The image of China's economical situation after 3 quarters of this year is much different from that of abroad media. In fact, how they interpret authoritative data.

Between January and the end of September 2023, the global economy, and thus the Chinese economy, functioned under complex global conditions. At the same time, China faced interior challenges of economical slowdown and thus measures to increase home demand, increase marketplace assurance and prevent risks.

In this context, it is clear that the Chinese economy slow but consistently recovered vigor, production (the largest, most crucial section of the Chinese economy) and supply steadily increased, marketplace request increased, unemployment and prices decreased.

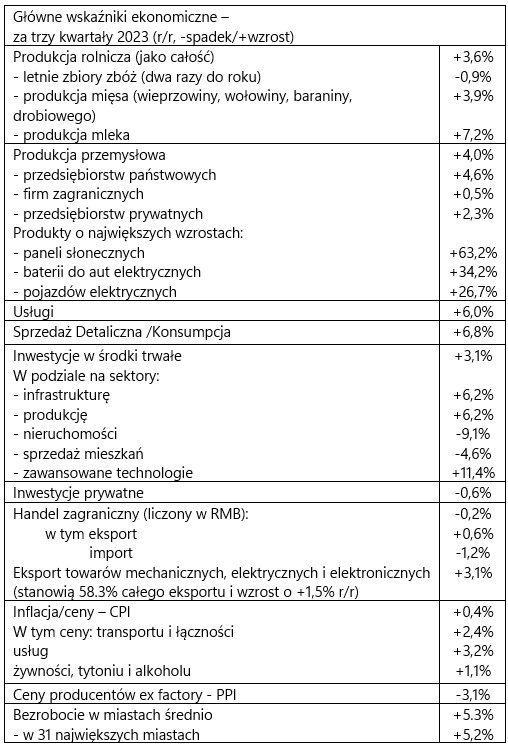

And yes (three quarters data, unless otherwise specified):

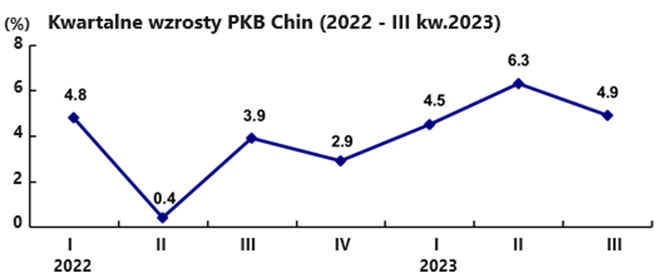

– China's GDP increased by 5.2% year-on-year (year/year) over this period, with

- in the first 4th increase by 4.5% y/y,

- in the second 4th increase by 6.3% y/y,

- in Q3 increase of 4.9% y/y

The accomplishment of the year-round GDP growth mark of 5% appears so not to be at risk. By comparison, the US economy is expected to increase by 2.0~2.3% this year and the European Union economy by 1~1.2%.

– China's industrial production increased by +4% y/y, in September by 4.5% y/y.

– Services increased by 6.0% y/y.

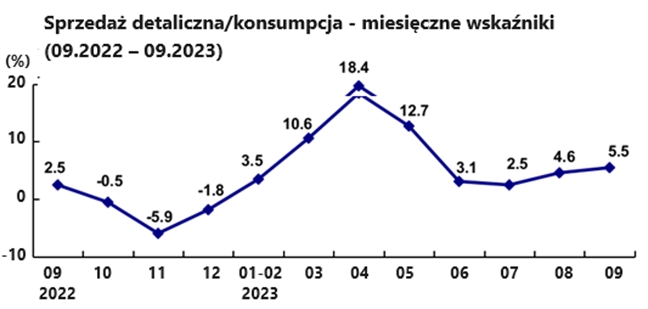

– Sales/consumption: an increase of 6.8% y/y – inactive insufficient to represent a crucial driver for the full state economy.

