MUMBAI- Adani Airports Holdings Limited (AAHL), the aviation arm of Adani Enterprises and India’s largest private airport operator, has secured USD 1 billion in project financing for Mumbai International Airport Ltd (MIAL).

The financing includes USD 750 million in investment-grade bonds maturing in July 2029, with an additional USD 250 million provisioned under the same framework. Major international investors, including Apollo-managed funds, BlackRock, and Standard Chartered, backed the deal.

Photo: Utkarsh Thakkar (Vimanspotter)

Photo: Utkarsh Thakkar (Vimanspotter)Adani Mumbai Airport Expansion

The funding deal reflects rising global investor confidence in India’s airport infrastructure. Structured as a private investment-grade bond issuance — the first of its kind in India’s airport sector — the transaction strengthens Adani’s commitment to expanding and modernising Mumbai International Airport (BOM).

The USD 750 million tranche will be primarily used to refinance existing debt, ensuring capital efficiency and liquidity. The remaining USD 250 million, yet to be drawn, adds financial flexibility to support upcoming capital expenditure, including terminal upgrades, runway expansion, and technology enhancements.

This strategic move aligns with AAHL’s long-term vision of transforming India’s aviation infrastructure. The funds will also contribute to MIAL’s push towards sustainability, with a target of achieving net-zero emissions by 2029.

The deal attracted participation from a syndicate of major global investors. Lead investor Apollo was joined by funds managed by BlackRock and banking giant Standard Chartered, all reflecting robust global interest in India’s aviation growth story.

The bond notes are expected to receive a BBB-/stable rating, underpinned by MIAL’s consistent cash flows, strong asset base, and operational resilience.

Legal advisors on the deal included Allen & Overy, Shearman & Sterling, and Cyril Amarchand Mangaldas on behalf of MIAL, while Milbank LLP and Khaitan & Co. represented the investors.

Photo: Mumbai CSMIA Airport Adani X page

Photo: Mumbai CSMIA Airport Adani X pageReinforcing Financial Discipline and Market Confidence

Arun Bansal, CEO of Adani Airports Holdings Ltd, emphasized the significance of the financing round:

“This successful issuance validates the strength of the Adani Airports’ operating platform, the robust fundamentals of Mumbai International Airport, and our commitment to sustainable infrastructure development.”

He added that the ability to raise one of India’s largest private investment-grade project financing packages reflects the company’s financial discipline and long-term focus on value creation.

The fundraising builds on AAHL’s earlier USD 750 million raised through global banks, further enhancing its access to diversified international capital markets.

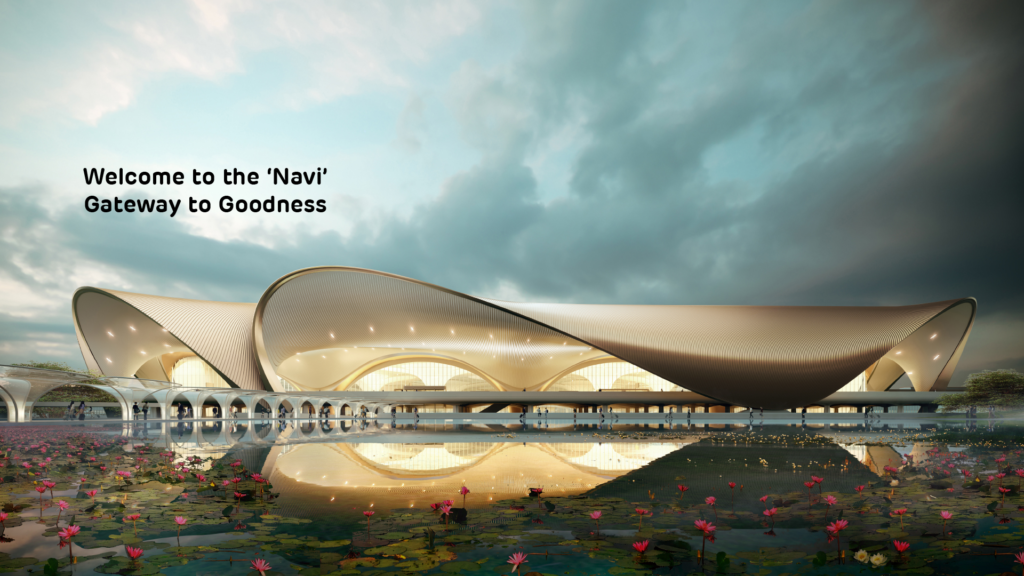

Photo: NMIA

Photo: NMIANMIA Update

The Airports Economic Regulatory Authority (AERA) has approved an ad-hoc User Development Fee (UDF) for passengers using the upcoming Navi Mumbai International Airport.

Passengers flying out on domestic routes from Navi Mumbai (NMI) will pay ₹620, while international travelers will be charged ₹1,225. The airport is being developed by Navi Mumbai International Airport Ltd (NMIAL) and is expected to become operational later this year.

AERA, the statutory body regulating economic aspects of major Indian airports, has permitted Navi Mumbai International Airport Ltd (NMIAL) to collect a provisional UDF from departing and arriving passengers. This fee is intended to support early-stage operations and infrastructure at the greenfield airport until a formal tariff is finalized.

For outbound travel, passengers will be charged ₹620 for domestic flights and ₹1,225 for international routes. For arriving passengers, the UDF will be ₹270 (domestic) and ₹525 (international). These charges will apply only during the interim period set by AERA, which lasts through the end of FY 2025–26 or until a final tariff structure is determined, whichever comes first.

Tariff Validity and Revenue Adjustment

The ad-hoc UDF will remain in effect until March 31, 2026, providing NMIAL a temporary mechanism to recover part of its capital investment.

AERA clarified that the revenue earned under this interim model will be factored into the authority’s future tariff-setting exercise.

The regulator issued a detailed 42-page order explaining the rationale, stating that the provisional UDF is necessary to bridge the funding gap during the initial years of airport operation.

However, the rates are subject to revision based on the airport’s performance and passenger traffic once regular tariff proceedings begin.

Strategic Role of Navi Mumbai Airport

The Navi Mumbai International Airport (NMIA) is set to become the second major airport serving the Mumbai Metropolitan Region (MMR), after Chhatrapati Shivaji Maharaj International Airport (IATA: BOM).

The airport is expected to ease congestion at BOM and significantly expand aviation capacity in western India.

Built through a public-private partnership and led by the Adani Group, NMIAL is designed to handle 60 million passengers annually once fully developed. Its phased opening will begin later in 2025.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News

Navi Mumbai, Jewar Airport Eyes New Flights to these Gulf Cities

The post Adani Gets $1 Billion for Mumbai International Airport Expansion appeared first on Aviation A2Z.

![[FILM] Z dachu jadącego Forda spadła bryła lodu pod koła policyjnego radiowozu](https://images8.polskie.ai/images/2217/37738887/1d39afc298b4a4b11b1adc6bd392ab09.jpg)