Cattle Herd Rebuild Begins Just As Consumers Get Slaughtered By Record Beef Prices

Foreign-owned globalist meatpacking giant JBS—labeled a „modern-day monopoly” by Republican Senator Josh Hawley—has acknowledged that the U.S. cattle industry is in the beginning stages of rebuilding its decimated herd from seven-decade lows. While the move to rebuild is underway, the company warns that meaningful increases in beef supply—and any relief for consumers facing record-high retail prices—aren’t expected until at least 2027.

„We are into herd rebuild right now,” said Wesley Batista Filho, CEO of JBS North America, in an interview quoted by Bloomberg. He added, „The economic incentives are there, the weather is helping.”

Batista pointed out that a decline in female cattle slaughter suggests that ranchers are retaining more cows for breeding, signaling herd rebuilding has commenced. However, he warned that recovery time will be slow, with no significant increase in beef supply expected until 2027.

Batista’s analogy to the rebuilding cycle is this: „It’s more like taking the stairs than the elevator.”

Which means ground beef prices at the supermarket will remain high through this year and into 2026.

Batista’s comments come days after Goldman Sachs analysts Leah Jordan and Eli Thompson told clients that beef cycle indicators suggest a rebuilding cycle has begun:

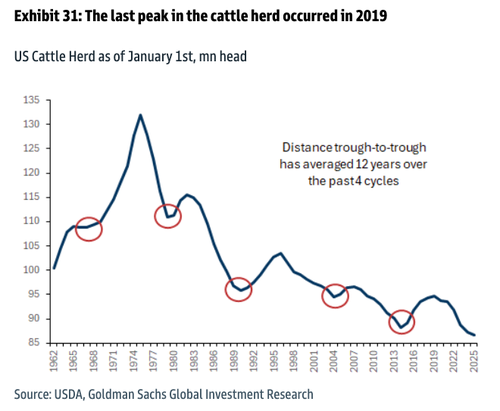

Beef cycles typically last about twelve years on average, looking at trough-to-trough in the cattle herd. The prior trough in the herd occurred in 2014, while the prior trough in beef packer margins occurred in 2015. The current herd liquidation cycle began in 2019, with the herd tracking at ~86.7mm as of January 1, 2025, the lowest level since the 1950s. Herd rebuilding may already be underway, or is likely soon, noting supportive industry conditions (high calf prices and low feed costs), which should further constrain supply in the near-term, partially offset by record weights for cattle on feed.

Analysts posed the question: „When will the beef cycle turn?” — a question we’ve been asking at ZeroHedge as well.

Here’s a visual breakdown of the beef industry’s turning point…

The rebuilding phase will be rocky for the four mega-corporations (JBS, Tyson Foods, Cargill, and National Beef) that control 80% of beef processing in America because, as Senator Hawley warned on Wednesday at an antitrust hearing on Capitol Hill, scrutiny on the meatpacker „monopoly” has begun, calling for the urgent need of more competition.

A total of 4 companies control a whopping 80% of the entire beef-processing industry. That’s a modern-day monopoly.

The winners here? The monopolists – like Tyson Foods. The losers? Farmers & grocery shoppers.

We need more industry competition in America pic.twitter.com/UxZc7eoAOZ

— Josh Hawley (@HawleyMO) June 24, 2025

The path to rebuilding starts with reviving regional microprocessing plants across the country—creating a more resilient, decentralized food supply chain that’s less vulnerable to disruptions.

Just as important, Americans need to rethink how they buy beef: skip the globalist mega-supermarkets and instead support local ranchers directly.

What the Globalists Don’t Want You to Have…

That keeps dollars in the hands of mom-and-pop ranchers, not globalist Wall Street, which has stripped the Heartland of wealth for decades. Now, the pendulum swings the other way as MAHA begins.

Tyler Durden

Sun, 06/29/2025 – 11:05