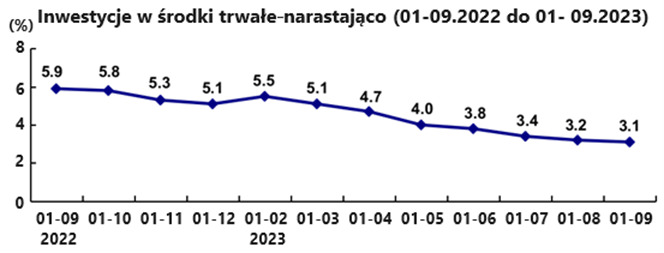

– Investments in fixed assets increased by 3.1% y/y, in the infrastructure sector by 6.2% y/y, in the advanced technology sector by 11.4% y/y. At the same time, there was a decline in the real property sector (-9.1% y/y).

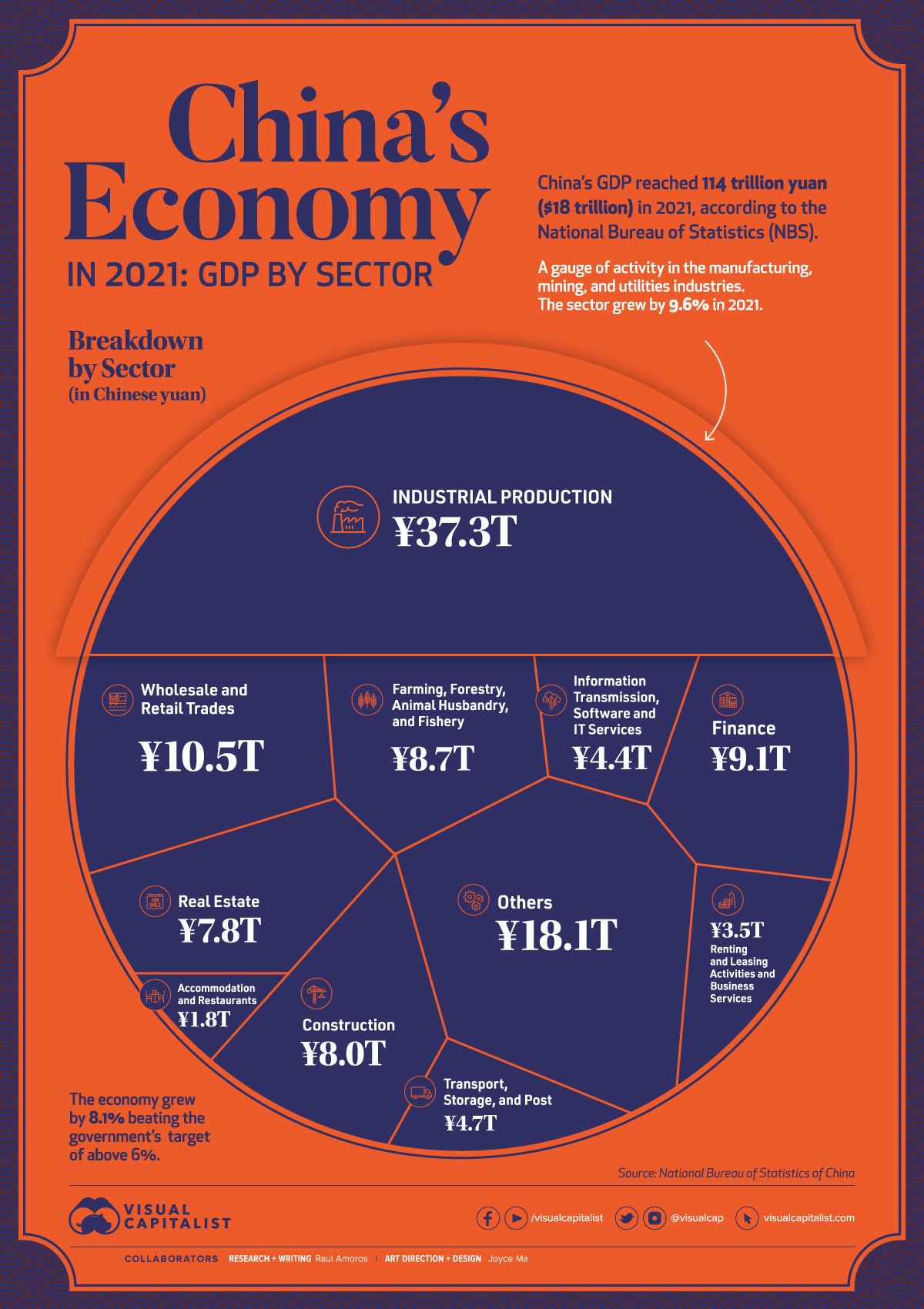

The problems in this sector will not be resolved rapidly over the years. It will be a long-term process. Here we will callback the share of the real property sector in the Chinese economy as a whole, especially in comparison to the production sector:

"Foreign trade comes out of the gap in the mediate of the year. But it is inactive in the decline zone, although the trend is gradually changing. The volume of abroad trade between China and the planet decreased by 0.2% in the period I-IX. There are many indications that by the end of the year Chinese abroad trade will enter the growth zone.

– Consumer prices (CPI) rose by 0.4% y/y. The threat of deflation inactive exists, although it has not been recorded in 2 months. She only performed in July. In September, inflation (CPI) was 0.0% y/y. The economical plans for 2023 projected inflation to increase to 3%.

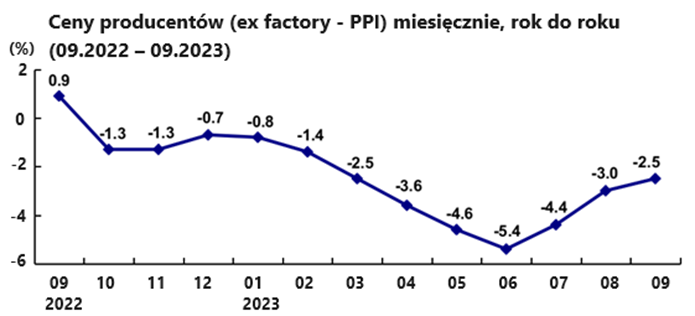

– The factory/production prices are inactive in the negative region – in the first 3 quarters of this year the PPI was in value – 3.1% y/y, which means deconiecture in the manufacturing sector. The largest decrease in maker prices was recorded in June (-5.4% y/y). From now on, prices are rising. In September the PPI was -3.6% y/y.

– Urban unemployment was 5.3% on average in 3 quarters. In September, 5.0%. On average, the working time of people employed in companies in the country was 44.8 hours. At the end of the 3rd quarter, the full number of migrant workers (working outside the permanent residence) amounted to 187.74 million, an increase of 2.8% y/y.

