Bond Market Paradigm Shift?

Via RealInvestmentAdvice.com,

Some bearish bond investors in Japan and the US appear to believe that a paradigm shift is underway in the sovereign bond markets.

To wit, consider the following statement from Jim Bianco on Thoughtful Money:

“If these deficits are really going to kick in and cause problems, these rates are going to go much higher than this.”

The bond market paradigm shift we observe is that some people believe the governments and central banks of the largest nations are no longer managing interest rates.

For those who believe in this paradigm shift, we ask a simple question: Why Would They Stop Now?

The governments and central banks of developed countries have long-standing policies that keep high levels of public and private debt serviceable.

Moreover, these same policies aim to incentivize further debt accumulation.

The bearish voices in the bond market, claiming a paradigm shift is underway, show a disregard for history.

Bond bulls and bears can all agree that global fiscal debt trends are not sustainable.

However, do you think the governments are now willing to pay the price for such malfeasance?

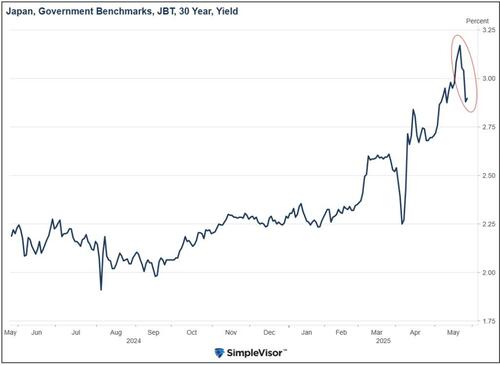

Two years ago, the Japanese government uncapped its interest rates, and not surprisingly, they have surged higher.

However, with their 30-year bond approaching 3%, they announced that they are considering adjusting their debt issuance patterns. As shown below, its 30-year bond fell 35 basis points after the announcement.

Bond yields in the US and around the world fell in sympathy.

Governments around the world will preserve their debt-driven financial systems and economies by keeping a lid on interest rates.

Again, ponder the one simple question if you believe in the paradigm shift: why would the governments and central banks stop manipulating the bond market now?

Tyler Durden

Mon, 06/02/2025 – 10:20