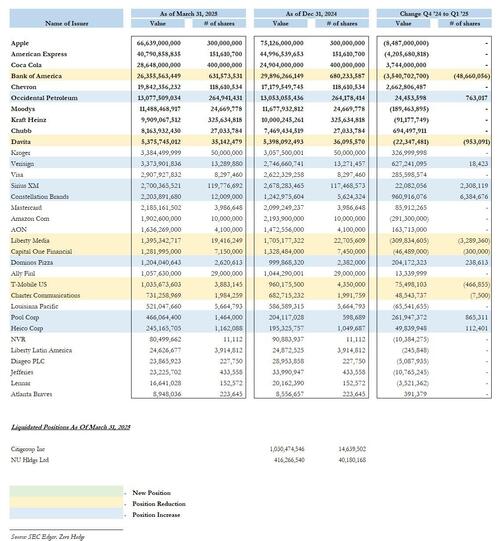

Buffett Liquidated Citigroup, Dumped Financial Stocks As US Entered Trade War : Full 13F Breakdown

Warren Buffett already stunned the Berkshire faithful with his „shocking” announcement last weekend that the 94 year old billionaire was, gasp, finally retiring as CEO of the $1 trillion+ conglomerate. Luckily, there were no surprises in Buffett’s latest 13F filing published at the close today: while Buffett did not add any new positions in the quarter that preceded Trump’s trade war, he did liquidate two of his previous large holdings, and continued to trim positions in financial stocks while adding to a handful others.

Buffett started off the last year of his tenure as CEO of Berkshire by exiting his once-huge position in Citigroup, while also shrinking his holdings in Capital One Financial and continuing to trim his longtime stake in Bank of America.

While it is still a top 5 position valued at $26.4 billion at the end of Q1, Buffett started selling his BofA stake in July last year, without providing any explanation for the move. He now owns 8.3% of the US lender and is no longer its biggest shareholder, according to data compiled by Bloomberg.

Berkshire also fully liquidated its stake in Brazil’s Nubank, which has grown into one of the world’s biggest digital banks since its 2013 founding. Berkshire bought a $500 million stake before the bank went public in 2021. The stock has gained 46% since.

On the plus side, Buffett added to his stake in Constellation Brands, which now totals 6.6%, or $2.2 billion; he opened the new position in the alcohol distributor in the last quarter of 2024. He also bought more Sirius XM Holdings and Occidental Petroleum, where he is by far the largest holder with 27% of the shares outstanding. In addition, the company requested confidentiality treatment from the Securities and Exchange Commission, meaning Berkshire was allowed to omit one of more holdings in its filing Thursday.

After aggressively selling down his stake in Apple for much of 2023 and 2024, his AAPL shares were untouched in Q1 and still represents the billionaire’s portfolio’s most valuable holding.

Here is a full breakdown of what Berkshire did in Q1. It added to position in:

- Occidental Petroleum, +763,017 million shares to 264.9 million shares, or $13.1 billion as of March 31

- Verisign, +18.423 shares to 13.3 million shares or $3.4 billion

- SiriusXM, +2.3 million shares to 119.8 million shares, or $2.7 billion

- Constellation Brands, +6.4 million shares to 12.009 million, or $2.2 billion

- Dominos Pizza, +238,613 shares to 2.6 million shares, or $1.2 billion

- Pool Corp, +865,311 shares to 1.5 million shares, or $466 million

- Heico Corp, +112,401 shares to 1.2 million shares, or $245.2 million

It reduced its positions in:

- Bank of America, by 48.7 million shares to 631.6 million shares, or $26.4 billion as of March 31

- Davita, by 953,091 shares to 35.1 million shares, or $5.4 billion

- Liberty Media, by 3.3 million shares to 19.4 million shares or $1.4 billion

- Capital One, by 300K shares to 7.150 million shares, or $1.3 billion

- T-Mobile, by 469K shares to 3.9 million shares, or $1.0 billion

- Charter Communications, by 7500 shares to 1.98 million shares, or $731 million

Buffett largely refrained from making large acquisitions in recent years, instead building a cash pile that reached nearly $350 billion by the end of March. At the conglomerate’s annual meeting this month, the billionaire said the recent market downturn was “really nothing,” pointing to times in Berkshire’s history when his company’s stock lost half of its value in short spans.

As we reported at the start of May, Buffett will step down as chairman at year-end. He built Berkshire into a business valued at more than $1.1 trillion, with individuals as well as professionals closely watching and sometimes imitating his investment moves.

Shares of Omaha, Nebraska-based Berkshire have gained more than 11% so far this year. The S&P 500 Index has risen less than 1% during the same period.

A full breakdown of Berkshire’s holdings is below.

Source: Edgar

Tyler Durden

Thu, 05/15/2025 – 20:05