– Per capita disposable income is growing. During the period of 9 months, the average rate was 29,398 RMB (about PLN 16,993) and this is an increase of 6.3% y/y. For the township it amounted to 39,428 RMB (approx. PLN 22,796) and increased by 5.2% y/y and for the village dweller 15,705 RMB (approx. PLN 9,080) and grew faster, as by 7.2% y/y. However, it is inactive a immense distance between towns and villages. Currently, in the Chinese village, disposable income is 2.5 times smaller than that obtained by urban residents. This is simply a large challenge for the ruling. While China managed to overcome poverty, there is inactive a immense population (about 600 million) of low-income people (below 1000 RMB, or about 580 PLN).

The State Statistical Office, despite the recovery noted, warns against force from a low-optimistic and complex external environment, reinforced by weak request in the country. It calls for increased efforts to consolidate the foundations for economical recovery.

Do the above data confirm the ubiquitous belief in Polish media that China is on the brink of economical collapse? China is experiencing economic, interior and external difficulties, but they are most likely not more serious than those experienced by European economies (including Polish economies) or countries widely understood in the West (with Australia, Japan or South Korea).

Source:

- stats.gov.cn

- wallstreetcn.com

- news.cn/a fortune/2023-10/18

- baijiahao.baidu.com

Data based on information from the State Statistical Office (chin. 国家统计局); r/r – year to year; m/m – period to month;

Author: 梁安基 Andrzej Z. Liang, 上海 Shanghai, 中国 China

Email: [email protected]

Editorial: Leszek B.

Email: [email protected]

© www.chiny24.com