China’s Need For US Chemicals Greater Than US Need For Rare Earths

US petrochemical producers may have found themselves on the front line of global trade wars, BNEF reports, with China’s dependence on the US for feedstocks (see „Chinese Plastics Factories Face Mass Closure As US Ethane Supply Evaporates”) blunting the impact of its dominations of exports of rare earth metals.

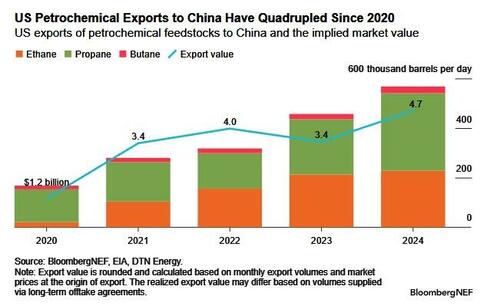

China imported more than 565,000 barrels per day of petrochemical feedstocks from the US in 2024 according to the Energy Information Administration, with a value of over $4.7 billion. That dwarfed the $170 million of rare earths the US imported last year, about 70% of which came from China, according to the US Geological Survey.

The figures show the dependence the US and China have developed on each other by ever tightening trade links over the past few decades. While China has a tight grip on refining many metals crucial for industry, it also takes in niche chemicals from the US that are difficult to buy elsewhere.

China leans on naphtha to produce most base chemicals, which are processed further to end up in everyday items like electronics and clothing. However, some plants can switch to cheaper propane when the economics make sense, which they do regularly. Propane dehydrogenation plants however can’t process alternatives like naphtha. The US accounted for over half of all China’s propane imports in 2024.

US producers have looked to China to buy their ballooning volumes of feedstock, the market value of which has almost quadrupled since 2020. China accounts for almost half of all new mixed-feed ethylene and propylene production capacity set to come online globally over the next four years, based on data compiled by BloombergNEF.

A forced divorce

The honeymoon period may be about to end. Following the implementation of tariffs by President Donald Trump’s administration in April, China retaliated with its own on US imports — including a 125% tariff on feedstocks like propane and ethane. The duty effectively killed the economics of importing US feedstocks.

Alternative sources of propane may be hard or expensive to come by, with producers in the Middle East sending most of their supplies to India, South Korea and Japan. While some rerouting could take place, Middle Eastern players could use the lack of alternatives for China’s propane dehydrogenation plants to charge a premium. China’s propane dehydrogenation operators, like Hengli Petrochemical, have already suffered from weak margins over the past years. Many may opt to shut their operations temporarily.

A messy settlement

China moved quickly to remove tariffs on US ethane as trade talks commenced. However, while China seems willing to buy US ethane, the US administration may no longer allow it. Enterprise Products Partners — the largest US-based exporter of petrochemical feedstocks — received a notice on Wednesday from the Bureau of Industry and Security at the US Department of Commerce, denying licenses to export ethane to China on the basis that such flows “pose an unacceptable risk of use in or diversion to a ‘military end use’ in China.” Energy Transfer received a similar communication.

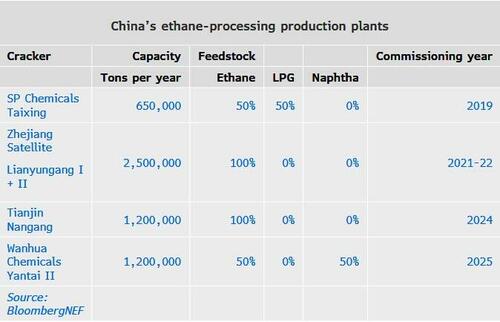

China’s ethane cracking capacity is dwarfed by its capacity to process naphtha and propane, but almost all of its ethane imports come from the US. The restrictions will have a significant impact on the Lianyungang and Tianjin plants, owned by Satellite Chemical, Sinopec and INEOS. SP Chemicals, a Singapore-based producer, sources most of its feedstock from Enterprise Products Partners.

As the trade war continues, it appears commodities may lead the confrontation, with players on both sides set to feel the pain.

Tyler Durden

Mon, 06/09/2025 – 20:10