Boeing Jumps After Beating Apocalyptic Estimates Despite Biggest Cash Burn In 4 Years

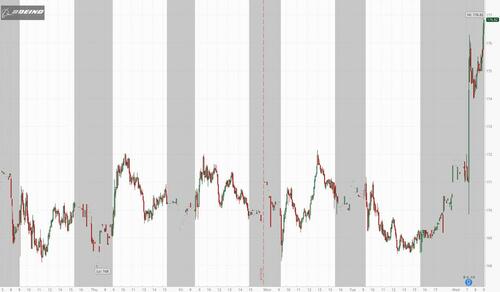

Having been hammered like a nail for much of 2024 as a consequence of incidental after incidental involving its flying paperweights (most late this morning), Boeing stock enjoyed a modern recovery this morning erstwhile the plane maker reported returns, EPS and cash flow that we were all strongr than expected, while Assuring investors that “demand across its portfolio was incredibly strong.”

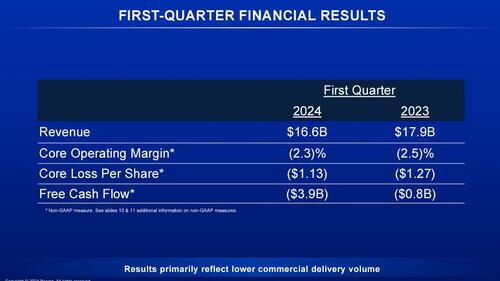

Here is what the company reported for Q1:

- Revenue of $16.57BN, down from $17.9BN in Q1 2023 but beating estimates of $16.25BN

- Commercial Airplanes returnue: $4.65BN, missing est. of 5.45BN

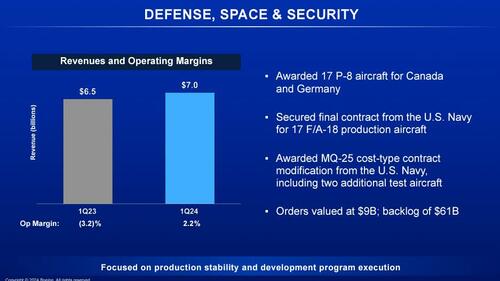

- Defense. Space & safety revenge: $6.95BN, beating est of 6.38BN

- Global Services revenue: $5.05BN, beating est of 4.98BN

- Adjusted EPS of -1.13, beating the estimation of an even bigger failure at -$1.76

- Defense. Space & safety Operating Earlings: USD 151mln, (exp. 62.7mln)

- Global services operating hours: USD 916 million, (exp. 824.7 million)

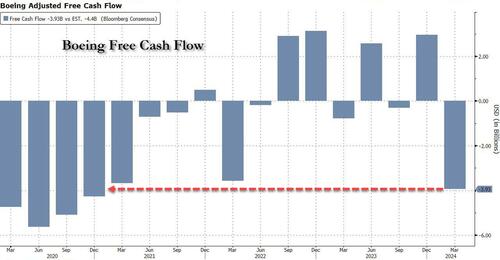

- Free Cash Flow $3.93BN), bage than the $(0.8BN) cash burn a year ago, but beating estimates of a $(4.4BN) burn.

The latest failure reflected slower 737 Max production, lower 737 transportation and compensation to customers after a door panel blew out on a commercial flight.

“Our first-quarter results reflect theimmediate actions we’ve taken to slow down 737 production to drive improvements in quality,” said chief executive Dave Calhoun.

But while Boeing is “driving improvements”, its cash flow is imploding and in Q1 punged the bridge in 3 years. Well, nobody said DEI comes cheap...

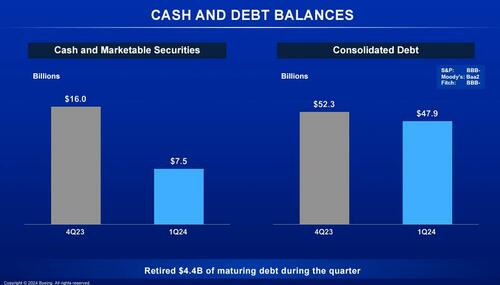

And with Boeing incinerating cash at a close evidence pace, which far by $8.5BN, even as maturing debt declined by just $4.4BN,net debt actually rose by $4.1BN!

