Economic data January-February 2023

China's economical situation over the first 2 months of 2023 provides grounds for optimism. The economy is growing, although we will be able to talk about full stableness of growth in the following months.1

The rate of growth in industrial production, retail and investment in the first 2 months of 2023 was higher than in December 2022. However, any indicators proved to be weaker than economists' forecasts. The improvement of the Chinese economy is slower now than before the coronavirus pandemic, and the acceleration is besides short to be called ‘stable’.

Industrial production

This period increased by 2.4% y/y. In November and December, growth was smaller.

Services

they increased by 5.5% y/y and inactive in December 2022 were at an expanding minus (– 0.8%). There is besides a higher increase than in the same period last year (4.2% y/y).

There have besides been crucial increases in the various service sectors:

- IT software and services by 9,3 % y/y;

- The financial sector by 7,6 % y/y;

- Catering and HORECA (hotels, restaurants) by 11,6 % y/y;

- Transport, retention and transportation by 4,2 % y/y;

- Wholesale and retail services by 3% y/y

Consumption/sales

A strong reflection, due to the fact that 3.5% up after 2 months of fall.

Investments in fixed assets

At unchangeable growth levels by more than 5% y/y (January-February 5.5% y/y).

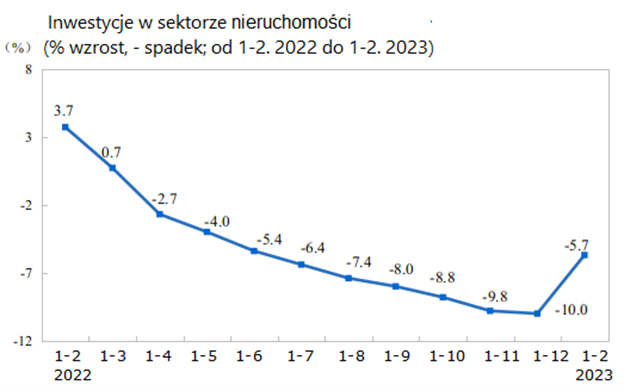

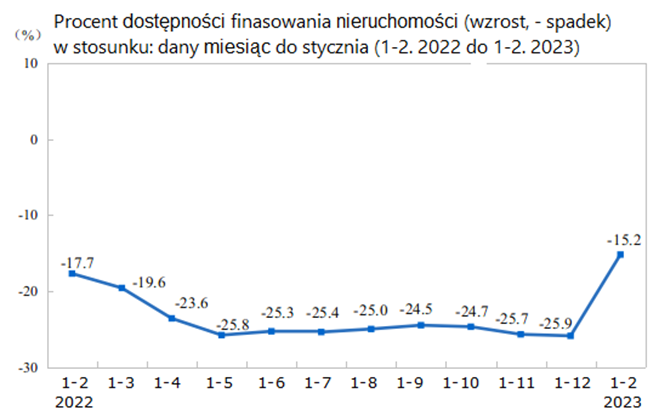

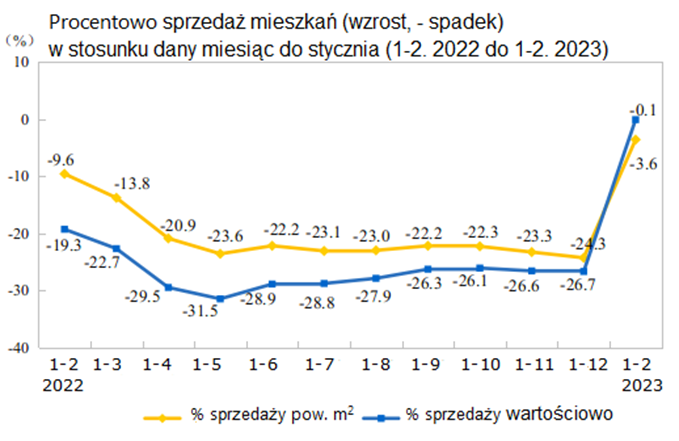

Real property sector

The data collected after the first 2 months of the year gives hope that this large division of the Chinese economy has already passed. While investment indicators, availability of funding, housing sales (whether calculated by area sold or by value) are inactive negative, their growth is significant. Real property in this year (after a year of decline and turbulence) have a chance to come up positive.

