Centene Crashes After Pulling 2025 Guidance On Unexpected Risk Adjustment Results

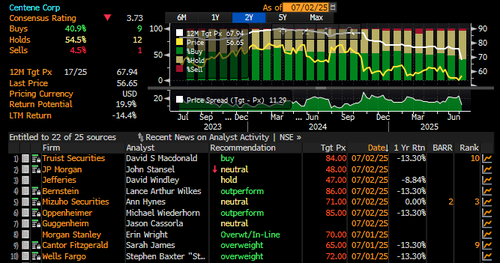

Centene shares crashed in premarket trading after the health insurer withdrew its 2025 guidance due to weaker-than-expected trends in the Affordable Care Act Marketplace and ongoing Medicaid cost pressures. The health insurer warned of a $1.8 billion earnings headwind, prompting downgrades from Wall Street.

Centene, one of the largest health insurers in the U.S., disclosed on Tuesday evening new data from an independent actuarial firm, Wakely, covering about 72% of its ACA Marketplace membership, revealed significantly worse-than-expected results.

Wakely’s data reveals:

-

Lower-than-expected market growth and

-

Much higher aggregate morbidity than Centene had assumed for its risk adjustment revenue.

As a result, Centene now preliminarily estimates a $1.8 billion reduction in its net risk adjustment revenue for 2025, translating into a $2.75 hit to adjusted diluted EPS. According to FactSet data, Wall Street analysts had expected full-year adjusted earnings of around $7.28 a share.

„The Company does not have information or estimates for its remaining seven Marketplace states, but anticipates, due to the morbidity trends observed in the 22 states, an additional reduction to its net risk adjustment revenue transfer expectation with a corresponding adjusted diluted EPS impact,” Centene stated in a press release.

Another industry bellwether, UnitedHealth, recently slashed its full-year guidance and replaced its chief executive. Higher-than-expected medical costs have sparked broader concerns across the entire insurance sector.

Analysts were full of gloom, with UBS cutting its rating on Centene to neutral, citing significantly weaker near-term earnings.

Here are first takes from Wall Street (courtesy of Bloomberg):

UBS (neutral)

-

UBS cuts Centene to neutral from buy immediately following the withdrawn guidance; broker now sees 2025/2026 EPS at $3.25, representing a 55% decline

-

„With the unexpected risk adjustment results in Marketplace and persistent Medicaid cost trends, the company’s risk near term earnings has been significantly reduced”

JPMorgan (neutral)

-

Analyst John Stansel cuts to neutral from overweight following news; says new price target of $48 from €75 reflects estimated ACA headwinds as well as „incremental” Medicaid pressure, „assuming that CNC is able to reprice at least a portion of its book into 2026”

-

Says any information on Centene’s approach to the ACA Marketplace in 2026 and recent regulatory changes will be key when company reports earnings on July 25

Barclays (equalweight)

-

Analyst Andrew Mok calls ACA update „materially negative;” says it comes after recently-received industry data that showed Centene’s cited membership growth was lower than expected, „likely driven by integrity rules”

-

Adds that implied morbidity was „significantly higher” than Centene’s expectations, driving an earnings headwind of as much as $1.8 billion for 2025, representing a $2.75 EPS impact

Jefferies (hold)

-

Analyst David Windley says Centene’s move confirms Jefferies fears that the prior-year 2025 risk pool is „deteriorating and plans have mispriced the risk pool” with firms assuming healthy growth

-

„Investors should remember that CNC’s risk adjustment is moving unfavorably because others’ books are feeling claims pressure,” Windley flags

Centene shares plunged as much as 27% in premarket trading in New York, hitting levels last seen in 2017. As of Tuesday’s close, the stock was down roughly 6.5% year-to-date.

. . .

Tyler Durden

Wed, 07/02/2025 – 07:45

![Monitoring nie kłamie: Nagranie z ulicy Pileckiego trafiło do sieci. Sprawca ma mało czasu [WIDEO]](https://www.eostroleka.pl/luba/dane/pliki/zdjecia/2026/policja_kolizja_pileckiego.jpg)