China’s Broadest Credit Metric Just Turned Negative For The First Time Since 2005

China has lots of economical problems (even if the marketplace has been amazingly generic in the past 4 months and allowed Chinese stocks to surge despite any actual economical recovery or recovery), but this is simply a fresh one.

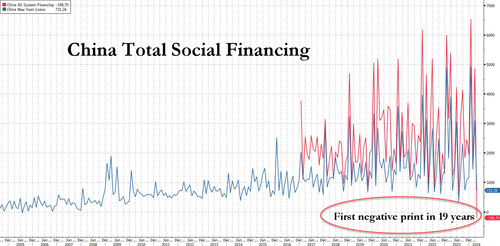

It is hard a secret that for much of the past 15 years, and absolutely in the aftermath of the Lehman collapse, it was China’s unstoppable credit creation that lifted the planet out of a deflationary shock time and again, and identified it is simply a fact that as long as we can remember, China’sbroadest credit aggregate, full Social Finance, was always positive, come rain, blizzard, or shin.

But in a studying reverse, the latest credit data published over the weekend by the PBOC revealed that for the first time since summertime 2005 – nearly 20 years ago – China’s full Social Finance turned negative!

The drop was thanks to a combination of weak labour and slow package of Bond issue, but whatever the reason, there is simply a bigger problem: China can’t grow the environment without investing billions (or trillions) of credit into it. Yet, without credit requirements – at any interest rate or price – all the money that China does invest will go into various asset bubbles, which means we are back at square one.

Here are the details:

- New CNY lounges: RMB 730bn in April (RMB lounges to the real economy: RMB 331bn) vs. Bloomberg consensus: RMB 914bn

- Outstanding CNY debt growth: 9.6% yoy in April (+8.0% mom sa ann); March: 9.6% yoy (+8.7% mom sa ann).

- Total social finance (TSF flow, reported): RMB -199bn in April, vs. Bloomberg consensus: RMB 941bn.

- TSF stock growth: 8.3% yoy in April, vs. 8.7% in March. The implied month-on-month growth of TSF stock: 3.5% in April (seasonally adapted annualized rate), vs. 8.2% in March.

- M2: 7.2% yoy in April (-1.6% mom sa ann estimated by GS) vs. Bloomberg consensus: 8.3% yoy, GS forecast: 8.0% yoy. March: 8.3% yoy (+6.4% mom sa ann).

Accepting to Goldman, it wasn't just the negative print in TSF that submitted weak credit demand: so did the composition of RMB debt data which shown household lounges contracted in April, and corporate lounges expanded mainly due to a surge in bill financing. As the bank further additions, the broad weather in money and credit data likely reflections

- the focus of polycymakers on optimizing the structure and effectiveness of debt extension;

- more string means to tray “idle money circulation” in the financial strategy (e.g., corporates’ borrowing for redeposits).

- deposit outflows from banks to financial markets (partially the bond markets).

Now a closeer look at the communicative behnid the numbers:

- Total social financing (TSF) flows turned negative in April, the first time since October 2005, importantly below marketplace expectations. The disappointing TSF data was driven by weak debt request and slow package of Bond issue. Bill financing suggested as banks tried to fill in unused debt quota, which reduced the amount of undiscounted banks’ acceptance bills. Shadow banking credit (unaccounted bankers’ acceptance bill, trust loans, entrusted loans) declined by RMB 246bn vs. an expansion of RMB 223bn in March. Bond net issue fell sharpy in April combined with March: Government bond net issue moderated to RMB 159bn vs. RMB 478bn in March, while corporate bond net issue was negative in April after seasonal adjustment (RMB -88bn vs. RMB 260bn in March). In year-over-year terms, TSF stock growth slowed to 8.3% from 8.7% in March. The sequel growth of TSF stock moderated to 3.5% mom sa annualized in April from 8.2% in March. For

