Foreign trade China 2023

The General Administration of Customs of China (chin. 中国海关总署) reported that in December 2023) Chinese exports counted in RMB of the country increased by 3.8% y/y and imports by 1.6% y/y. abroad trade increased by 0.2% y/y for the full year, including exports by 0.6% y/y, while imports decreased by 0.3% y/y.

China's abroad trade in yuan shows a recovery trend. However, another image appears, in a dollar bill.

In December last year Chinese exports increased by 2.3% y/y, imports by 0.2% y/y, erstwhile in November the erstwhile increased by 0.5% y/y and imports decreased by 0.6% y/y.

Throughout 2023, abroad trade in China in US dollars decreased by 5.0% y/y, including exports by 4.6% y/y (first decrease since 2016), and imports by 5.5% y/y (lowest in 3 years).

Geopolitical tensions, global economical slowdown, weak home request – these are the main factors in this situation.

The first 3 most crucial trading partners of China do not change. The largest are inactive the countries of Southeast Asia ASEAN (turnover increased by 0.20% y/y). The second is the European Union, although with a fall of 1.9% y/y. 3rd place was taken by the United States, with a fall of 6.89% y/y.

Last year, turnover with Latin American countries increased (growth by 6.8% y/y) and Africa (growth by 7.1% y/y). Against this background, Chinese exports to Russia increase by 47% and imports by 13%.

A strong point of export is the alleged “new three” product:

- lithium-ion batteries,

- electric cars and

- Solar panels.

Their average export growth in 2023 was 29.9% y/y. For electrical cars, this increase was 58.6% y/y.

Source: https://wallstreetcn.com/articles/3706224

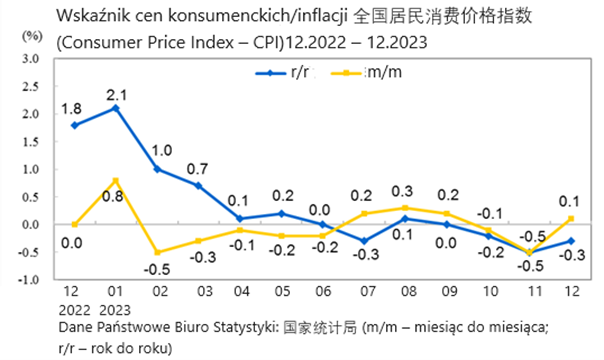

CPI and PPI inflation in China 2023

Deflationary force doesn't decrease. In December, the 3rd period in a row, consumer goods prices (CPI) fell. December inflation reached -0.3% y/y. Over the full year 2023 inflation was 0.2% y/y (the slowest rate since 2009), which is simply a contrast to inflation levels recorded in another countries, especially those of highly developed countries.

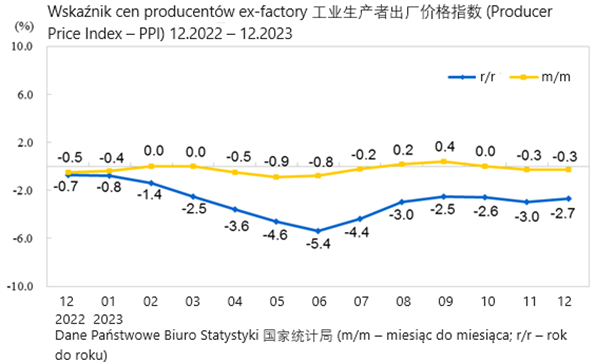

Producer prices (PPI) besides decreased last year. In December this indicator reached -2.7% y/y, the average over the full 2023 was -3.0% y/y.

Internal request is weak, and the problems of the real property sector proceed to weigh heavy on the economy.

Source:

- https://wallstreetcn.com

- https://www.stats.gov.cn

- https://www.stats.gov.cn

“The hardest” companies on Chinese stock exchanges

At the end of 2023 the most valuable companies The marketplace value of Chinese exchanges was

- Taiwan Semiconductor Manufacturing Co., Ltd. (TSMC) (combined circuits, semiconductors) — 3,82 trillion RMB (approx. PLN 2,134 trillion),

- Shenzhen Tencent Computer Systems Co., Ltd. (games, social media, WeChat, Wechat Mobile Pay) – 2,523 trillion RMB (approx. PLN 1,407 trillion),

- China Kweichow Moutai Distillery (Group) Co., Ltd. (manufacturer of the celebrated MaoTai) – 2,168 trillion RMB (approx. 1,210 trillion PLN), who lost his position as leader after six years of leadership in this category.

Source: https://news.mydrivers.com/1/955/955778.htm

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© www.chiny24.com

![Gdzieś w Hrubieszowie… Stacja kolejowa [ZDJĘCIA]](https://lubiehrubie.pl/wp-content/uploads/2025/06/20250629_100939_001.jpg)