A closeer look at the various divisions, staring with Commercial Airplanes, which Saw gross slam from $6.7BN to $4.7BN

- Undertaking comprehensive actions to strengthen quality and safety.

- Secured 125 net orders, including 85 737-10 for American Airlines and 28 777X airplanes

- Delivered 83 airplanes

- Backlog of USD 448bln: over 5.600 airplanes

... and Defense, Space & Security, where thanks to the myriad US wars, gross rose from $6.5BN to $7.0 BN

- Awarded 17 P-8 aircraft for Canada and Germany

- Secured final contract from the U.S. Navy for 17 F/A-18 production aircraft

- Awarded MQ-25 cost-type contract modification from the U.S. Navy, including 2 additional test aircraft

- Orders valued at USD 9bln; backlog of USD 61bln.

As Bloomberg notes, while the defence business posted a slim, $151 million operating profit for the first time in more than a year, the division is inactive grappling with cost overruns on fixed-price defence contracts, a hangover from its strategy of biding aggressively to safe military contracts last decade. “Results besides reflect $222 million of losses on cetain fixed-price improvement programs,” the earlys release stood, without elaborating.

In any early morning message, Boeing CEO Dave Calhoun touted the advancement Boeing is making in stacking its quality breakdowns. He toured a 500% increase in employer “Speak Up” subscriptions combined to 2023. talk Up is simply a program that Boeing started in 2019 to encourage employers to internly study possible safety issues. In total, more than 70,000 employees have participated in these “quality stand downs.”

The company has been helping the program in fresh months, as it faces allegations from Whistleblowers who say they were punited in the past for racing concerts. That includes fresh claims from a union that represents Boeing employees, which on Tuesday alleged the company retaliated against 2 engineers who raised deals about its 777 and 787 jets in 2022.

“Near term, yes, we are in a tough moment. Lower transportation can be affected for our customers and for our financials. But safety and quality must and will come beyond all else,” Calhoun said.

The gloriously incompetent and virtue signaling Boeing chief besides acknowledged his plans to step down as CEO “around the end of the year,” adding he would spend his restoring time working to rebuild assurance in Boeing, and to gain that idiotic comp package he received for burning the stock price to the ground.

Turning to M&A, Boeing confirmed last period that it’s in talks to buy back fuselage maker Spirit AeroSystems but there were no updates on the deal in the learning materials. In the meanstime, Boeing is providing a $425 million cash advance to Spirit to aid stabilize its operations while delivering slow and the supplier works to improve quality control

This latest bailout by Boeing of 1 of its most crucial suppliers may signal the admission is taking money to negotiate, RBC analyst Ken Herbert gate in a note. The deal talks have hit a snake over pricing for products that make components for Airbus SE jets, Bloomberg reported this week.

Looking forward, Boeing hasn't provided any hints for its near- and longer-term prospects in the prepared materials published this morning so investors will gotta wait for CEO Dave Calhoun’s application on CNBC or a later arrivals call to learn more. Of partial interest: whother the planner inactive expects to make $10 billion in yearly free cash at any point during 2025 or 2026, as it had targeted before the latest crisis. The company suspended its yearly financial guidance back in 2019, erstwhile the 737 Max tragedy sparked a global grounding that batteryed Boeing's finances. Much of that item seems uncertain right now with the FAA having a large say over production of the cash-cow jet. Boeing CFO Brian West said in March that the company inactive effects to make cash for the year in the low-single-digit billions of dollars.

Still, while the results were received in multipleillicit wars – and BA stock managed to phase a modern short slide in premarket trading, which is not saying much: the bounce comes after a harp saltoff in the stock this year that made Boeing 1 of the worst performers in the S&P 500 Index. Also, whother the surgeon can stick is simply a different matter.

The company’s Q1 investor presentation is here.

Tyler Durden

Wed, 04/24/2024 – 09:24