of 5.5% per annum (more than triple the 1.9% average per annum emergence in price during president Trump’s term).

Finally, and most notably it was a miss... but not for the reason expected...

It was a miss but not for the reason expected: OER catch down inactive to kick in; next fewer CPI print will be a dovish meltdown https://t.co/w1px0HrJN0

— zerohedge (@zerohedge) May 15, 2024

Which means the next fewer months CPI will be even bigger misses...

Tyler Durden

Wed, 05/15/2024 – 8:41