’Free’ Government Money Accounts For 19% Of All Personal Income

Authored by Mike Shedlock via MishTalk.com,

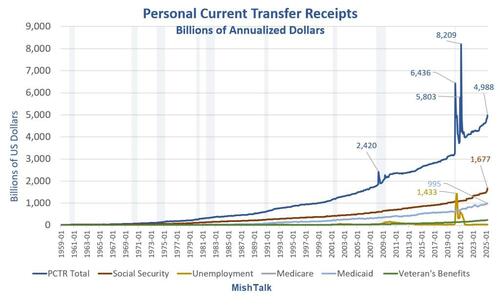

Free money includes Medicare, Medicaid, SNAP, Social Security, and more, discussed below.

Some may object to the term “free money” but the definition of Personal Current Transfer Receipts (PCTR) is “Payments to individuals for which no current services are performed, representing a component of personal income.”

I don’t want to get into a debate over “free” based on “current services”. Instead, let’s focus on the sustainability of the current path.

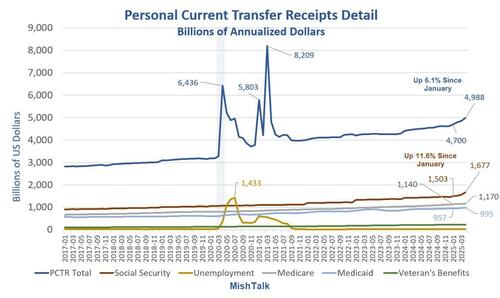

Personal Current Transfer Receipts Billions of Dollars Detail

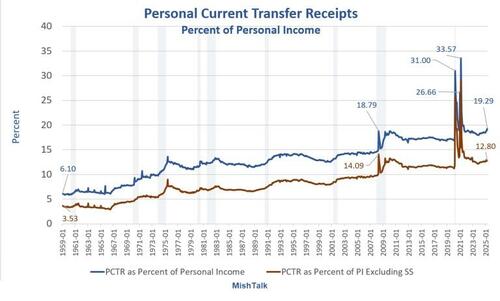

PCTR as Percent of Personal Income

PCTR as a percent of PI is now 19.29 percent and rising.

Q: What if we adjust for inflation?

A: The numbers in billions change, but the percentages don’t. They are nearly identical.

Real vs Nominal Explanation

Medicare is indexed for inflation in several ways. The income thresholds for income-related monthly adjusted amounts (IRMAA) surcharges for Parts B and D premiums are adjusted annually for inflation. Additionally, certain payment rates for providers and other aspects of Medicare, such as Part D out-of-pocket caps, are also indexed for inflation.

Social Security benefits are indexed for inflation through a process called a Cost-of-Living Adjustment (COLA). This adjustment ensures that benefits keep pace with the rising cost of living.

Medicaid is indexed for inflation to a degree. Specifically, certain aspects of Medicaid, like the federal poverty level (FPL) used to determine eligibility, are updated annually for inflation. Additionally, the Affordable Care Act (ACA) expanded Medicaid eligibility to non-elderly adults with incomes up to 138% FPL, and the federal government provides 90% financing for this expansion.

Since benefits are indexed to inflation, there is no difference in the nominal vs real percentage numbers.

Demographics

Please consider 65…What It Means for You

The year 2025 marks a significant milestone in the United States. Why? Because a record number of people will reach the age of 65. On average about 11,400 Americans will turn 65 every day of the year 2025 a phenomenon referred to as Peak 65. This demographic shift, largely driven by the baby boomer generation, will have implications for retirement planning, healthcare, and the economy at large.

By 2025, approximately 73 million baby boomers will be 65 or older, making up more than a fifth of the U.S. population. This milestone represents not only an achievement in longevity but also a shift in how we think about aging, retirement, and more. As baby boomers reach retirement age in record numbers, many will be looking at new opportunities, while others may face unexpected hurdles.

Looking Ahead

Social Security payment are poised to skyrocket. Medicare will do the same.

There are fewer replacement workers and even less with skills. Those who support “deport them all” madness need to reconsider quickly.

Deportations or not, we are on a very unsustainable path with fewer workers with no wage guarantees who support more retirees with inflation-indexed benefits.

What’s Trump Doing?

As with Biden, and every preceding president, the answer is making it worse.

Trump is angry with Republicans for wanting to cut Medicaid. And Trump wants to make Social Security payments tax free.

And on the revenue side, the latest tax bill is a monstrosity. It’s expected to add $22 trillion to the national debt over the next 10 years.

* * *

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

Tyler Durden

Mon, 06/02/2025 – 11:40