Unemployment

It remains comparatively high. At the end of February this year, it amounted to 5.6% in cities (planned for this year 5.5%), and 18.1% among people aged 16-24. In the age group 25-59, only 4.8% are unemployed.

Source:

Data by State Statistical Office (国家统计局)

A bright future?

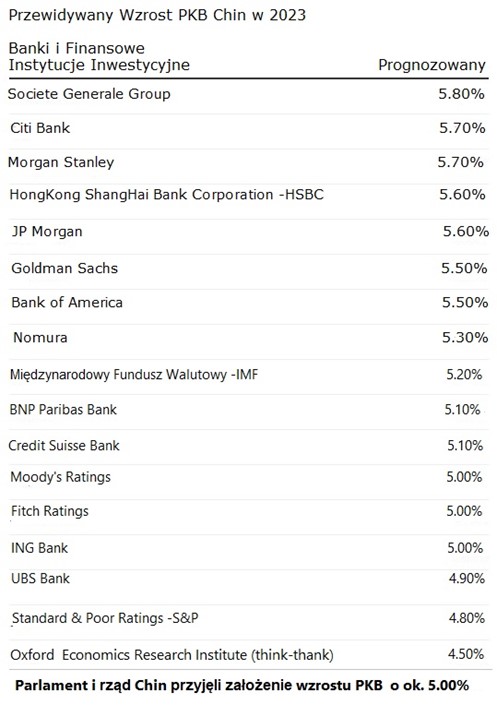

Among the 18 largest and most influential banks and investment and advisory institutions in the world, 3 foretell that the Chinese economy will increase by around 5% in 2023 according to Chinese declarations. 3 in turn anticipate a more pessimistic script in which Chinese GDP will grow much slower this year than Beijing expects.1 Among the remainder (i.e. most banks and financial institutions) there is simply a belief that the Chinese government presents conservative, cautious assumptions that in fact Chinese GDP can (because there are specified conditions) exceed the set 5% growth rate in the year-to-year ratio.

Source:

Foreign trade has weakened

Foreign trade turnover in the first 2 months of that year (calculated in RMB) decreased by 0.8% y/y.1 Although exports increased by +0.9%, imports decreased by 2.9%.

Meanwhile, the surplus in the trade balance rose by 16.2%.

In January and February (usually taken together for Chinese fresh Year) turnover with China's most crucial trading partners, i.e.:

- With Southeast Asian countries, ASEAN increased by 9.6% (export on plus 17.9%, import on minus, decrease by 0.9%, increase in affirmative trade balance by 91.6%);

- with the European Union countries fell by 2.60% (export -5.0%, but import +2.1%, decrease in affirmative trade balance by 12.1%);

- with the United States decreased by 10.6% (export -15.2%, import +2.8%, decrease in affirmative balance -24.9%).

In all Chinese abroad trade ASEAN accounts for 15.4%, the European Union 13.8% and the United States 11.4%. These 3 directions dominate and account for a full of 40.6% of China's trade with the world.

During the first 2 months of the year Chinese exports to Russia increased by 19.8% (15 billion USD, about PLN 66 billion). Imports from Russia increased by 31.3%, reaching USD 18.65 billion (approximately PLN 82 billion).

As far as the export structure is concerned, the steady trend is the expanding share of mechanical, technological, highly processed products, and it falls those requiring advanced human labour. Group 1 is 58% of full exports (January-February increase 0.4% y/y).

The biggest increase in exports was recorded in the automotive industry: by 78.9% (!!!).

The import traditionally dominates natural materials. In January and February imports of iron ore, petroleum and its derivatives, natural gas, coal increased (the biggest leap, due to the fact that by 70.8%) and soy beans. Copper imports fell (9.3%), integrated circuits (26.5%), mechanical and electrical products (19.8%).

All this data is undoubtedly a informing signal despite any structural positives. It's besides early for pessimism, but besides optimism is out of place. Even given the fluctuations in exchange rates, a regular decrease in the amount of mating at the beginning of the year. But are specified numbers the alleged accident at work or the trend already? We'll see about that on March.

Source:

1 http://finance.people.com.cn

All percentages for the same period last year (January-February 2022)

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© China: Facts, Events, Opinions – www.chiny24.com