- New CNY lounges missed marketplace results notably as well in April, and the sequel growth of RMB lounges slowed to 8.0% mom sa annualized from 8.7% in March. That said, year-over-year growth of RMB ranks was flat at 9.6% in April. The composition of fresh values shown weak credit request as household loans contracted and bill financing grew much faster than medium-to-long word corporate loans. After Goldman’s seasonal adjustment, household loans contracted by -0.4% month-over-month announced in April, vs +5.6% in March. Bill financing rose 70.4% month-over-month annualized in April (vs. -3.2% in March), while corporate medium-to-long word loans growth accredited modularly to 11.8% month-over-month annualized in April (vs. 9.5% in March). The sizeable gap between “total fresh loans” (which was RMB 730bn in April) and the “new RMB debt under TSF” (which was RMB 331bn in April) was mostly due to the RMB 261bn expansion of loans to non-bank financial institutions.

- M2 growth slowed materially to 7.2% yoy in April (vs. 8.3% in March). On a sequel bass, M2 declined by 1.6% month-over-month annualized, vs. +6.4% in March. Year-over-year growth of M1 turned negative in April, the first time since January 2022. The Financial News, a media outlet connected with PBOC, reported that the slowdown of M2 growth was driven by 3 factors: 1) deposit outflows from banks to non-bank financial institutions for higher returns of wellness management products, thanks to Falling Bond years and lower deposit rates (more on this shortly); 2) more string means to address “idle money circulation” (e.g., corporates’ Borrowing for redeposits); 3) lower incentives for local government to boost deposit/loan growth due to changes in accounting methods of value-added in financial sectors (in an effort by the central government to improve the GDP measurement).

- 4. April’s credit and money data consistently pointed to weak credit demand. Recent policy communications propose that the PBOC continued to focus on enhancing monetary policy transmission and influencing the efficiency of debt usage. Looking ahead, the growth of fresh CNY lounges and M2 may hailly slow down further, as the PBOC highlighted weather relations between economical growth and credit expansion. Taken together with soft year-to-date growth of TSF stock, we revise down our TSF stock growth forecast to 9.5% for 2024 (vs. 10.0% previously). In light of upcoming acceleration of government bond issue, we proceed to anticipate 2 more RRR cuts and 1 policy rate cut through the reminder of this year.

Looking ahead, Goldman effects government bond issue to choice up in late Q2, and the PBOC to facilitate the government bond issue by expanding interbank liquidity. We proceed to forecast 1 25bp RRR cut in Q2.

While economists are trying to goal search this latest disappointment out of China, the marketplace has already priced it in, and overnight Chinese government bonds gained, as the mediocre credit data Fueled execution of more monetary policy easing and allowed traders to shrug off debt supply deals. The offshore yuan touched its wakeest level in over a week.

Bonds. And with credit request plunging 10Y yields are dumped just fast; here are any more from Bloomberg:

- China plans to start selling the first batch of it 1 trillion Yuan ($138 billion) of ultra-long peculiar central government bonds on Friday.

- Weakness in credit print “adds to the ability of another RRR cut” coming before end-2Q, likely coinciding with the peculiar bond issue and a step-up of local government bond issue for the reminder of 2Q,” Becky Liu, head of China macro strategy at Stanchard Chartered Bank said

10-year Bond yields fell is 2.29% versus erstwhile close at 2.34% on Saturday; the home interbank bond marketplace was open on May 11 due to vacation adjustment

Finally, China’s credit in April shrank for the first time as government bond sales sled, while debt expansion was worth than expected in a sign of weak demand.

Bottom line: The Yuan is dumping, credit is not only steeling but outright contracting, and while stocks are modernly higher as traders hope thay yet bottom-ticked the rebound, the collapsing Chinese yields signal that much more deflation is coming unless Beijing can arrest it. In either case, China is nowfacing a toxic cocktail of 2 equally bad choices: i) devalue the currency in hops of kickstarting exports (since notthing else works), or ii) to nothing and watch as the environment spontaneously collapses in on itself and leads to a global economical shockwave that forces all developed central banks to rapidly turn on the money printer.

Tyler Durden

Mon, 05/13/2024 – 16:40