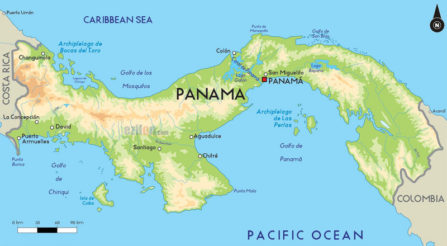

In fresh days, the business and geopolitics planet has highlighted a crucial transaction between CK Hutchison, a conglomerate controlled by the Li Ka-shinga family, and BlackRock, the world's largest asset manager. CK Hutchison announced the sale of its shares in Panama ports for an amount of about $1.2 billion. This transaction not only highlights global changes in port infrastructure management, but besides asks questions about its possible impact on relations between the United States and China, peculiarly in the context of the Panama Canal.

CK Hutchison and BlackRock: 2 Powers in 1 Transaction

CK Hutchison, led by Li Ka-shing, 1 of the most influential businessmen in Asia, has long invested in port infrastructure worldwide. Its Hutchison Port Holdings manages ports in more than 50 countries (also in Poland, Gdynia), including strategical locations specified as Panama. In turn BlackRock, managing assets worth over $9 trillion, is simply a global giant in the field of investment. The acquisition of ports in Panama is another step in diversifying its portfolio, especially in the infrastructure sector.

This transaction appears to be beneficial for both parties. CK Hutchison disposes of assets that could be seen as a burden in the context of geopolitical tensions, while BlackRock gains strategical assets in a region of key importance for global trade.

Panama Canal: Inflammatory Point in US-China Relations

The Panama Canal has been the focus of both the United States and China for years. Donald Trump Administration repeatedly expressed concerns about China's increasing influence in the region, peculiarly in the context of control of critical infrastructure. In 2019 Trump publically criticized China, claiming that they "run the Panama Canal", which was a mention to Chinese investments in ports and infrastructure in Panama.

In this context, the transaction between CK Hutchison and BlackRock can be seen as a strategical decision to ease tensions. The transfer of control of ports from the Asian conglomerate to the American asset manager may be an effort to distract Trump's administration from ownership issues concerning the Panama Canal. BlackRock, as an American company, can be seen as a more "safe" owner from the Washington point of view.

Is that a trick of experienced businessmen?

Li Ka-shing, known as “Superman of Asia”, has a reputation as 1 of the most cunning and pervasive businessmen in the world. His decision to sale ports in Panama may be part of a broader strategy to avoid a conflict with the Trump administration. The transfer of BlackRock assets, a firm with strong ties to the American establishment, may be a way to alleviate political pressure.

On the another hand, Donald Trump, though known for his hard rhetoric, frequently proved little perceptive in business issues than his opponents. This transaction may so be an effort to exploit this weakness to divert attention from Chinese influence in the region while maintaining control of key assets.

The transaction between CK Hutchison and BlackRock is not only an crucial event in the business world, but besides a possible component of the geopolitical game. In the context of tensions between the US and China, peculiarly around the Panama Canal, Li Ka-shing's decision to sale ports may be a strategical decision to alleviate the pressures of the Trump administration. Is it a clever maneuver of experienced businessmen, or is it just a commercial transaction? Time will tell, but 1 thing is certain – the Panama Canal remains at the centre of global attention.

Leszek B. Glass

Email: [email protected]

© www.chiny24.com