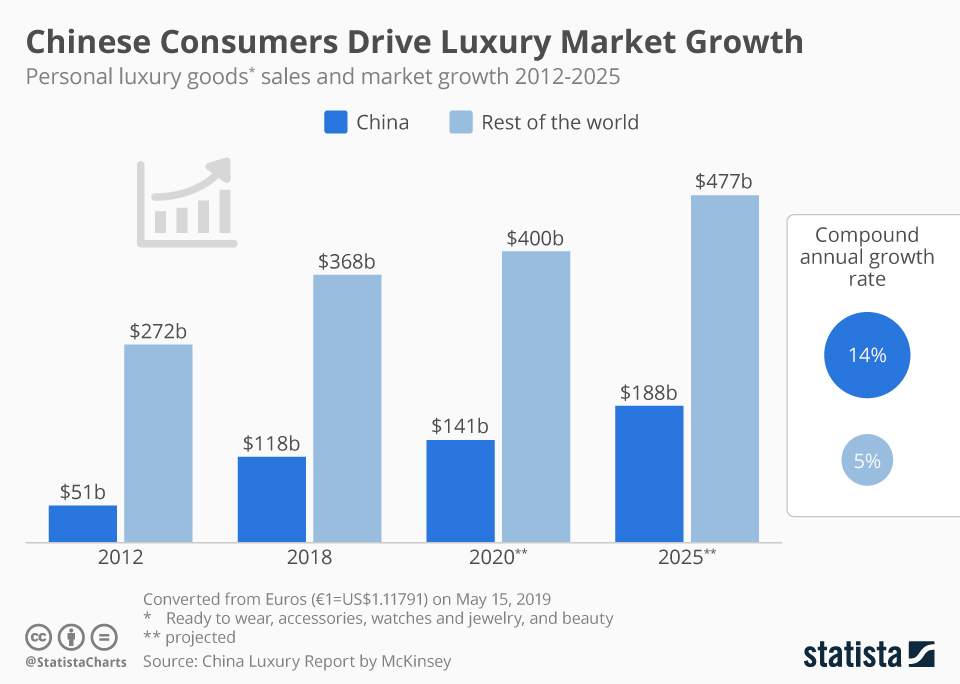

China will shortly lead the planet marketplace for luxury goods

According to Bain & Co. and Altagamma, Chinese consumers are expected to become the most crucial demographic section in the global luxury market, representing between 35 and 40 percent of this marketplace by 2030.

Americans and Europeans will take second and 3rd places, with an estimated 22-24 percent and 16-18 percent marketplace share," Bain stated in its latest study on the luxury goods market.

Overall, the global marketplace for luxury goods, including clothing, cosmetics, jewelry and watches, has a promising future and will increase about 2.5 times the size of 2020, reaching an estimated value of EUR 540-580 billion in 2030 (about $586-629 billion).

By this year, 2 thirds of the full marketplace will be driven by online and monobrand channels.

Given the age groups, millennials will dominate the marketplace for luxury goods with a share of 50 to 55 percent. The Z generation will be between 20 and 25 percent, and the Alpha generation will be about 5 percent.

Looking to the close future, a slow increase in the luxury sector is expected in 2024, only by 1 to 4 percent at fixed exchange rates compared to 2023, which is little than half an 8% increase year-on-year, which is due to take place by the end of 2023.

China in the lead

According to Bain & Co., China is expected to contribute to 40 percent of global luxury spending by 2030, compared to 33 percent in 2019.

The study besides foresees that purchasing habits will shift geographically towards mainland China. In 2019, malls on the continent generated only 11 percent of the sales of luxury goods, while US and European regions accounted for 62 percent of sales.

By 2030, shops in mainland China will attract up to 27 percent of the sale of luxury goods, which catalyses the transformation of Hainan into a duty-free island by 2025. Although the US and Europe will keep their position as key global buying centres, their collective geographic marketplace share could fall to 46-50 percent.

After reopening the borders this year Continental China showed promising signs of recovery, noting a strong first 4th for the luxury sector. However, the weakening assurance of consumers due to macroeconomic problems, specified as restless real property markets, rising youth unemployment rates and migration of wealth abroad, has led to slower than expected growth, says the report. Q4 is expected to lead China on a affirmative trajectory.

2023 — year of rebirth

In 2023 the reopening of China proved to be more beneficial to Asian countries, 55 percent of Chinese tourist spending concentrated in Asia compared to 40 percent in Europe. Expenditure in Asia was driven by wealthy Chinese customers, while generation Z and millenniums preferred Europe. In Asia Japan in peculiar recorded a boom of sales of luxury goods throughout the year, as it attracted Chinese tourists due to a weak yen.

The global marketplace for luxury goods, including the luxury of individual use, is expected to scope a value of EUR 1.5 trillion (US$1.63 trillion) by the end of 2023, expanding by 8-10% compared to 2022.

The volume of the marketplace for luxury individual usage in mainland China is expected to scope EUR 56 billion (US$60.73 billion) by the end of 2023, a 12% increase compared to 2022 at fixed exchange rates. Compared to this, Europe will end the year as a global marketplace leader with a marketplace size of EUR 102 billion (US$110.76 billion).

In 2024, forecasts indicate a promising increase in local consumption in mainland China, as real GDP could increase to 4.2% year-on-year. another key markets specified as Europe and the United States can see a importantly lower GDP growth of 1.4% and 1.5%, respectively.

Source: Jing Daily, The Business of Luxury in China

Leszek B. Glass

Email: [email protected]

© www.chiny24.com